My question to myself would be : and what is the reference ? Is it one year ago ? is it March 20, 2024 ?

So with this in mind, this is my take :

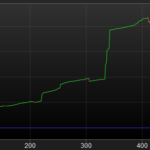

What you see below starts at Jan 4, 2024, just because it is there where I let go AutoTrading on IB (what you see is from IB indeed). The highest peak is at trade 460. This is on April 12.

If I take that as the reference for the max increase since Jan 4, then we could state that at 1. The last trade in there (from yesterday) is is then at 0.6897. Thus, 69% left of the max gain in that period. If we let these figures speak, then we could attest that the 1 is 100K and thus the remaining gain is 69K. And Yes, that is 31K loss. What is is in real money you will never know, unless I tell. 🙂

My Accounts are typically down 25% …

It is there where we should be careful. My account (the one I showed) is not 25% down at all. And not 31% either. I could be a matter of wording, but this is exactly why I put the intro like I did;

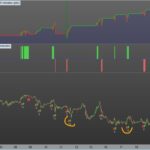

In trading all tells nothing when looked at in the short term. But what period to look at then ? I coincidentally could use the “start of autotrading for IB”. But then again it does not tell nothing much really because in January I had maybe 3 or 4 different instruments running with AutoTrading, while right now it is 13 (all different because it’s IB). New Instruments and Systems (algos) are always under trial. They always fail at first. This is all incorporated. Want to see it ? look at the 2nd picture. Same account, now showing from Jan 4, 2023. You could say that is all misery, but it is all trial and error. The same happens today still. But today it is in the mid of now working systems. 3 of them still fail. They are in for observation, but they fail and lose money. Fail means : a. unexpected broker issues and b. not the best strategy after all.

Ad b.:

This is mainly phoentzs thing;

Once you have things running, and you start to run more of them, you dive into the global strategy stuff. This is not only about Long Only (and the like) but merely about market influences like when all goes down, Gold may go up. So have Gold too. However, there is a lot to learn when this is about AutoTrading, because we can’t play out strategies like “Stocks go down so let’s do some Gold” (Mr. ProRealTime, WHEN can we finally do that ?!?). So this means both are in, and it’s in the lap of the Gods what happens when. I can tell you : 4-5-6 weeks ago, Gold went as good as Stocks did. Should not be but was so. Then 1-2-3 weeks ago (from of beginning of April) Stocks were Down and Gold was still up. I can’t even tell what would have happened with the daily losses when Gold would not have been there. Then came 3 days ago and all was down. Hmm … not good. And mind you, I am not the guy who starts to throw out AutoTrading Systems. Never. Then came two days ago and all was up and the profit was equal to the loss of the day before (better think “huge” as in : did not happen before like this). So then I decided that I could have too many systems running, all going in the same direction at times. And since then I am thinking of a next global strategy :

Make more profit per trade.

Believe it or not, but that is a strategy too.

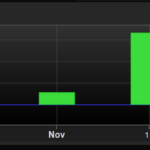

The third picture shows this. This one started at April 1 (no joke) and it performed relatively very well. How ? because it explicitly makes use of what you see happening in the 4th picture. Think Long only but Enter lower than the previous Exit. This is not easy to accomplish and this is a first one where I could apply this.

The whole of this week I am sitting down to make this a general “algo” but a lack of time or focus withheld me from it so far. On my rough estimate my mentioned 31% loss should turn into maybe 10%. But mind you, the absolute losses will be the same, but because a winning trade wins more, the relative loss will be smaller.

“Ha ha” you could say, but, if you are Long only, how to turn that into better than Buy and Hold eh ? So this is what I have been looking at since January with all going good and even better. It can’t be, you know. And it couldn’t.

Oh wait, it is still 69% vs 31%. So it could. But wait for the next cruise missile and be prepared (meaning : make more profit to cover for the upcoming losses – this really *is* my global strategy and thinking).

My advice is indirectly the same as phoentzs’ : create Strategies around Long Only. This really really implies completely different thinking, especially because it allows for a good focus (you’ll really know what you head for). And indeed, I too can’t make any strategy work with Short incorporated or even Short only in “bad times” (I could re-apply it to the past 3 weeks, but I am confident nothing much will come from it).

I hope you all appreciate this AutoTrading as the best hobby there is. I know I do.

🙂