Frankie goes to Perceptron Strategy (DAX – M5)

Forums › ProRealTime English forum › General trading discussions › Frankie goes to Perceptron Strategy (DAX – M5)

- This topic has 6 replies, 4 voices, and was last updated 5 years ago by

Vonasi.

-

-

12/08/2018 at 8:36 AM #86548

Dear friends,

I’ve been working on other of my frankenstein strategies, but now I’m playing and learning about neural networks. I found perceptron indicator made by Nicolas, and I started to play with it.

Idea is using it as a MA and I applied it some filters (WMA generally). If Price wma crosses PWMA (Perceptron WMA), strategy goes long, and viceversa. Similar to VWAP but in this case it could be PWAP (Perceptron Weighted Average Price 😛 )

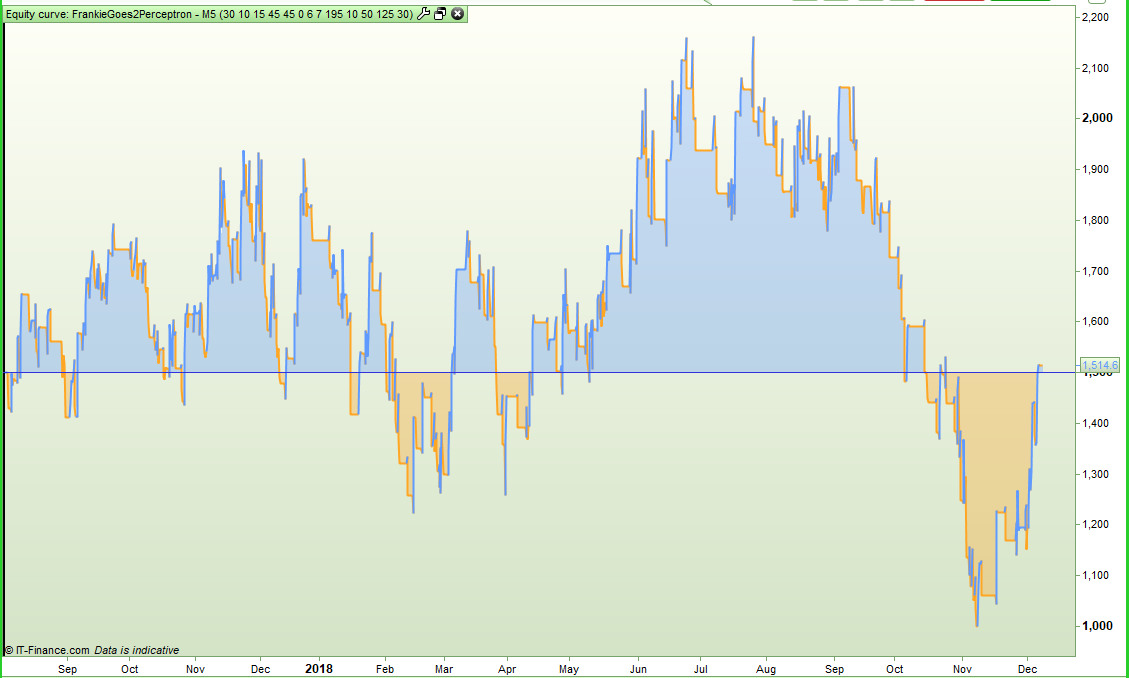

After tunning strategy and adding some rules: stops, trailing, etc. I think I have something, but I don’t know if it’s really useful, may be improved, or it’s a real garbage. I see equity curve is quite nice, but winners ratio is quite low too.

What do you think about? Does it worth it? Any idea to improve it?

Thanks a lot and best regards.

12/08/2018 at 11:20 AM #86553Wow looks great to me, love the low drawdown! Love the 5M TF also … loads of trades, keeps the interest up!

Anybody else trying it … you need to change the times to suit your TF, e.g. I’m – 1 hour in UK.

Love your System title, so in the words of their song … “Rage Hard, you’re doing it right” ! hahahhahahaha

I’l come back with any improvements, but doubt I’ll find any!

I’m starting it on Demo Forward Test on Monday!

Many Thanks for Sharing

PS

Feeling good today as you can tell! 🙂

St Johns Wort pills are working well!! 🙂1 user thanked author for this post.

12/08/2018 at 11:44 AM #86554Thanks for your words @GraHal

Any improvement or clue is welcome 🙂

12/08/2018 at 11:49 AM #8655512/08/2018 at 11:52 AM #86558You can improve results tunning variables. It’s a bit slow >100K bars, but you can get nice results.

Regards,

12/08/2018 at 11:56 AM #86559Hi Tradingthelife,

Thanks for sharing, the equity curve looks nice. Can you explain the logic of the system? I mean does it looks for pullbacks, reversals, breaks…? I ask because in my experience if there is no logic behind, just some indicators mixed in there usually the results won´t hold in the future. Anyway that´s the only real proof, wait and see if the future results are similar to backtest. I can tell you put a lot of effort in this system so I really hope it yelds you a good result, I will keep in my demo to discover.

Good Luck!

12/08/2018 at 12:27 PM #86562My first thoughts on looking at the code was that there is an awful lot of variables that can mean only one thing – massive possibility of curve fitting. Then add in a trailing stop with curve fitted variables and then curve fitted time based conditions and it would seem that you have a massive possibility of having created a curve fitted strategy.

With so many variables it can be difficult to confirm curve fitting with any analysis of results as there are so many possible combinations but for example if you just change one variables value slightly say y4 from 180 to 195 then you suddenly get this equity curve and that screams curve fit to me:

Sorry to be the voice of doom. Forward testing may prove me wrong but on a five minute time frame I would want a very long forward test as I’d want to see it trading through very bullish, very bearish and sideways markets to test for robustness.

-

AuthorPosts