Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Help for the translation from trading view

- Forums

- ProRealTime English Forum

- Platform Support: Charts, Data & Broker Setup

- Help for the translation from trading view

-

AuthorPosts

-

Hi All,

I would like to ask for help to translate a script from tradingview as below with thanks in advance

AI Trend Navigator by ZeiiermaYou need to post the script on here so as to tempt one of our wizard coders to help you.

Click on Insert PRT Code buttom (at left hand end of the top row of tools above) before inserting the code for AI Trend Navigator.

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/ // © Zeiierman { //@version=5 indicator('AI Trend Navigator', overlay=true) // ~~ Tooltips { t1 ="PriceValue selects the method of price computation. \n\nSets the smoothing period for the PriceValue. \n\nAdjusting these settings will change the input values for the K-Nearest Neighbors algorithm, influencing how the trend is calculated." t2 = "TargetValue specifies the target to evaluate. \n\nSets the smoothing period for the TargetValue." t3 ="numberOfClosestValues sets the number of closest values that are considered when calculating the KNN Moving Average. Adjusting this number will affect the sensitivity of the trend line, with a higher value leading to a smoother line and a lower value resulting in a line that is more responsive to recent price changes." t4 ="smoothingPeriod sets the period for the moving average applied to the KNN classifier. Adjusting the smoothing period will affect how rapidly the trend line responds to price changes, with a larger smoothing period leading to a smoother line that may lag recent price movements, and a smaller smoothing period resulting in a line that more closely tracks recent changes." t5 ="This option controls the background color for the trend prediction. Enabling it will change the background color based on the prediction, providing visual cues on the direction of the trend. A green color indicates a positive prediction, while red indicates a negative prediction." //~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~} // ~~ Inputs { PriceValue = input.string("hl2", options = ["hl2","VWAP", "sma", "wma", "ema", "hma"], group="", inline="Value") maLen = input.int(5, minval=2, maxval=200, title="", group="", inline="Value", tooltip=t1) TargetValue = input.string("Price Action", options = ["Price Action","VWAP", "Volatility", "sma", "wma", "ema", "hma"], group="", inline="Target") maLen_ = input.int(5, minval=2, maxval=200, title="", group="", inline="Target", tooltip=t2) // Input parameters for the KNN Moving Average numberOfClosestValues = input.int(3, "Number of Closest Values", 2, 200, tooltip=t3) smoothingPeriod = input.int(50, "Smoothing Period", 2, 500, tooltip=t4) windowSize = math.max(numberOfClosestValues, 30) // knn Color Upknn_col = input.color(color.lime, title="", group="KNN Color", inline="knn col") Dnknn_col = input.color(color.red, title="", group="KNN Color", inline="knn col") Neuknn_col = input.color(color.orange, title="", group="KNN Color", inline="knn col") // MA knn Color Maknn_col = input.color(color.teal, title="", group="MA KNN Color", inline="MA knn col") // BG Color bgcolor = input.bool(false, title="Trend Prediction Color", group="BG Color", inline="bg", tooltip=t5) Up_col = input.color(color.lime, title="", group="BG Color", inline="bg") Dn_col = input.color(color.red, title="", group="BG Color", inline="bg") //~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~} // ~~ kNN Classifier { value_in = switch PriceValue "hl2" => ta.sma(hl2,maLen) "VWAP" => ta.vwap(close[maLen]) "sma" => ta.sma(close,maLen) "wma" => ta.wma(close,maLen) "ema" => ta.ema(close,maLen) "hma" => ta.hma(close,maLen) meanOfKClosest(value_,target_) => closestDistances = array.new_float(numberOfClosestValues, 1e10) closestValues = array.new_float(numberOfClosestValues, 0.0) for i = 1 to windowSize value = value_[i] distance = math.abs(target_ - value) maxDistIndex = 0 maxDistValue = closestDistances.get(0) for j = 1 to numberOfClosestValues - 1 if closestDistances.get(j) > maxDistValue maxDistIndex := j maxDistValue := closestDistances.get(j) if distance < maxDistValue closestDistances.set(maxDistIndex, distance) closestValues.set(maxDistIndex, value) closestValues.sum() / numberOfClosestValues // Choose the target input based on user selection target_in = switch TargetValue "Price Action" => ta.rma(close,maLen_) "VWAP" => ta.vwap(close[maLen_]) "Volatility" => ta.atr(14) "sma" => ta.sma(close,maLen_) "wma" => ta.wma(close,maLen_) "ema" => ta.ema(close,maLen_) "hma" => ta.hma(close,maLen_) knnMA = meanOfKClosest(value_in,target_in) //~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~} // ~~ kNN Prediction { // Function to calculate KNN Classifier price = math.avg(knnMA, close) c = ta.rma(knnMA[1], smoothingPeriod) o = ta.rma(knnMA, smoothingPeriod) // Defines KNN function to perform classification knn(price) => Pos_count = 0 Neg_count = 0 min_distance = 10e10 nearest_index = 0 for j = 1 to 10 distance = math.sqrt(math.pow(price[j] - price, 2)) if distance < min_distance min_distance := distance nearest_index := j Neg = c[nearest_index] > o[nearest_index] Pos = c[nearest_index] < o[nearest_index] if Pos Pos_count += 1 if Neg Neg_count += 1 output = Pos_count>Neg_count?1:-1 // Calls KNN function and smooths the prediction knn_prediction_raw = knn(price) knn_prediction = ta.wma(knn_prediction_raw, 3) //~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~} // ~~ Plots { // Plots for display on the chart knnMA_ = ta.wma(knnMA,5) knnMA_col = knnMA_>knnMA_[1]?Upknn_col:knnMA_<knnMA_[1]?Dnknn_col:Neuknn_col Classifier_Line = plot(knnMA_,"Knn Classifier Line", knnMA_col) MAknn_ = ta.rma(knnMA, smoothingPeriod) plot(MAknn_,"Average Knn Classifier Line" ,Maknn_col) green = knn_prediction < 0.5 red = knn_prediction > -0.5 bgcolor( green and bgcolor? color.new(Dn_col,80) : red and bgcolor ? color.new(Up_col,80) : na) //~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~} // ~~ Alerts { knnMA_cross_Over_Ma = ta.crossover(knnMA_,MAknn_) knnMA_cross_Under_Ma = ta.crossunder(knnMA_,MAknn_) knnMA_cross_Over_Close = ta.crossover(knnMA_,close) knnMA_cross_Under_Close = ta.crossunder(knnMA_,close) knnMA_Switch_Up = knnMA_[1]<knnMA_ and knnMA_[1]<=knnMA_[2] knnMA_Switch_Dn = knnMA_[1]>knnMA_ and knnMA_[1]>=knnMA_[2] knnMA_Neutral = knnMA_col==Neuknn_col and knnMA_col[1]!=Neuknn_col greenBG = green and not green[1] redBG = red and not red[1] alertcondition(knnMA_cross_Over_Ma, title = "Knn Crossover Average Knn", message = "Knn Crossover Average Knn") alertcondition(knnMA_cross_Under_Ma, title = "Knn Crossunder Average Knn", message = "Knn Crossunder Average Knn") alertcondition(knnMA_cross_Over_Close, title = "Knn Crossover Close", message = "Knn Crossover Close") alertcondition(knnMA_cross_Under_Close, title = "Knn Crossunder Close", message = "Knn Crossunder Close") alertcondition(knnMA_Switch_Up, title = "Knn Switch Up", message = "Knn Switch Up") alertcondition(knnMA_Switch_Dn, title = "Knn Switch Dn", message = "Knn Switch Dn") alertcondition(knnMA_Neutral, title = "Knn is Neutral", message = "Knn is Neutral") alertcondition(greenBG, title = "Positive Prediction", message = "Positive Prediction") alertcondition(redBG, title = "Negative Prediction", message = "Negative Prediction") //~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~}Hi GraHal,

