Morning / evening all.

Having had some sleep and another look at the above screenshots i have posted, the first one shows the trade opening no a green candle (Full bodied) and i said it was wrong, it was very right. This was a great trade.

The second screenshot is how i do it (Did it) and was expecting something similar, so my apologies for getting that wrong BobOgden. Great work.

Its the rest of the system / strategy that needs to get coded too :

A. FIBO on correct Candle.

B. Order set (Or opened) when price breaches the 100% FIBO point

C. SL (Stop) 10 points below / above the 0% FIBO point

D. Price moves to 200% SL moved to BE (Personal choice)

E. Take 75% profit at 250% FIBO and let rest run

F. Take remainder of profit at 300% FIBO / Or 400% FIBO if good momentum.

EXTRA – Any pinbar can be traded, so if in a trade and another pinbar sets up, this can be traded while also in the previous pinbar trade…. (I know what i mean)

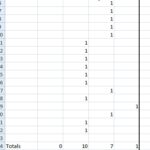

NOTE – I understand from other aspects of the chat / topic that taking partial profits is “Difficult” in PRT from IG, so if unable to do that via code, full profit to be taken at 250% or 300% as they get hit the most. Ill try and upload a screenshot of my November trades do far, these aren’t all the pinbars, just the ones i could trade / got up for.

Great work all, and if we can get this coded not only will it be a profitable system, but it may even get some peoples sanity back (Mine)

Mitch

Hey,

I’m sorry but I haven’t had much time to work on the algo lately. I will eventually get back to it though! Christmas vacation is just around the corner so hopefully I’ll manage to free some time

Concerning the strategy, you said the trade on the first screenshot was actually correct. So does it mean I was right to leave an up to 4-hour span to open the trade ? Because I wasn’t sure that was what you wanted.

PRT v11 has been launched on Demo, and apparently there would be some partial closure code in it! I’ll have to dig deeper into that since it’s exactly what you’d need

Not sure it could work with IG though

Hullo !

I’ve tried quite a few combinations and I can’t figure out how to improve the base algo. So would anybody be so kind as to WF (70/30 with 1 or more occurrences, as you wish) the algo on a longer period than 100,000 candles ? 🙂

Currently, I tried WF 70/30 on 100,000 candles and it read +59% so not too bad even though probably curvefitted, but still worth a try

The algo is long only, detects a hammer and opens a position when curent price is above the highest point of the hammer.

The most important variables are:

- the definition of what a hammer (aka pinbar) is – bas and haut

- the trading hours – EU time here

- the TS (start and step)

Thank you very much lads!

I forgot to say that it’s on DJI 1 minute *

The idea of the code is genial I find…continue it is worth the headache!

Yes deffo continue please!

I get attached with the TS values 100, 50

I’m putting it on Demo Forward Test tomorrow, I’ll report back.

Thanks lads.

I know those last few days have been pretty crazy but I’ve been running a version (without the trading hour filter) on demo since December 24th, and for now only wins with trailingstart = 22 and trailingstep = 0.6

For all it’s worth, you can find the attached file there.

Sup all.

Long time no post – I have been away at work (No need to know what) sorting C*V*D patients out and am back for a little rest. Seeing as i have internet again, thought i would see how the thread is doing.

I am still no closer to getting a FIB on each candle, and after talking to a coder who then put me in touch with another coder, its clear that others (Traders or coders) don’t really understand what i mean.

Regardless whether you automate this or not, its profitable –

A pinbar (Any pinbar doesnt matter) which closes above or below the 65% point on a fib drawn on the candle {Depends which way the pinbar is facing….} should be traded in the opposite direction of the tail / wick.

Draw a Fibonacci retracement on the candle so that the 0% is at the wick end, set entry 2points above or below the 100% line and take profit at 261% Fib.

Its a set and forget system, works very well on higher timeframes, but scalping on 5min is do-able.

My best instrument is Brent Crude 15min or 1hr.

Take care guys and i hope someone manages to automate this as its amazing.

Mitch

Be good if you did a sketch mock-up of your explanation above … picture tells a thousand words? 🙂

Attached for encouragement!

If it helps anybody trying to code this strategy, attached is a .jpg of the .docx that was posted in the 5th post from the top of this Topic.

It be better if the text showing Fib % was larger then not need zooming in to read. I can’t change text size as the original is an image emebedded in a .docx.

Hey all.

Hope the attached makes it a little easier to see / understand.

Would love to have an actual chat with you GraHal as the screener you had on the post above looks promising.

I would suggest to ALL – Backtest this sucker as i can tell you its worth it.

Mitch

So – Looks like i have an actual spare day next week.

Tuesday the 13th is a whole day to myself.

Anyone free to skype / watsapp / zoom video call so i can share screens or we can share each others screens.

Im a little more motivated recently to try and automate this (Failing eyesight) so would love to turn this into a very profitable automated system with anyone else who has the time and wish.

Thanks again all.

Mitch

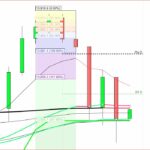

Attached is a trade taken as proof of concept. It might lose or it might win, the strategy is in favour of winning, but as we all know some we lose…..

LCO (Brent Crude) 1D TF

So the bar ar the red arrowhead (attached) is the pin bar. Do you work to any strict definition of the pin bar or just by sight? As you know, a strict definition of a pin bar is needed to code it into an Algo.

So (unless I misunderstand your rules ?) you have opened a short even though price has not (yet) dropped below the 100% Fib retrace of the pin bar (high of pin bar = 0%) ?

It be easier for us (following your ideas) if you show positions on your charts.

Hey GraHal.

Kind of but no and yes.

The bar you have put an arrow to IS the pin bar i use – My Pin Bar criteria are as follows:

The pinbar body (Coloured thick bit) MUST open and close within / be within the, 61% – 100% of the fib drawn. So, if the pinbar body closes or is outside of the 61-100% points then i dont use it.

Thats the pinbar definition. If the body its self is ANYWHERE between the 61% and 0% then DONT USE IT.

Remember that the FIB MUST be drawn from the wick tip to wick tip. and the candle body MUST be within the 61-100% point of that FIB.

If it is – then place an order to open a trade as i have done on the screenshot i attached 1point below / above the 100% point of the FIB, and the stop at the 0% point of fib.

I dont open a trade, it is always an order to open, as sometimes price doesnt even make it past the 100% point and shoots off the other way. So NO i dont open a trade, i set an order to open if price hits that point.

Hope thats answered the questions.

Attached is a trade taken as proof of concept

I guess it was you saying above … I tend to think of a trade as an actual position opened.

Thanks for the explanation, be great if somebody could code your strategy then we can backtest over an extended period etc.