Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Division by zero in position sizing code error

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Division by zero in position sizing code error

-

AuthorPosts

-

Dear all,

I’ve been trying for long to figure out why my code gets divison by zero error. Usually i can’t even start the code without that it goes 1 minute and it shuts down with division by zero error. But on some occasions, dont ask me why, it can start and run, but if i stop and try to run it again it wont work. I’ve narrowed it down to my position sizing calculation, since if i remove this it works fine. But i can figure out how to change the code to have the same position sizing code without causing divison by zero error.

The thought is to not risk more that 0,5% of the Equity by setting a stop in relation to ATR on entry.

WCS = MyStop

InitialEquity = 3000

Equity = InitialEquity+Strategyprofit

MyPercRisk = 0.995

MinPositionSize = 1

PositionSize = MinPositionSize*ROUND((Equity-(Equity*MyPercRisk))/(((MinPositionSize*WCS))))Timeframe (5 minutes)

IF NOT ONMARKET THEN

IF Z1 or Z2 or Z3 or Z4 or Z5 or Z6 or Z7 or Z8 or Z9 or Z10 THEN

MyStop = AverageTrueRange[17](close[3])*ATRMult

BUY Positionsize CONTRACTS AT MARKET

endif

endifIF Z1 or Z2 or Z3 or Z4 or Z5 or Z6 or Z7 or Z8 or Z9 or Z10 THEN

MyStop = AverageTrueRange[17](close[3])*ATRMult

SELLSHORT Positionsize CONTRACTS AT MARKET

endifI would be happy with suggestions that i could try,

Best regards Anders

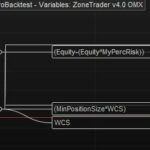

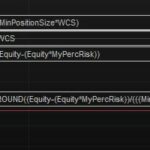

Append these lines to visually detect any cause:

graph ROUND((Equity-(Equity*MyPercRisk))/(((MinPositionSize*WCS)))) graph (Equity-(Equity*MyPercRisk)) graph (MinPositionSize*WCS) graph WCS //this line could retain 0Reddington thanked this postThanks Roberto, i atleast can see that it is due to something in the start. When i change the backtest size it always starts with 0 as you can see in my example pics. I do not know how to solve it though.. 🙂

Tips?

Br Anders

What value should MyStop have?

Ciao,

It should be based on AverageTrueRange, but it seems like it cant calculate the ATR directly when i start the system? Below you can see what MyStop should be, i have it embedded in the buying section to avoid that it recalculates on every bar, because i want the initial ATR based upon the entry candle.

IF NOT ONMARKET THEN

IF Z1 or Z2 or Z3 or Z4 or Z5 or Z6 or Z7 or Z8 or Z9 or Z10 THEN

MyStop = AverageTrueRange[17](close[3])*ATRMult

BUY Positionsize CONTRACTS AT MARKET

endif

endifBr Anders

Where can I find variables Z1, Z2, Z3, Z4, Z5, Z6, Z7, Z8, Z9 and Z10?

I think it would be easier if you posted the running code so that I can test it.Defparam cumulateorders = False WCS = MyStop InitialEquity = 3000 Equity = InitialEquity+Strategyprofit MyPercRisk = 0.995 // Max risk, bör ej vara över 2% = 0.98 MinPositionSize = 1//Minsta size PositionSize = MinPositionSize*ROUND((Equity-(Equity*MyPercRisk))/(((MinPositionSize*WCS)))) ATRMult = 5 SLMult = 1 //1 = ingen multiplier, starta alltid med 1, försämrad risk/reward vid multiplier MyProfit = 0 //0 är standard MyStartTrade = 090000 MyEndTrade = 173000 DaytoFilter = 0 Timeframe (Default) Z1H = 2204 Z1L = 2191 Z2H = 2250 Z2L = 2245 Z3H = 2284 Z3L = 2277 Z4H = 2308 Z4L = 2300 Z5H = 2362 Z5L = 2356 Z6H = 2413 Z6L = 2404 Z7H = 2383 Z7L = 2376 Z8H = 4620 Z8L = 4615 Z9H = 4665 Z9L = 4670 Z10H = 4698 Z10L = 4704 Z1 = Close > Z1L and Close < Z1H Z2 = Close > Z2L and Close < Z2H Z3 = Close > Z3L and Close < Z3H Z4 = Close > Z4L and Close < Z4H Z5 = Close > Z5L and Close < Z5H Z6 = Close > Z6L and Close < Z6H Z7 = Close > Z7L and Close < Z7H Z8 = Close > Z8L and Close < Z8H Z9 = Close > Z9L and Close < Z9H Z10 = Close > Z10L and Close < Z10H Long = Average[9](close) < Average[20](close) Short = Average[9](close) > Average[20](close) Timeframe (5 minutes) IF NOT ONMARKET THEN IF CurrentDayOfWeek <> DaytoFilter and Time > MyStartTrade And Time < MyEndTrade THEN IF Long THEN IF Z1 or Z2 or Z3 or Z4 or Z5 or Z6 or Z7 or Z8 or Z9 or Z10 THEN MyStop = AverageTrueRange[10](close[1])*ATRMult BUY Positionsize CONTRACTS AT MARKET endif endif IF Short THEN IF Z1 or Z2 or Z3 or Z4 or Z5 or Z6 or Z7 or Z8 or Z9 or Z10 THEN MyStop = AverageTrueRange[10](close[1])*ATRMult SELLSHORT Positionsize CONTRACTS AT MARKET endif endif endif endif Timeframe (Default) SHL = (Close - (Positionprice+(Mystop*2))) SellHalfL = (SHL > 0.5) SHS = ((Positionprice-(Mystop*2)) - Close) SellHalfS = (SHS > 0.5) SLL = ((Positionprice-(Mystop*SLMult)) - Close) StopL = (SLL > 0.5) SLS = (Close - (Positionprice+(Mystop*SLMult))) StopS = (SLS > 0.5) BEL = (Close-Positionprice) BrkEL = (BEL < 1) BES = (Positionprice-Close) BrkES = (BES < 1) BCL = (Close - (Positionprice+(MyStop))) BeCalcL = (BCL > 1) BCS = ((Positionprice-(1)) - Close) BeCalcS = (BCS > 1) HalfPos = (Positionsize/2) IF abs(CountOfPosition) = 0 THEN Count = 0 endif IF LONGONMARKET THEN IF SellHalfL AND abs(CountOfPosition) = PositionSize THEN SELL HalfPos CONTRACTS AT MARKET elsif StopL THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET elsif BECalcL THEN Count = Count + 1 IF Count >= 1 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif endif IF SHORTONMARKET THEN IF SellHalfS AND abs(CountOfPosition) = PositionSize THEN EXITSHORT HalfPos CONTRACTS AT MARKET elsif StopS THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET elsif BECalcS THEN Count = Count + 1 IF Count = 1 AND BrkES THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif endif If MyProfit > 0 then SET TARGET PPROFIT MyProfit endifThanks, i’ve added the full code.

Br Anders

It’s due to WCS being 0 at the beginning(line 2), so that line 7 will immediately result in a “DIVISION BY 0” error.

Code is read and executed sequentially, you need to set a value for MyStop prior to line 2. Or you may want to move lines 2-7 to a line AFTER MyStop is assigned a correct value, other than 0.

Reddington thanked this postBig THANKS! 😀

Ciao Roberto,

Hope you are well! You solved the divison error for me and i’ve been trading the code for a while. But now i have another “issue”, i’ve tried to build a scaling out system based on how many times my risk im in profit. And i do not want to leave a position in market which would be easier but instead i would like the code to sell based on if the calculation is true.

Issue #1: My self half code works very well when im short. It sells half of the contract and keeps the other half. But when Long, it sell halfs and on next bar sell the other half directly. In my backtest everything looks fine.

Issue #2: When i was in a short pos recently and it scaled out half, it never triggered my other commands to sell remaining half even though it passed well the 2x of profit and should have sold on 1.25 times the entry. I can’t find a reason for why? Everything looks OK in the backtest.

Hope you or someone else could give some guidance, last time you mentioned in which steps the code is read. Could you elaborate this point a bit further?