Noted with thanks for your reminding.

Here above is the code, please help me for the translation in your convenience with thanks.

Hi All,

Can anyone help me to convert the above indicator with thanks.

Hi

Here you have the indicator://-----------------------------------------------------------// //PRC_AI Trend Navigator //version = 0 //24.04.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //-----------------------------------------------------------// //-----Inputs------------------------------------------------// PriceValue=0//0=hl2,1=vwap,2=sma,3=wma,4=ema,5=hma maLen=5 TargetValue=0//0=Price Action, 1=vwap,2=volatility,3=sma,4=wma,5=ema,6=hma maLen1=5 //---Input parameters for the KNN Moving Average numberOfClosestValues=3//Number of Closest Values smoothingPeriod=50 windowSize=max(numberOfClosestValues,30) //---Background Colour bgcolour=0//Boolean//Backgroundcolor //-----------------------------------------------------------// //-----PriceValue calculation--------------------------------// if PriceValue=0 then ValueIn=average[maLen]((high+low)/2) elsif PriceValue=1 then ValueIn=VolumeAdjustedAverage[maLen](close) elsif PriceValue=2 then ValueIn=average[maLen](close) elsif PriceValue=3 then ValueIn=weightedaverage[maLen](close) elsif PriceValue=4 then ValueIn=exponentialaverage[maLen](close) elsif PriceValue=5 then ValueIn=hullaverage[maLen](close) endif //-----------------------------------------------------------// //-----Target input calculation------------------------------// if TargetValue=0 then alpha = 1/maLen1 if barindex <= maLen1 then TargetIn=close else if barindex = maLen1 then TargetIn = average[maLen1](close) else TargetIn = alpha*close + (1-alpha)*TargetIn[1] endif endif elsif TargetValue=1 then TargetIn=VolumeAdjustedAverage[maLen1](close) elsif TargetValue=2 then TargetIn=averagetruerange[14](close) elsif TargetValue=3 then TargetIn=average[maLen1](close) elsif TargetValue=4 then TargetIn=weightedaverage[maLen1](close) elsif TargetValue=5 then TargetIn=exponentialaverage[maLen1](close) elsif TargetValue=6 then TargetIn=hullaverage[maLen1](close) endif //-----------------------------------------------------------// //-----KNN Classifier----------------------------------------// //knnMA = meanOfKClosest(value_in,target_in) $closestDistances[0]=exp(10) $closestValues[0]=0 for i=1 to windowSize do myvalue=valueIn[i] distance=abs(targetIn-myvalue) maxDistIndex=0 maxDistValue=$closestDistances[0] for j=0 to numberOfClosestValues-1 do if $closestDistances[j] > maxDistValue then maxDistIndex=j maxDistValue=$closestDistances[j] endif next if distance < maxDistValue then $closestDistances[maxDistIndex]=distance $closestValues[maxDistIndex]=myvalue endif next sumclosestValues=summation[numberOfClosestValues]($closestValues[lastset($closestValues)]) knnMA = sumclosestValues/numberOfClosestValues //-----------------------------------------------------------// price1=(KnnMA+close)/2 alpha1 = 1/smoothingPeriod alpha2 = 1/smoothingPeriod if barindex <= smoothingPeriod then c = knnMA[1] o = knnMA else if barindex = smoothingPeriod then c = average[smoothingPeriod](knnMA[1]) else c = alpha1*knnMA[1] + (1-alpha1)*c[1] endif if barindex = smoothingPeriod then o = average[smoothingPeriod](knnMA) else o = alpha2*knnMA + (1-alpha2)*o[1] endif endif //-----------------------------------------------------------// poscount=0 negcount=0 mindistance=10*exp(10) nearestindex=0 for j=1 to 10 do distance1=sqrt(pow(price1[j]-price1,2)) if distance1 < mindistance then mindistance=distance1 nearestindex=j neg=c[nearestindex]>o[nearestindex] pos=c[nearestindex]<o[nearestindex] if pos then poscount=1+poscount elsif neg then negcount=1+negcount endif endif next if poscount>negcount then knnPredictionRaw=1 else knnPredictionRaw=-1 endif knnPrediction=weightedaverage[3](knnPredictionRaw) //-----------------------------------------------------------// KnnMA1 = weightedaverage[5](KnnMA) if KnnMA1>KnnMA1[1] then r=0 g=230 b=118 elsif KnnMA1<KnnMA1[1] then r=255 g=82 b=82 else r=255 g=152 b=0 endif //-----------------------------------------------------------// alpha2 = 1/smoothingPeriod if barindex <= smoothingPeriod then MAknn=knnMA else if barindex = smoothingPeriod then MAknn = average[smoothingPeriod](knnMA) else MAknn = alpha2*knnMA + (1-alpha2)*MAknn[1] endif endif //-----------------------------------------------------------// if bgcolour then if knnPrediction > -0.5 then rbars=0 gbars=230 bbars=118 elsif knnPrediction < 0.5 then rbars=255 gbars=82 bbars=82 endif backgroundcolor(rbars,gbars,bbars,35) endif //-----------------------------------------------------------// return knnMA1 as "Knn Classifier Line"coloured(r,g,b)style(line,2), MAknn as "Average Knn Classifier Line"coloured(1,137,123)Annchow8052014 thanked this postI copy and pasted the above code and the Indicator appears to work fine.

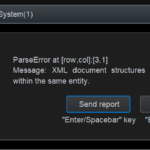

I then used the Algo Simplified Creation tool on the Indicator, but I get the attached error message when I try to run the Algo … any ideas why?

I get exact same error message as I posted above when I make an Algo using the full Indicator code in the Algo (i.e. NOT using Simplified Creation).

Indicator works fine … see attached

Hi Ivan,

Thanks for your help. I also find some error, please check and update for us. Thanks in advance.

Hi Ivan,

Further to my study, the indicator is in good condition (picture 1), but on last Friday, the Knn line go to “0” after around 22:10 (picture 2) , can you check and update for us with thanks.

-

AuthorPosts

- You must be logged in to reply to this topic.

Help for the translation from trading view

Platform Support: Charts, Data & Broker Setup

Author

Summary

This topic contains 8 replies,

has 3 voices, and was last updated by Annchow8052014

1 year, 2 months ago.

Topic Details

| Forum: | Platform Support: Charts, Data & Broker Setup |

| Language: | English |

| Started: | 04/24/2024 |

| Status: | Active |

| Attachments: | 4 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.