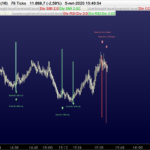

I was inspired by the “Another RSI Divergence Indicator by Nicolas. The same idee has applied to the SMI and to the CCI indicators.

OverboughtLevel are not 70 and 30 RSI but 40 and -40 for SMI and 100 and -100 for CCI.

And as you can see the RSI is replaced by the SMI and the CCI respectively.

// Settings for SMI Divergence

obLevel=40 //overbought level

osLevel=-40 //oversold level

minimalBars=5 //minimal count of bars where CCI is ob or os

// End of settings

iSMi =SMI[14,3,5](close)

ob = iSMi>obLevel

os = iSMi<osLevel

if ob then

if not ob[1] then

maxSMi = 0

maxprice = 0

firstobbar = barindex

endif

maxSMi=max(maxSMi,ISMI)

maxprice=max(maxprice,high)

if maxSMi<>maxSMi[1] then

maxSMibar=barindex

endif

endif

if os then

if not os[1] then

minSMi = 100

minprice = close*100

firstosbar = barindex

endif

minSMi=min(minSMi,ISMI)

minprice=min(minprice,low)

if minSMi<>minSMi[1] then

minSMibar=barindex

endif

endif

divsell=0

if ISMI crosses under obLevel then

//verif divergence

div = maxprice>oldmaxprice and maxSMi<oldmaxSMi and (barindex-firstobbar)>=minimalBars

if div then

drawsegment(oldmaxSMibar,oldmaxSMi,maxSMibar,maxSMi) coloured(200,0,0)

drawarrowdown(maxSMibar,maxSMi) coloured(200,0,0)

DRAWVLINE(barindex)coloured(200,120,0,255)

divsell=osLevel

endif

oldmaxSMi = maxSMi

oldmaxprice = maxprice

oldmaxSMibar = maxSMibar

endif

divbuy=0

if iSMI crosses over osLevel then

//verif divergence

div = minprice<oldminprice and minSMi>oldminSMi and (barindex-firstosbar)>=minimalBars

if div then

drawsegment(oldminSMibar,oldminSMi,minSMibar,minSMi) coloured(0,120,200)

drawarrowup(minSMibar,minSMi) coloured(0,120,200)

DRAWVLINE(barindex)coloured(0,120,200,255)

divbuy=osLevel

endif

oldminSMi = minSMi

oldminprice = minprice

oldminSMibar = minSMibar

endif

return iSMI style(line,2) as "SMI",obLevel coloured(168,168,168) style(dottedline,2) as "overbought level", osLevel coloured(168,168,168) style(dottedline,1) as "oversold level", divsell coloured(200,0,0), divbuy coloured(0,200,0)

// Settings for CCI Divergence

obLevel=40 //overbought level

osLevel=-40 //oversold level

minimalBars=5 //minimal count of bars where CCI is ob or os

// End of settings

iSMi =SMI[14,3,5](close)

ob = iSMi>obLevel

os = iSMi<osLevel

if ob then

if not ob[1] then

maxSMi = 0

maxprice = 0

firstobbar = barindex

endif

maxSMi=max(maxSMi,ISMI)

maxprice=max(maxprice,high)

if maxSMi<>maxSMi[1] then

maxSMibar=barindex

endif

endif

if os then

if not os[1] then

minSMi = 100

minprice = close*100

firstosbar = barindex

endif

minSMi=min(minSMi,ISMI)

minprice=min(minprice,low)

if minSMi<>minSMi[1] then

minSMibar=barindex

endif

endif

divsell=0

if ISMI crosses under obLevel then

//verif divergence

div = maxprice>oldmaxprice and maxSMi<oldmaxSMi and (barindex-firstobbar)>=minimalBars

if div then

drawsegment(oldmaxSMibar,oldmaxSMi,maxSMibar,maxSMi) coloured(200,0,0)

drawarrowdown(maxSMibar,maxSMi) coloured(200,0,0)

DRAWVLINE(barindex)coloured(200,120,0,255)

divsell=osLevel

endif

oldmaxSMi = maxSMi

oldmaxprice = maxprice

oldmaxSMibar = maxSMibar

endif

divbuy=0

if iSMI crosses over osLevel then

//verif divergence

div = minprice<oldminprice and minSMi>oldminSMi and (barindex-firstosbar)>=minimalBars

if div then

drawsegment(oldminSMibar,oldminSMi,minSMibar,minSMi) coloured(0,120,200)

drawarrowup(minSMibar,minSMi) coloured(0,120,200)

DRAWVLINE(barindex)coloured(0,120,200,255)

divbuy=osLevel

endif

oldminSMi = minSMi

oldminprice = minprice

oldminSMibar = minSMibar

endif

return iSMI style(line,2) as "SMI",obLevel coloured(168,168,168) style(dottedline,2) as "overbought level", osLevel coloured(168,168,168) style(dottedline,1) as "oversold level", divsell coloured(200,0,0), divbuy coloured(0,200,0)