Code has been traded on: Sverige 30 Cash, 1 min timeframe (if you talk 1k bars back you will have the latest trades i done, which are fine, but not really acc the backtest since it kept the position until i manually closed the short almost 3x of profits)

Br Anders

Defparam cumulateorders = False ATRMult = 1//4 SellHalf = 1 // 0 = säljer poss till 2:1 RR, 1 säljer halva vid 2:1 BE1 = 1 // 1= BE lyfts in vid 1:1 BEMult = 1 // 1 = ingen multiplier, starta alltid med 1. Vid ex2 ggr måste kurs nå 2 ggr risk innan den flyttar till BE. BE2 = 1 // 1= BE lyfts in till 1.25:1 vid 2:1 BE3 = 1 // 1= BE lyfts in till 2.5:1 vid 3:1 BE4 = 1 // 1= BE lyfts in till 3.75:1 vid 4:1 SLMult = 1 //1 = ingen multiplier, starta alltid med 1, försämrad risk/reward vid multiplier MyProfit = 0 //0 är standard MyStartTrade = 060000 MyEndTrade = 173000 DaytoFilter = 0 Timeframe (Default) Z1H = 23080 //LONG Z1L = 23030 //LONG Z2H = 23000 //LONG Z2L = 22290 //LONG Z3H = 22870 //LONG Z3L = 22770 //LONG Z4H = 2315 // SHORT Z4L = 2308 // SHORT Z5H = 2342 // SHORT Z5L = 2338 // SHORT Z6H = 2371 // SHORT Z6L = 2365 // SHORT Z7H = 15955 Z7L = 15955 Z8H = 15955 Z8L = 15955 Z9H = 15955 Z9L = 15955 Z10H = 15955 Z10L = 15955 Z11H = 15955 Z11L = 15955 Z12H = 15955 Z12L = 15955 Z13H = 15955 Z13L = 15955 Z14H = 15955 Z14L = 15945 Z15H = 16010 Z15L = 15995 Z16H = 16055 Z16L = 16045 Z17H = 16110 Z17L = 16090 Z18H = 16155 Z18L = 16135 Z19H = 16235 Z19L = 16215 Z20H = 16295 Z20L = 16280 Z21H = 16360 Z21L = 16345 Z22H = 16420 Z22L = 16400 Z23H = 16525 Z23L = 16500 Z24H = 16610 Z24L = 16595 Z25H = 16775 Z25L = 16775 Z1 = Close > Z1L and Close < Z1H Z2 = Close > Z2L and Close < Z2H Z3 = Close > Z3L and Close < Z3H Z4 = Close > Z4L and Close < Z4H Z5 = Close > Z5L and Close < Z5H Z6 = Close > Z6L and Close < Z6H Z7 = Close > Z7L and Close < Z7H Z8 = Close > Z8L and Close < Z8H Z9 = Close > Z9L and Close < Z9H Z10 = Close > Z10L and Close < Z10H Z11 = Close > Z11L and Close < Z11H Z12 = Close > Z12L and Close < Z12H Z13 = Close > Z13L and Close < Z13H Z14 = Close > Z14L and Close < Z14H Z15 = Close > Z15L and Close < Z15H Z16 = Close > Z16L and Close < Z16H Z17 = Close > Z17L and Close < Z17H Z18 = Close > Z18L and Close < Z18H Z19 = Close > Z19L and Close < Z19H Z20 = Close > Z20L and Close < Z20H Z21 = Close > Z21L and Close < Z21H Z22 = Close > Z22L and Close < Z22H Z23 = Close > Z23L and Close < Z23H Z24 = Close > Z24L and Close < Z24H Z25 = Close > Z25L and Close < Z25H IF NOT ONMARKET THEN IF CurrentDayOfWeek <> DaytoFilter and Time > MyStartTrade And Time < MyEndTrade THEN IF Z1 or Z2 or Z3 or Z7 or Z8 or Z9 or Z10 or Z11 or Z12 or Z13 or Z14 or Z15 or Z16 or Z17 or Z18 or Z19 or Z20 or Z21 or Z22 or Z23 or Z24 or Z25 THEN MyStop = 8*ATRMult WCS = MyStop InitialEquity = 3000 Equity = InitialEquity+Strategyprofit MyPercRisk = 0.995 // Max risk, bör ej vara över 2% = 0.98 MinPositionSize = 1//Minsta size PositionSize = MinPositionSize*ROUND((Equity-(Equity*MyPercRisk))/(((MinPositionSize*WCS)))) BUY Positionsize CONTRACTS AT MARKET endif endif IF Z4 or Z5 or Z6 or Z7 or Z8 or Z9 or Z10 or Z11 or Z12 or Z13 or Z14 or Z15 or Z16 or Z17 or Z18 or Z19 or Z20 or Z21 or Z22 or Z23 or Z24 or Z25 THEN MyStop = 8*ATRMult WCS = MyStop InitialEquity = 3000 Equity = InitialEquity+Strategyprofit MyPercRisk = 0.995 // Max risk, bör ej vara över 2% = 0.98 MinPositionSize = 1//Minsta size PositionSize = MinPositionSize*ROUND((Equity-(Equity*MyPercRisk))/(((MinPositionSize*WCS)))) SELLSHORT Positionsize CONTRACTS AT MARKET endif endif Timeframe (Default) SHL = (Close - (Positionprice+(Mystop*2))) SellHalfL = (SHL > 0.5) SHS = ((Positionprice-(Mystop*2)) - Close) SellHalfS = (SHS > 0.5) SLL = ((Positionprice-(Mystop*SLMult)) - Close) StopL = (SLL > 0.5) SLS = (Close - (Positionprice+(Mystop*SLMult))) StopS = (SLS > 0.5) BEL = (Close-Positionprice) BrkEL = (BEL < 1) BES = (Positionprice-Close) BrkES = (BES < 1) BCL = (Close - (Positionprice+(MyStop*BEMult))) BeCalcL = (BCL > 1) BCS = ((Positionprice-(Mystop*BEMult)) - Close) BeCalcS = (BCS > 1) BEL2 = (Close-(Positionprice+MyStop*1.25)) BrkEL2 = (BEL2 < 1) BES2 = ((Positionprice-MyStop*1.25)-Close) BrkES2 = (BES2 < 1) BCL2 = (Close - (Positionprice+(MyStop*2))) BeCalcL2 = (BCL2 > 1) BCS2 = ((Positionprice-(Mystop*2)) - Close) BeCalcS2 = (BCS2 > 1) BEL3 = (Close-(Positionprice+(MyStop*2.5))) BrkEL3 = (BEL3 < 1) BES3 = ((Positionprice-(MyStop*2.5))-Close) BrkES3 = (BES3 < 1) BCL3 = (Close - (Positionprice+(MyStop*3))) BeCalcL3 = (BCL3 > 1) BCS3 = ((Positionprice-(Mystop*3)) - Close) BeCalcS3 = (BCS3 > 1) BEL4 = (Close-(Positionprice+(MyStop*3.5))) BrkEL4 = (BEL4 < 1) BES4 = ((Positionprice-(MyStop*3.5))-Close) BrkES4 = (BES4 < 1) BCL4 = (Close - (Positionprice+(MyStop*4))) BeCalcL4 = (BCL4 > 1) BCS4 = ((Positionprice-(Mystop*4)) - Close) BeCalcS4 = (BCS4 > 1) BEL5 = (Close-(Positionprice+(MyStop*4.5))) BrkEL5 = (BEL5 < 1) BES5 = ((Positionprice-(MyStop*4.5))-Close) BrkES5 = (BES5 < 1) BCL5 = (Close - (Positionprice+(MyStop*5))) BeCalcL5 = (BCL5 > 1) BCS5 = ((Positionprice-(Mystop*5)) - Close) BeCalcS5 = (BCS5 > 1) BEL6 = (Close-(Positionprice+(MyStop*5.5))) BrkEL6 = (BEL6 < 1) BES6 = ((Positionprice-(MyStop*5.5))-Close) BrkES6 = (BES6 < 1) BCL6 = (Close - (Positionprice+(MyStop*6))) BeCalcL6 = (BCL6 > 1) BCS6 = ((Positionprice-(Mystop*6)) - Close) BeCalcS6 = (BCS6 > 1) BEL7 = (Close-(Positionprice+(MyStop*6.5))) BrkEL7 = (BEL7 < 1) BES7 = ((Positionprice-(MyStop*6.5))-Close) BrkES7 = (BES7 < 1) BCL7 = (Close - (Positionprice+(MyStop*6))) BeCalcL7 = (BCL7 > 1) BCS7 = ((Positionprice-(Mystop*6)) - Close) BeCalcS7 = (BCS7 > 1) BEL8 = (Close-(Positionprice+(MyStop*7.5))) BrkEL8 = (BEL8 < 1) BES8 = ((Positionprice-(MyStop*7.5))-Close) BrkES8 = (BES8 < 1) BCL8 = (Close - (Positionprice+(MyStop*7))) BeCalcL8 = (BCL8 > 1) BCS8 = ((Positionprice-(Mystop*7)) - Close) BeCalcS8 = (BCS8 > 1) HalfPos = (Positionsize/2) IF abs(CountOfPosition) = 0 THEN CountSellHalf = 0 endif IF abs(CountOfPosition) = 0 THEN Count = 0 endif IF abs(CountOfPosition) = 0 THEN Count2 = 0 endif IF abs(CountOfPosition) = 0 THEN Count3 = 0 endif IF abs(CountOfPosition) = 0 THEN Count4 = 0 endif IF abs(CountOfPosition) = 0 THEN Count5 = 0 endif IF abs(CountOfPosition) = 0 THEN