Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

help with break-even code as a second position and second exit

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- help with break-even code as a second position and second exit

-

AuthorPosts

-

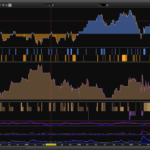

I’ve cleaned up the code and remove the exit indicator to see if the contracts continue but the code will continue to sell the second contract and that’s the one I want to allow it to run too continue basically i’ve added a picture and on the picture there’s a blue Arrow which shows a sell that is correct but there’s also a red arrow which also shows a sell I want to stop that one from happening

// Definition of code parameters DEFPARAM CumulateOrders = False // Cumulating positions deactivated // Conditions to enter long positions indicator1 = AroonUp[19] indicator2 = AroonDown[19] c1 = (indicator1 CROSSES OVER indicator2) IF c1 AND Not OnMarket THEN // Stops and targets : Enter your protection stops and profit targets here St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) BUY 2 PERPOINT AT MARKET ENDIF // target IF Close >= (TradePrice + Tp) THEN SELL 1 PERPOINT AT MARKET ENDIF // Stops SET STOP LOSS StThat’s because each time line 18 is executed, if conditions are still met, SELL will be executed again closing the second position.

To keep it running (until you add a condition to close it), replace line 18 with this one:

IF Close >= (TradePrice + Tp) AND abs(CountOfPosition) = 2 THENso it will execute SELL only the first time.

Patrick K Templar thanked this postThat is absolutely brilliant thank you

I am so sorry to ask for more help with the same indicator,

// Definition of code parameters DEFPARAM CumulateOrders = False // Cumulating positions deactivated // Conditions to enter short positions indicator1 = CALL DDMIHL1 c3 = (indicator1 CROSSES UNDER 0) IF c3 AND Not OnMarket THEN // Stops and targets : Enter your protection stops and profit targets here St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) SELLSHORT 2 PERPOINT AT MARKET ENDIF IF Close >= (TradePrice + Tp) AND abs(CountOfPosition) = 2 THEN BUY 1 PERPOINT AT MARKET ENDIF // Conditions to exit short positions indicator3 = DI[10](close) indicator4 = WeightedAverage[11](DI[10](close)) c4 = (indicator3 CROSSES OVER indicator4) IF c4 AND abs(CountOfPosition) = 1 THEN BUY AT MARKET ENDIF // Stops and targets SET STOP LOSS StI can’t get the short side of a position to work not too sure what it is if you don’t mind thank you very much

I’ve played around with it I found the sell shorts and exit shorts were wrong but I believe the line 16 is not right for shorts i’ve adjusted that as well

// Definition of code parameters DEFPARAM CumulateOrders = False // Cumulating positions deactivated // Conditions to enter long positions indicator1 = CALL DDMIHL1 c1 = (indicator1 CROSSES UNDER 0) IF c1 AND Not OnMarket THEN // Stops and targets : Enter your protection stops and profit targets here St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) SELLSHORT 2 PERPOINT AT MARKET ENDIF IF Close <= (TradePrice - Tp) AND abs(CountOfPosition) = 2 THEN EXITSHORT 1 PERPOINT AT MARKET ENDIF // Stops and targets SET STOP LOSS St // Conditions to exit long positions indicator3 = DI[10](close) indicator4 = WeightedAverage[11](DI[10](close)) c2 = (indicator3 CROSSES OVER indicator4) IF c2 AND abs(CountOfPosition) = 1 THEN EXITSHORT AT MARKET ENDIFYes, correct.

Patrick K Templar thanked this postHello i’m afraid that system that you have helped me build may have an underlying fault built into it or it might just be a part of the sellshort side of the code,

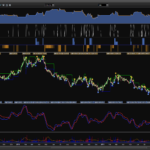

What I have is a screenshot the top 1 is the normal logic and the bottom one is the break-even and scale-out and as you can see the bottom one does not shortsell as much as I think it should and when you compare it to the normal logic it looks bad i’m wondering if there’s anything that can be done here, thannk youI will post both systems normal logic first then the break-even

// Definition of code parameters DEFPARAM CumulateOrders = False // Cumulating positions deactivated // Conditions to enter long positions indicator2, indicator1, ignored = CALL "PRC_QQE indicator"[5, 14, 4.236] c1 = (indicator1 CROSSES OVER indicator2) IF c1 THEN BUY 1 PERPOINT AT MARKET ENDIF // Conditions to enter short positions indicator4, indicator3, ignored = CALL "PRC_QQE indicator"[5, 14, 4.236] c2 = (indicator3 CROSSES UNDER indicator4) IF c2 THEN SELLSHORT 1 PERPOINT AT MARKET ENDIF // Stops and targets : Enter your protection stops and profit targets here St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) SET STOP LOSS St SET TARGET PROFIT Tp// Conditions to enter long positions defparam cumulateorders = false startBreakeven = TP //how much pips/points in gain to activate the breakeven function? PointsToKeep = 10 //how much pips/points to keep in profit above of below our entry price when the breakeven is activated (beware of spread) // Conditions to enter long positions indicator2, indicator1, ignored = CALL "PRC_QQE indicator"[11, 14, 4.236] c1 = (indicator1 CROSSES OVER indicator2) if c1 AND Not OnMarket THEN // Stops and targets : St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) BUY 2 PERPOINT AT MARKET SET STOP PLOSS St //first stoploss endif //reset the breakevenLevel when no trade are on market IF NOT ONMARKET THEN breakevenLevel=0 ENDIF // --- BUY SIDE --- //test if the price have moved favourably of "startBreakeven" points already IF LONGONMARKET AND close-tradeprice(1)>=startBreakeven*pipsize THEN //calculate the breakevenLevel breakevenLevel = tradeprice(1)+PointsToKeep*pipsize ENDIF IF LONGONMARKET AND Close >= (TradePrice + Tp) AND abs(CountOfPosition) = 2 THEN SELL 1 PERPOINT AT MARKET ENDIF //place the new stop orders on market at breakevenLevel IF breakevenLevel>0 THEN SELL AT breakevenLevel STOP ENDIF // Conditions to exit long positions indicator3, indicator4, ignored = CALL "PRC_QQE indicator"[11, 14, 4.236] B1 = (indicator4 CROSSES UNDER indicator3) IF B1 THEN SELL AT MARKET ENDIF // Conditions to enter short positions // Conditions to enter short positions indicator1, indicator2, ignored = CALL "PRC_QQE indicator"[11, 14, 4.236] A1 = (indicator2 CROSSES UNDER indicator1) if A1 AND Not OnMarket THEN // Stops and targets : St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) SELLSHORT 2 PERPOINT AT MARKET SET STOP PLOSS St //first stoploss endif //reset the breakevenLevel when no trade are on market IF NOT ONMARKET THEN breakevenLevel=0 ENDIF // --- Sell SIDE --- //test if the price have moved favourably of "startBreakeven" points already IF SHORTONMARKET AND close-tradeprice(1)>=startBreakeven*pipsize THEN //calculate the breakevenLevel breakevenLevel = tradeprice(1)+PointsToKeep*pipsize ENDIF IF SHORTONMARKET AND Close <= (TradePrice - Tp) AND abs(CountOfPosition) = 2 THEN EXITSHORT 1 PERPOINT AT MARKET ENDIF //place the new stop orders on market at breakevenLevel IF breakevenLevel>0 THEN SELL AT breakevenLevel STOP ENDIF // Conditions to exit short positions indicator3, indicator4, ignored = CALL "PRC_QQE indicator"[11, 14, 4.236] B1 = (indicator4 CROSSES OVER indicator3) IF B1 THEN EXITSHORT AT MARKET ENDIFThere’s always something to be done. If something doesn’t work as expected it’s just a matter of making it work!

Append these few lines at the end of your code:

Graph B1 Graph abs(CountOfPosition) GraphOnPrice (TradePrice + Tp) coloured(0,255,0,255) AS "Long EXIT 1" GraphOnPrice (TradePrice - Tp) coloured(0,0,255,255) AS "Short EXIT 1"you will be able to see data plotted using GRAPH in the variable window of ProBackTest and data plotted using GRAPHONPRICE on your chart,candleby candle.

You will be able to detect any wrong value that may cause issues.

You can add more variables, if needed.

Patrick K Templar thanked this postDefinitely should be some shorts there you can see an August at the beginning of the chart there’s a crossover and it not on market yet no short and in September there’s a long where they shouldn’t be it goes long yet the qqe has not crossed over i’m going to test a different indicator “what if it’s the indicator”

Eureka I found it he was the indicator numbers

Hello I’ve noticed some anomalies on the chart and I’m not too sure what they are are I’ve uploaded a picture and I put red arrows on it they don’t affect the equity curve nor is there contracts for them i’m wondering if they can affect the trading backtest algorithm or if on market and the blue arrows show a buy but the conditions for the trade was not met the qqe did not crossover, i’m thinking that’s a problem with the code for the QQE or if it repainted.

// Conditions to enter long positions defparam cumulateorders = false startBreakeven = TP //how much pips/points in gain to activate the breakeven function? PointsToKeep = 2 //how much pips/points to keep in profit above of below our entry price when the breakeven is activated (beware of spread) // Conditions to enter long positions indicator2, indicator1, ignored = CALL "PRC_QQE indicator"[11, 20, 4.236] A1 = (indicator1 CROSSES OVER indicator2) indicator3 = Williams[8](close) A2 = (indicator3 >= -20) IF A1 AND A2 AND Not OnMarket THEN // Stops and targets : St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) BUY 2 PERPOINT AT MARKET SET STOP PLOSS St //first stoploss endif //reset the breakevenLevel when no trade are on market IF NOT ONMARKET THEN breakevenLevel=0 ENDIF // --- BUY SIDE --- //test if the price have moved favourably of "startBreakeven" points already IF LONGONMARKET AND close-tradeprice(1)>=startBreakeven*pipsize THEN //calculate the breakevenLevel breakevenLevel = tradeprice(1)+PointsToKeep*pipsize ENDIF IF LONGONMARKET AND Close >= (TradePrice + Tp) AND abs(CountOfPosition) = 2 THEN SELL 1 PERPOINT AT MARKET ENDIF //place the new stop orders on market at breakevenLevel IF breakevenLevel>0 THEN SELL AT breakevenLevel STOP ENDIF // Conditions to exit long positions indicator5, indicator4, ignored = CALL "PRC_QQE indicator"[11, 20, 4.236] B1 = (indicator4 CROSSES UNDER indicator5) IF B1 THEN SELL AT MARKET ENDIF // Conditions to enter short positions // Conditions to enter short positions indicator7, indicator6, ignored = CALL "PRC_QQE indicator"[11, 20, 4.236] C1 = (indicator6 CROSSES UNDER indicator7) indicator8 = Williams[8](close) C2 = (indicator8 <= -80) IF C1 AND C2 AND Not OnMarket THEN // Stops and targets : St = ROUND((AverageTrueRange[14](CLOSE))*2) Tp = ROUND((AverageTrueRange[14](CLOSE))*1.5) SELLSHORT 2 PERPOINT AT MARKET SET STOP PLOSS St //first stoploss endif //reset the breakevenLevel when no trade are on market IF NOT ONMARKET THEN breakevenLevel=0 ENDIF // --- Sell SIDE --- //test if the price have moved favourably of "startBreakeven" points already IF SHORTONMARKET AND close-tradeprice(1)>=startBreakeven*pipsize THEN //calculate the breakevenLevel breakevenLevel = tradeprice(1)+PointsToKeep*pipsize ENDIF IF SHORTONMARKET AND Close <= (TradePrice - Tp) AND abs(CountOfPosition) = 2 THEN EXITSHORT 1 PERPOINT AT MARKET ENDIF //place the new stop orders on market at breakevenLevel IF breakevenLevel>0 THEN EXITSHORT AT breakevenLevel STOP ENDIF // Conditions to exit short positions indicator10, indicator9, ignored = CALL "PRC_QQE indicator"[11, 20, 4.236] D1 = (indicator9 CROSSES OVER indicator10) IF D1 THEN EXITSHORT AT MARKET ENDIF Graph B1 Graph abs(CountOfPosition) GraphOnPrice (TradePrice + Tp) coloured(0,255,0,255) AS "Long EXIT 1" GraphOnPrice (TradePrice - Tp) coloured(0,0,255,255) AS "Short EXIT 1"thank you

You should duplicate line 5 and move one of them just after line 17 and the other one after line 62.

Patrick K Templar thanked this postHello thank you

I did that and had exactly the same results so no real effect by doing that

What is exactly the problòem where the arrows are plotted.

What date are those candles?

Since there’s no variable declared in the original indicator I don’t know in which order you arranged them, when you call the indicator, is the first parameter the RSIperiod?

Yeah sorry I did not know no what was causing that one contract to come into the market and then go out and like I said it was not affecting the equity curve and it wasn’t showing any contracts on the price chart those blue Arrows that I pointed out in the picture, so what I did I started to strip away at the code and take stuff off so I took the break-even off and that did not affect it and I simplified the code just long and it was still there it’s obvious now to me that is the take profit contract for some reason

I thank you very much for your help so far

-

AuthorPosts

- You must be logged in to reply to this topic.

help with break-even code as a second position and second exit

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 38 replies,

has 3 voices, and was last updated by ![]() robertogozzi

robertogozzi

5 years, 2 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 11/22/2020 |

| Status: | Active |

| Attachments: | 11 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.