Bonjour,

La conversion de cet indicateur trouvé sur tradingview est-elle possible? merci par avance

lien: https://fr.tradingview.com/script/POrDlSAK-Smart-Money-Volume-Activity-AlgoAlpha

Description:

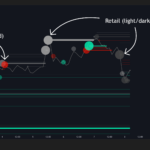

Cet outil visualise le comportement des acteurs du marché de la smart money et des retails grâce à une analyse des volumes sur une période plus courte. Il détecte les pics de volume bien supérieurs à l’activité normale, les classe comme institutionnels ou particuliers et projette ces zones comme niveaux réactifs. Le script se met à jour dynamiquement à chaque barre, indiquant l’entrée des acteurs importants et vérifiant si ces événements restent rentables. Chaque événement est représenté par une ligne horizontale avec des marqueurs de bulles et synthétisé dans un tableau de résultats en temps réel comparant les acteurs du marché des capitaux intelligents et du commerce de détail.

Script:

// © AlgoAlpha

//@version=6

indicator(“Smart Money Volume Activity [AlgoAlpha]”, “AlgoAlpha – Smart Money Volume”, overlay = true, max_lines_count = 150, behind_chart = false)

zLen = input.int(50, “Period (Chart Bars)”, minval = 5, tooltip = “Number of chart bars to analyze when aggregating lower-timeframe volumes and computing Z-scores. Larger values smooth results but reduce sensitivity.”, group = “Calculations”)

thAbs = input.float(2, “Threshold (|Z|)”, step = 0.1, tooltip = “Minimum absolute Z-score required for a lower-timeframe volume event to be considered significant. Higher values show fewer but stronger events.”, group = “Calculations”)

ltf_ = input.timeframe(“5”, “Lower Timeframe Value”, tooltip = “Determines the lower timeframe used to calculate buying and selling volume”, group=”Calculations”)

who = input.string(“Both”, “Show”, options = [“Smart Money”, “Retail”, “Both”], tooltip = “Filter which class to include in levels, bubbles, and P/L table.”, group = “Calculations”)

levels = input.bool(true, “Show Levels”, tooltip = “Draw horizontal levels at significant lower-timeframe volume events.”, group = “Calculations”)

bubbles = input.bool(true, “Show Bubbles”, tooltip = “Display a bubble marker at the strongest event on each bar. Opacity scales with the event |Z|-score.”, group = “Calculations”)

showPLTable = input.bool(true, “Show P/L Table”, tooltip = “Show a table comparing profit/loss volumes for Retail vs Smart Money.”, group = “Appearance”)

table_size = input.string(“Small”, “Table Size”, options=[“Tiny”,”Small”,”Medium”,”Large”], tooltip = “Controls text size for the P/L table.”, group=”Appearance”)

plTablePosition = input.string(“top right”, “Table Position”, options=[“bottom center”,”bottom left”,”bottom right”,”middle center”,”middle left”,”middle right”,”top center”,”top left”,”top right”], tooltip = “Position of the P/L table on the chart.”, group = “Appearance”)

bullColor = input.color(#00ffbb, “Smart Money Color”, tooltip = “Color for Smart Money bullish events and profit cells.”, group=”Appearance”, inline = “smColors”)

bearColor = input.color(#ff1100, “”, tooltip = “Color for Smart Money bearish events and loss cells.”, group = “Appearance”, inline = “smColors”)

retailbullcol = input.color(#9c9c9c, “Retail Color”, tooltip = “Color for Retail bullish events.”, group=”Appearance”, inline = “retColors”)

retailbearcol = input.color(#4a4a4a, “”, tooltip = “Color for Retail bearish events.”, group = “Appearance”, inline = “retColors”)

tableSize(sz) =>

switch sz

“Tiny” => size.tiny

“Small” => size.small

“Medium” => size.normal

“Large” => size.large

posFromString(str) =>

switch str

“bottom center” => position.bottom_center

“bottom left” => position.bottom_left

“bottom right” => position.bottom_right

“middle center” => position.middle_center

“middle left” => position.middle_left

“middle right” => position.middle_right

“top center” => position.top_center

“top left” => position.top_left

“top right” => position.top_right

var table plTable = na

var int plLastCols = na

var int plLastRows = na

var string plLastPos = “”

var string plLastSize = “”

alphaForVal(v, vmax) =>

vmax <= 0 ? 85 : math.round(85 – math.min(1.0, v / vmax) * 70)

lt_v = request.security_lower_tf(syminfo.tickerid, ltf_, volume)

lt_c = request.security_lower_tf(syminfo.tickerid, ltf_, close)

lt_o = request.security_lower_tf(syminfo.tickerid, ltf_, open)

var vols = array.new_float()

res_size = lt_v.size()

maximum = zLen * res_size

indexes = array.new_int()

var line[] levelLines = array.new()

var float[] levelPrices = array.new()

var int[] levelTypes = array.new()

var int[] levelCreatedBars = array.new()

var int[] levelClasses = array.new()

var line[] levelGlow1Lines = array.new()

var float[] levelVols = array.new()

var float[] levelZs = array.new()

maxStored = 150

zStoredCap = 100

var float[] levelActiveVols = array.new()

float barMaxAbsZ = na

int barBubbleDir = na

float barBubblePrice = na

int barBubbleClass = na

// