Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

How to go Broke without knowing (IBKIR)

- Forums

- ProRealTime English Forum

- Platform Support: Charts, Data & Broker Setup

- How to go Broke without knowing (IBKIR)

-

AuthorPosts

-

… with a pinch of salt, but still a serious warning for those AutoTrading Live.

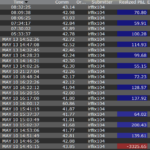

First pic below is a snapshot of one of the instruments and its trade results. Important : this is Live.

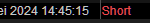

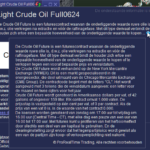

Second pic is the net result so far.Third pic is reality. The difference ? look at the Comm(ission) column in the third pic.

Because I saw this happening in the Executed Orders list (see fourth pic), I called PRT Support with the message “what the heck ?!?”. The simple response :

Oh Peter, didn’t you know ? everybody knows. It is also in the help text. I don’t know where any more but it is there for sure.Sure.

My initial thought was “I am fine, because the Commission is all over incorporated in my Backtesting. So no matter the individual Results in Live, the overall result will be fine.”.

And indeed, incorporating the Commission decently in the backtesting is a hell of a job in itself, with the notice that a. there weren’t even enough decimals to register it correctly (until I made a ticket about that a couple of months back) and b. for Forex the math applied by backtesting is seriously wrong hence it still does not work correctly. Ah, nobody noticed ? then my advice is to take extra care.But my initial thought today appears not to have been the final thought, because look at pic #2 again – the Detailed Report is based on the very same lacking Commission. And would one depend on those results, … you will be losing massively without knowing. And really, I did not know this.

But it also can’t be justified. This is about money.I want to make clear again, that if your backtesting has been decent, you don’t need to worry. But would you look at your Detailed Reports and start to buy new cars, then it would by worrying.

People would not notice this because the Commission usually is relatively low; gain could be 100 with a Commission of 5. In this case Commission is relatively high. Gain is 140 and Commission is 84. What’s left is 70,80 (top-most trade in pic #3).

Apart from the “stuff it” message from PRT Support, hence this is what it is and you should know it, it won’t be solved anyway. No need to file a ticket. Why ? well, because the IBKR API does not provide the data.

I hope this helps someone !

KumoNoJuzza thanked this postHi Peter,

Thanks for sharing your experience once again.

From my experience, IBKR is only interesting when trading futures, I find the forex commission pretty high unless you trade with a lot big enough (like at least 3000€ of required margin). If you trade multiple pairs it requires substantial money 😮

I have one question off topic. Is the strategy you used to portrait your case wihtout stoploss ?

I have kind of same results on some strategies without stoploss. It is works well 95% of the time, but at some point there always is that very bad trade that screws up everything. I am still trying to find exit conditions to identify and exit that dangerous tide.

(apologies for the typo in the title of the topic)

Hi Kumo,

Maybe there is a misunderstanding, or possibly is the instrument I used there misleading;

First off, I can’t translate your USD 3000 of required margin into an amount to invest, but if I had to guess it would be 33 x 3000 = EUR 100K (margin 3%). If that is correct, then that would imply Commission on EUR/USD of USD 8 In + Out (thus total 8). I now used the commission for someone not very regularly trading (hence no discount).

This is not what my situation showed. That showed Spot Silver, which bears a relatively (very) high commission for IB. Still it can be scalped nicely – also see below for today’s further progress.The picture below nicely bridges to your second subject : No SL ?

This system uses a SL all right, though technically it is not visible. If that is what you referred to, then indeed; It creates an Exit when the direction remains against it for too long. Hut maybe you referred merely to this :

What coincicentally happened to this for me new System, is that it almost immediately started out with a loss. And believe it or not, but such a loss is calculated-in; It has been backtested without optimisation, unless it would be about the balance between the number of losses over the backtested period and the gains to counteract those. Of course this all includes the not being afraid of a Loss falling right at the start of the System, which you see applied here for real. And obviously don’t attempt this with a 3% margin and 3000 portfolio with 100K investment. Then you’re Out (in this case the 3000 would really have gone, looking at the 3200 loss I showed in the first post. –maybe you referred to something quite different, then just skip–

To summarise the above : you should of course never allow trades which will not allow the strategy with deep SL to survive (read : your portfolio should survive).

