Hi every one,

I start this topic to discuss this strategy and understand it and why not improve it and at the same time learn to program, here is the code of the strategy :

// END OF DAY - YEN

// www.doctrading.fr

Defparam cumulateorders = false

// TAILLE DES POSITIONS

n = 1

// PARAMETRES

// high ratio = few positions

// AUD/JPY : ratio = 0.5 / SL = 0.8 / TP = 1.2 / Period = 12

// EUR/JPY : ratio = 0.6 / SL = 1 / TP = 0.8 / Period = 8

// GBP/JPY : ratio = 0.5 / SL = 0.6 / TP = 1 / Period = 8

// USD/JPY : ratio = 0.5 / SL = 1 / TP = 0.8 / Period = 12

ratio = 0.5

// HORAIRES

startTime = 210000

endTime = 231500

exitLongTime = 210000

exitShortTime = 80000

// STOP LOSS & TAKE PROFIT (%)

SL = 1

TP = 0.8

Period = 12

// BOUGIE REFERENCE à StartTime

if time = startTime THEN

amplitude = highest[Period](high) - lowest[Period](low)

ouverture = close

endif

// LONGS & SHORTS : every day except Fridays

// entre StartTime et EndTime

if time >= startTime and time <= endTime and dayOfWeek <> 5 then

buy n shares at ouverture - amplitude*ratio limit

sellshort n shares at ouverture + amplitude*ratio limit

endif

// Stop Loss & Take Profit

set stop %loss SL

set target %profit TP

// Exit Time

if time = exitLongTime then

sell at market

endif

if time = exitShortTime then

exitshort at market

endif

This is a classic Asian session breakout strategy. You’ll find many literature on the web about.

tks you @Nicolas

if there are people willing to work with me on this strategy on understanding and why not improve it,

First of all I don’t know why my calculations are not good I don’t get the same entry price in Long :

Highest : 134.986

Lowest : 134.607

amplitude = Highest – Lowest = 134.986 – 134.607 = 0.379

Ouverture : 134.968

in this situation, there is the price of Buy and SellShort :

if time >= startTime and time <= endTime and dayOfWeek <> 5 then

buy n shares at ouverture - amplitude*ratio limit // 134.968 - 0.1895 = 134.778

sellshort n shares at ouverture + amplitude*ratio limit // 134.986 + 0.01895 = 135.157

endif

1) question one, why the entry limit price it’s not the same of my math, maybe I did wrong ? it’s a limit price not market

2) according to the documentation it is not possible to be long and short at the same time, so normally the SellShort order should close the Long buy order

3) Also we can notice that we doubled our capital which makes us a gain of 100%, but also we had drawdown of more than 30%, Perhaps a better management with multiple timeframe or a good follow-up of the winning positions would have brought us a little more gain

4) If you have video or other links that summarize / explain this strategy for understanding I am a taker

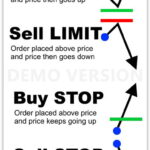

You are assuming LIMIT pending orders, while it could be that STOP pending are required. When placing pending orders, using the incorrect type may result in trades opened AT MARKET.

LIMIT pending orders are to be used when the entry price is most favourable than the entry price, i.e. you BUY at a lower price or SELLSHORT at a higher price, while STOP pending orders are to be used when you BUY at a higher price or SELLSHORT at a lower price (see attached pic).

ok, I understand you and your explaination is clear, but for me it’s still not clear why if they already have an limite long order it’s executed at a better price like a stop order, Also we speak about forex, so normaly no probleme of execution, but I don’t forget also I’m on a CFD with IG,

I will come back after some days about this execution problem, tks again robertogozzi

Let’s try to improve our code a little bit, some one can help me on line 50 to 54 ? I want to add an condition if our equity go down with X% (Drawdown) we have to stop the strategy :

// USD/JPY preferred

// H1

Defparam CumulateOrders = False

//Once Capital = 100000 // Initial Capital of 100 000 JPY

//Once Equity = Capital

// Lever (max recommended: 1.5)

Leverage = 1

// Choice of reinvesting earnings or not

REINV = 0

IF REINV = 0 THEN

n = 1 * Leverage

ENDIF

IF REINV = 1 THEN

Capital = 100000 + StrategyProfit

n = (Capital / 100000) * Leverage

IF n <1 THEN

n = 1 // Minimum Size : 1

ENDIF

ENDIF

// Reference candle 18 to 22H

If Time = 220000 THEN

Amplitude = Highest[4](High) - Lowest[4](Low)

Amplitude = Amplitude * 0.4

Opening = Close

ENDIF

// BUY & SELL between 22H et 23H & We have to check GTM Time

IF time >= 220000 and time <= 230000 THEN

Buy n Shares AT Opening - Amplitude Limit

Sellshort n Shares AT Opening + Amplitude Limit

ENDIF

// STOP & TARGET

SET STOP %LOSS 0.4

SET TARGET %PROFIT 1.2

// EXIT

IF time = 100000 THEN

SELL AT MARKET

EXITSHORT AT MARKET

ENDIF

// STOP STRATEGIE IF DRAWDOWN OF 10%

DrawDownwMax = 10

IF Capital <= (Capital[1] - (Capital[1] / DrawDownwMax)) Then

QUIT

ENDIF

//IF STRATEGYPROFIT < -100 THEN

//QUIT

//ENDIF

or this solution for max drawdown but sill not working :

// STOP STRATEGIE IF DRAWDOWN OF 30%

MaxDrawDownPercentage = 30

Equity = 100000 + StrategyProfit

MaxDrawdown = Equity * (MaxDrawDownPercentage/100)

IF OnMarket and ((PositionPrice - low)*CountOfPosition) > MaxDrawDown THEN

Quit

ENDIF

I found this solution for the maximum Drawdown, I save at every candle the highest equity I get in HighestEquity variable and compare with the current candle equity for quit if we got more then MaxDrawDownPercentage % :

// STOP STRATEGIE IF DRAWDOWN OF 30%

MaxDrawDownPercentage = 40

Equity = 100000 + StrategyProfit

HighestEquity = Max (HighestEquity,Equity) // Save the Maximum Equity we got

MaxDrawdown = HighestEquity * (MaxDrawDownPercentage/100)

ExitFromMarket = Equity <= HighestEquity - MaxDrawdown

IF ExitFromMarket Then

Quit

ENDIF

But this is woking good only after the position is closed, if some one can give me a help with the case if we are in the market for calculate the real PROFIT before closing a position in real time, because even we use a Stop Loss I think because we use only one time frame we can get some surprise, or maybe some good link for the equity management

@Moderator

I did a small mistake so maybe you can delete for me my message number: #212170 (or give me the possibility to edit it)

Hi every one,

So as you can see I did a mistake in the message number #212170, So now there is agan the original code or the first strategie “End Of Day – YEN M15” we are talking about (Knowing that I don’t really believe in this strategy or understand it well, but it is necessary to start from a base to work and improve the code and therefore my programming on ProBuilder)

// Strategy Name : END OF DAY - YEN

// Version : 2.0

// Information : I don't know what is this Strategie means ;-)

// PARAMETRES // this is from the original code, I don't if it's working good

// High Ratio = Few Positions

// AUD/JPY : Ratio = 0.5 / SL = 0.8 / TP = 1.2 / Period = 12

// EUR/JPY : Ratio = 0.6 / SL = 1 / TP = 0.8 / Period = 8

// GBP/JPY : Ratio = 0.5 / SL = 0.6 / TP = 1 / Period = 8

// USD/JPY : Ratio = 0.5 / SL = 1 / TP = 0.8 / Period = 12

// ============================================================

Defparam cumulateorders = false

// Initial Capital of 100 000 JPY & Spread : 2

Once Capital = 100000

// SIZE OF THE POSITIONS

N = 1

Ratio = 0.5

// TIMETABLE

StartTime = 210000

EndTime = 231500

ExitLongTime = 210000

ExitShortTime = 80000

// STOP LOSS & TAKE PROFIT (%)

SL = 1

TP = 0.8

Period = 12

// CANDLE REFERENCE to StartTime

IF Time = StartTime THEN

Amplitude = Highest[Period](High) - Lowest[Period](Low)

Opening = Close

ENDIF

// LONGS & SHORTS : every day except Fridays

// between StartTime and EndTime

IF Time >= StartTime AND Time <= EndTime AND DayOfWeek <> 5 THEN

Buy N Shares AT (Opening - Amplitude * Ratio) Limit

SellShort N Shares AT (Opening + Amplitude * Ratio) Limit

ENDIF

// Stop Loss & Take Profit

Set Stop %Loss SL

Set Target %Profit TP

// Exit Time

IF Time = ExitLongTime THEN

Sell AT Market

ENDIF

IF Time = ExitShortTime THEN

ExitShort AT Market

ENDIF

and there is the result with :

USD/JPY Mini

Initial Capital : 100000 JPY

Test on a candle history of : 50K

Spread : 2

Here are the results of the original strategy without any modifications (see photo)

Someone can tell me why there is a difference between the result of equity of : 202 880 JPY and 193 670 JPY, maybe the spread fees is calculated only in the detailed report ?

lets start with some backtest with a max DrowDawn of 5%, the result is -5,64% from the equity, you can see the screen short

with a max DrowDawn of 10%, the result is -10,51% from the equity, you can see the screen short

with a max DrowDawn of 20%, the result is -20,77% from the equity, you can see the screen short

with a max DrowDawn of 40%, the result is +100% from the equity, you can see the screen short