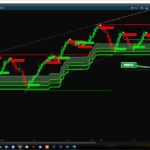

Background from the author of the strategy including pictures:

The SwingArm is an idea I had using the ATRTrailingStop and modifying it to have FIB Retracements into it. “I am not a coder…” I hired someone to help me out in getting it done.

It can be used on any timeframe. The best for me (day trading) is the 10-minute chart. For Swing Trading, the 4 hours chart works well. Alerts can be set up using an ATRTrailingStop scan

Thank you in advance!

The Code:

# blackFLAG FTS SwingArms

# Edited by: Jose Azcarate

# blackFLAG Futures Trading - FOR EDUCATIONAL PURPOSES ONLY

# TWITTER: @blackflagfuture

# Settings Vary. My preferred setting is 28 / 5 But also use 30 / 8 and 5 / 3.5 depending on strategy.

input trailType = {default modified, unmodified};

input ATRPeriod = 28;

input ATRFactor = 5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

input fib1Level = 61.8;

input fib2Level = 78.6;

input fib3Level = 88.6;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1] then high - close[1] else (high - close[1]) - 0.5 * (low - high[1]); def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

def ex = if BuySignal then high else if SellSignal then low else if state == state.long then Max(ex[1], high) else if state == state.short then Min(ex[1], low) else ex[1];

plot TrailingStop = trail;

TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS);

TrailingStop.DefineColor("Long", Color.GREEN);

TrailingStop.DefineColor("Short", Color.RED);

TrailingStop.AssignValueColor(if state == state.long

then TrailingStop.Color("Long")

else TrailingStop.Color("Short"));

plot Extremum = ex;

Extremum.SetPaintingStrategy(PaintingStrategy.POINTS);

Extremum.DefineColor("HH", Color.GREEN);

Extremum.DefineColor("LL", Color.RED);

Extremum.AssignValueColor(if state == state.long

then Extremum.Color("HH")

else Extremum.Color("LL"));

Extremum.Hide();

def f1 = ex + (trail - ex) * fib1Level / 100;

def f2 = ex + (trail - ex) * fib2Level / 100;

def f3 = ex + (trail - ex) * fib3Level / 100;

def l100 = trail + 0;

plot Fib1 = f1;

Fib1.SetPaintingStrategy(PaintingStrategy.POINTS);

Fib1.SetDefaultColor(Color.BLACK);

Fib1.Hide();

plot Fib2 = f2;

Fib2.SetPaintingStrategy(PaintingStrategy.POINTS);

Fib2.SetDefaultColor(Color.BLACK);

Fib2.Hide();

plot Fib3 = f3;

Fib3.SetPaintingStrategy(PaintingStrategy.POINTS);

Fib3.SetDefaultColor(Color.BLACK);

Fib3.Hide();

AddCloud(f1, f2, Color.LIGHT_GREEN, Color.LIGHT_RED, no);

AddCloud(f2, f3, Color.GREEN, Color.RED, no);

AddCloud(f3, l100, Color.DARK_GREEN, Color.DARK_RED, no);

def l1 = state[1] == state.long and close crosses below f1[1];

def l2 = state[1] == state.long and close crosses below f2[1];

def l3 = state[1] == state.long and close crosses below f3[1];

def s1 = state[1] == state.short and close crosses above f1[1];

def s2 = state[1] == state.short and close crosses above f2[1];

def s3 = state[1] == state.short and close crosses above f3[1];

def atr = Average(TrueRange(high, close, low), 14);

plot LS1 = if l1 then low - atr else Double.NaN;

plot LS2 = if l2 then low - 1.5 * atr else Double.NaN;

plot LS3 = if l3 then low - 2 * atr else Double.NaN;

plot SS1 = if s1 then high + atr else Double.NaN;

plot SS2 = if s2 then high + 1.5 * atr else Double.NaN;

plot SS3 = if s3 then high + 2 * atr else Double.NaN;

LS1.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

LS1.SetDefaultColor(Color.GREEN);

LS1.SetLineWeight(1);

LS1.Hide();

LS2.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

LS2.SetDefaultColor(Color.GREEN);

LS2.SetLineWeight(1);

LS2.Hide();

LS3.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

LS3.SetDefaultColor(Color.GREEN);

LS3.SetLineWeight(1);

LS3.Hide();

SS1.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SS1.SetDefaultColor(Color.RED);

SS1.SetLineWeight(1);

SS1.Hide();

SS2.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SS2.SetDefaultColor(Color.RED);

SS2.SetLineWeight(1);

SS2.Hide();

SS3.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SS3.SetDefaultColor(Color.RED);

SS3.SetLineWeight(1);

SS3.Hide();

Alert(l1, "Price crossed below Fib1 level in long trend", Alert.BAR, Sound.Bell);

Alert(l2, "Price crossed below Fib2 level in long trend", Alert.BAR, Sound.Bell);

Alert(l3, "Price crossed below Fib3 level in long trend", Alert.BAR, Sound.Bell);

Alert(s1, "Price crossed above Fib1 level in short trend", Alert.BAR, Sound.Bell);

Alert(s2, "Price crossed above Fib2 level in short trend", Alert.BAR, Sound.Bell);

Alert(s3, "Price crossed above Fib3 level in short trend", Alert.BAR, Sound.Bell);`