Eureka ?

Maybe not;

One could attest that no SL at all (also not hidden) would always survive best because you will never lose a trade. But this would be very bad for revenue because all the time in DD will not bring new trades and thus also no money. This in itself first requires that your strategy does better than Buy & Hold, hence that it is able to extra-gain on the way back (this one is Long + Short so this part of the story is a bit mute for this instrument but with the notice that Long + Short is only more difficult when using deep SL’s (because you don’t expect a direction in advance)). Otoh, Long + Short already takes advantage inherently from “a way back”, so that part should be more easy (if you get your Entries right).

To visualise the “not being unable to trade for too long”, look below where I also showed the duration of that loser, which has been 23 hours.All ‘n all it is one large forcefield of reasoning and how a strategy will be fine with a deeper SL, if only the profit is more than sufficient to overcome it when needed.

The fun could be that what we saw earlier today and what looked like a failed strategy (at least for these couple of days it is running), now suddenly looks like a winner. Why ? it was given the time (the air) to survive; it obviously was given the portfolio money to survive. Thus I don’t mean “sufficient investment” but just the headroom in the portfolio to allow for this. And this also with the knowledge in that other topic (GraHal’s vanished (demo) portfolio in the first 3 weeks of April), where ALL the instruments/strategies could work out similarly : in DD. And deep.The beauty of what you see below is that this one loss has already almost been covered for, and it happened today (but not really, see at the PS for explanation). Yes, right; one day. This can only happen because of the deeper DD but unconditionally with the knowledge in advance that the strategy will be a net winning one. Of course that is the hard part, but one has to work for his/her money, right ?

Don’t look at the figures which here coincidentally show; don’t be depressed when you recognize that you can’t make these trades with a portfolio means of 3000. Just divide all by 10, have that same 3000 in the portfolio and thus risk 300 only. Lose a first trade – no harm done. In one day you won’t earn (back) $2731 like you see here, but 273,30. That won’t be bad at all IMO. Notice, however, that my backtesting of this system, with the investment 10 times lower, shows a gain of 1200 per month. So of course it won’t gain 273,30 per day – it is only 1200 / 20 = 60. It may lose 320 once in a while, but that is included.

PS: On-Topic : We did not forget that this 2731 now shown is without deducted commission, right ? haha. So nothing was earned back in almost one day. It takes another day (or more); on estimate it is now at ~ break even. PRT’s glass is half full – always good to be positive ? No I think not. That is dangerous.

In this case Commission is relatively high. Gain is 140 and Commission is 84.

So with IG, if I buy 1 Contract on DJI, the total value of my trade would be £38,500 (roughly) and I would pay between £2.4 and £4.8 spread.

As a comparison, on what value of trade with IB would I pay a commission of £84.

Hi Peter, so if I trade future MNQ or Mini Crude oil, How much would it be commission? without conidering slippage. I still don’t understand How I could reach a so high commission of 84 euros!

I think you are twisting the things upside down. In good spirit that is. 😃

It is not about IB vs IG or something, it is about PRT not being able to show the commission in the result of the Live Thread (in the context of Backtesting being OK(-ish) with it).But to answer your question literally : something like 2x 0.62 for a full trade for 1 Mini (MYM) contract of ~ 20K and thus the 84 would bring 84 / 1.24 = 67.74, hence that times 20K = 1355K. And because it is rubbish to buy 67 contracts with higher commission than the full-blown DJ Future (YM) of 10 times the value at 5 times the cost, the real answer would be 2x 1355K or 2710K.

Please be aware that my math could be wrong (I stand corrected when necessary), that IB would bare very little spread too (so little that it can be ignored), that I made the GBP equal to EUR and USD (roughly this is fine) and that as said, this is turning things upside down.The latter in other words : it is not about IB and a high commission (vs spread) – it is merely about some instruments baring super-high commission like my Silver example. N.b.: Probably this is because Silver comes from London while IB comes from the USA (this is just my reasoning). It is a commodity and it bares a lot of hassle to get it to you (from the USA) which I think can’t even happen, but *has* to happen if it expires while in my possession when it expires. But this is another subject for another day. 😜 Thus, the commission on Silver is just crazy. But no worries, because all markets seems to be constructed such that the earning for a trader could be as easy (or difficult). E.g. Silver trades more easy (with profit) than Gold, but Gold bares a normal price (for Commission). For spread I don’t know and spread is a very different story. Try to trade EUR/CHF for example, and you will get that gist. Commission would be equal-ish, but spread is unbarable. And I talk IB now. But go to a physical bank, and you will experience the same.

Anyway and again, PRT does not (and can not) show the commission with IBKR on Live trades and this is dangerous. It is as dangerous as backtesting without spread on IG (because you’d forget to incorporate it), go Live and get killed.

Hi Peter, so if I trade future MNQ or Mini Crude oil, How much would it be commission? without conidering slippage. I still don’t understand How I could reach a so high commission of 84 euros!

Hello Alessio,

Mini Crude Oil I’d need to investigate (takes several hours to do it well, really !), but MNQ is 0.62 one side. Thus 0.62 in plus 0.62 out = EUR 1.34.

Notice that the Futures Commodities (like Oil) relate to Contract Baskets (this is my own wording from Dutch). Think of a minimum quantity like x barrels. It is thus unfair to just name a Commission, because it also incorporates the quantity hence minimum investment. It is not like IG and being able to buy (CFD) 0.5 contracts Nasdaq of ~ 5000 cash – with IB it is a minimum of 1 contracts of 37K. The commission goes along with that and is thus 0.62 one side.

IMHO the commission stuff is really complex and crucial to do well with backtesting, and thus also Live. It gets even more complex with the real Futures (IBKR) if you realize that you may end up with a garden full of barrels of oil, because you could not sell them before expiring and they thus will be delivered to you. A few years ago this really happened, with the price of oil being negative.

Don’t try this at home ?

🙂PS: I would be fine with a garden of troy ounces of Silver (or Gold for that matter). It should impress the neighbours. Oil I don’t know, chicken could be accepted, but dead cattle could be problematic again. Commodities are really another league, and AutoTrading with it ? … not at home ?

you’re telling me that if I don’t sell before the roll over there is a big risk I can find barrells of Oil in my garden? I can’t believe it’s true. By the way what does it really happens in that case? my position close immediately?

You may have read this balloon text more often at the financial futures (like S&P500) and thought “oh well, what can it mean”. And in the case of financial futures this would be correct; the trade is closed and the money will be delivered. Or subtracted. Just from your account.

With oil (and the 1000 other commodities) this can’t happen, and thus it will be shipped to you. And you pay for the shipping …And yes, when a contract expires, your position is closed. The delivery will be a day later (or the first day of the next week).

Try it with wheat or something and let me know. Don’t forget to make photos.

🙂 🙂Back in the mid 80’s when I was doing commodity options, I got one of my work colleagues interested.

I was doing well (for a short time!) so he piled in, but, not fully understanding, he bought Futures.

A few weeks later he came to me with a very worried look on his face saying something like … ‘I’ve had a letter and I’ve got tons of lead sitting on a dock in London that has to be collected within 48 hours’!

Word spread like wild-fire in the building where we worked; he went from an almost unknown to ‘overnight celeb status’!!

He managed to sell the lead on from the dock, albeit at a big loss!

When the dust settled, I think he enjoyed the ongoing notoriety of being forever known as ‘The Lead Man’! 😀

‘

-

AuthorPosts

- You must be logged in to reply to this topic.

How to go Broke without knowing (IBKIR)

Platform Support: Charts, Data & Broker Setup

Summary

This topic contains 9 replies,

has 4 voices, and was last updated by GraHal

1 year, 9 months ago.

Topic Details

| Forum: | Platform Support: Charts, Data & Broker Setup |

| Language: | English |

| Started: | 05/14/2024 |

| Status: | Active |

| Attachments: | 7 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.