Count6 = 0 endif IF abs(CountOfPosition) = 0 THEN Count7 = 0 endif IF abs(CountOfPosition) = 0 THEN Count8 = 0 endif IF abs(CountOfPosition) = 0 THEN HalfPos = 0 endif IF LONGONMARKET THEN IF SellHalf = 1 THEN IF SellHalfL AND abs(CountOfPosition) = PositionSize THEN SELL HalfPos CONTRACTS AT MARKET endif endif IF SellHalf = 0 THEN IF SellHalfL AND abs(CountOfPosition) = PositionSize THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF StopL THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif IF BE1 = 1 THEN IF BECalcL THEN Count = Count + 1 endif IF Count >= 1 and BrkEL THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BE2 = 1 THEN IF BECalcL2 THEN Count2 = Count2 + 1 endif IF Count2 >= 1 and BrkEL2 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BE3 = 1 THEN IF BECalcL3 THEN Count3 = Count3 + 1 endif IF Count3 >= 1 and BrkEL3 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BE4 = 1 THEN IF BECalcL4 THEN Count4 = Count4 + 1 endif IF Count4 >= 1 and BrkEL4 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BECalcL5 THEN Count5 = Count5 + 1 endif IF Count5 >= 1 and BrkEL5 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif IF BECalcL6 THEN Count6 = Count6 + 1 endif IF Count6 >= 1 and BrkEL6 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif IF BECalcL7 THEN Count7 = Count7 + 1 endif IF Count7 >= 1 and BrkEL7 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif IF BECalcL8 THEN Count8 = Count8 + 1 endif IF Count8 >= 1 and BrkEL8 THEN SELL abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF SHORTONMARKET THEN IF SellHalf = 1 THEN IF SellHalfS AND abs(CountOfPosition) = PositionSize THEN EXITSHORT HalfPos CONTRACTS AT MARKET endif endif IF SellHalf = 0 THEN IF SellHalfS AND abs(CountOfPosition) = PositionSize THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF StopS THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif IF BE1 = 1 THEN IF BECalcS THEN Count = Count + 1 endif IF Count >= 1 AND BrkES THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BE2 = 1 THEN IF BECalcS2 THEN Count2 = Count2 + 1 endif IF Count2 >= 1 AND BrkES2 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BE3 = 1 THEN IF BECalcS3 THEN Count3 = Count3 + 1 endif IF Count3 >= 1 AND BrkES3 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BE4 = 1 THEN IF BECalcS4 THEN Count4 = Count4 + 1 endif IF Count4 >= 1 AND BrkES4 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif endif IF BECalcS5 THEN Count5 = Count5 + 1 endif IF Count5 >= 1 AND BrkES5 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif IF BECalcS6 THEN Count6 = Count6 + 1 endif IF Count6 >= 1 AND BrkES6 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif IF BECalcS7 THEN Count7 = Count7 + 1 endif IF Count7 >= 1 AND BrkES7 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif IF BECalcS8 THEN Count8 = Count8 + 1 endif IF Count8 >= 1 AND BrkES8 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endif endif If MyProfit > 0 then SET TARGET PPROFIT MyProfit endifIssue #1: NO Long trades have been opened, despite trying with 1K, 5K, 10K, 15K, 50K, 100K and 200K units

Issue #2: Backtests seem to work correctly; it’s impossible to spot any real-time failure.

Thanks for supporting,

Issue #1: True, that is due to the fact that it has no levels that creates the buy signal for LONG. But i add those levels manually every week, and just now i did not have any long levels. But when it has an Long position, it scales out differently from short. Can that be due to that i have a certain sequence in the code?

Issue #2: Yes, i have the same conclusion the backtest looks just fine. But in real-time the code acts a bit differently by not respecting all sell calculations.

Is the code read from top to bottom or how does it work?

Br Anders

But when it has an Long position, it scales out differently from short. Can that be due to that i have a certain sequence in the code?

Hi Anders – Indeed it can. For example (and Yes, the code is executed from top to bottom) :

JustEntered = 0 // <<-- IF NOT ONMARKET THEN If not JustEntered then // <<-- This one is for good habit. IF CurrentDayOfWeek <> DaytoFilter and Time > MyStartTrade And Time < MyEndTrade THEN IF Z1 or Z2 or Z3 or Z7 or Z8 or Z9 or Z10 or Z11 or Z12 or Z13 or Z14 or Z15 or Z16 or Z17 or Z18 or Z19 or Z20 or Z21 or Z22 or Z23 or Z24 or Z25 THEN MyStop = 8*ATRMult WCS = MyStop InitialEquity = 3000 Equity = InitialEquity+Strategyprofit MyPercRisk = 0.995 // Max risk, bör ej vara över 2% = 0.98 MinPositionSize = 1//Minsta size PositionSize = MinPositionSize*ROUND((Equity-(Equity*MyPercRisk))/(((MinPositionSize*WCS)))) BUY Positionsize CONTRACTS AT MARKET JustEntered = 1 // <<-- endif endif endif If not JustEntered then // <<-- See text in post below.** IF Z4 or Z5 or Z6 or Z7 or Z8 or Z9 or Z10 or Z11 or Z12 or Z13 or Z14 or Z15 or Z16 or Z17 or Z18 or Z19 or Z20 or Z21 or Z22 or Z23 or Z24 or Z25 THEN MyStop = 8*ATRMult WCS = MyStop InitialEquity = 3000 Equity = InitialEquity+Strategyprofit MyPercRisk = 0.995 // Max risk, bör ej vara över 2% = 0.98 MinPositionSize = 1//Minsta size PositionSize = MinPositionSize*ROUND((Equity-(Equity*MyPercRisk))/(((MinPositionSize*WCS)))) SELLSHORT Positionsize CONTRACTS AT MARKET JustEntered = 1 // <<-- endif endif endif**) Without such an If, the SellShort will cancel out the Buy of the first section if the Buy happened as well.

You should NOT depend on the conditions for entering, no matter that you obviously think they will be mutually exclusive.

I only picked one example from your code, but it is full with these “mistakes”. So all your Sells and ExitShorts – same problem. For each of these commands, check whether you already executed them (e.g. If not JustExited).IF Count8 >= 1 AND BrkES8 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET endifMaye the CountOfPosition is good habit (told by someone), but I would never do that. Your code will be vague (ambiguous) because of it, because you won’t be able to follow (ProRealCode itself won’t have a problem with it). Look at this example :

IF Count6 >= 1 AND BrkES6 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET // Suppose this one triggers ... endif IF BECalcS7 THEN Count7 = Count7 + 1 endif IF Count7 >= 1 AND BrkES7 THEN EXITSHORT abs(CountOfPosition) CONTRACTS AT MARKET // ... then CountOfPosition is unchanged here. endifThus while you may think that when not OnMarket CountOfPosition will be 0 and nothing will happen anyway, you yourself won’t be able to check / follow what really will be happening. This is thus indeed because CountOfPosition will remain unchanged during all the lines of your code (this thus too may counteract an earlier command as per my example above). Only at the next call (when the current bar has passed / closed) these kind of “constants” will have been updated. Same with OnMarket and everything.

Notice that if you leave out the number of Contracts, it will also work for your example (not adding position to already existing position). Thus “ExitShort at Marlet” suffices.When you apply my “hints” it will be an eyeopener for you how

– suddenly the results are wildly different

– you suddenly understand what’s happening everywhere.Have fun !

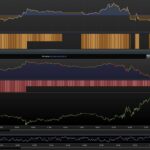

PeterReddington thanked this postHuge thanks Peter, i will most certainly start working on it. I actually got an new example today, i use the same code but with other levels on USTech, as seen in the image attached where i put the backtest above the actual trade, the position does the first move to halfen the size, but this should in my mind (before adding the wisedom from you Peter) also trigger my other condition to move the SL to BE according to my condition,

I will get on the task to correct my errors, please let me know if there is other vital mistakes i should consider 🙂

BR Anders

-

AuthorPosts

- You must be logged in to reply to this topic.

Division by zero in position sizing code error

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 15 replies,

has 3 voices, and was last updated by ![]() robertogozzi

robertogozzi

4 years, 2 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 11/08/2021 |

| Status: | Active |

| Attachments: | 5 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.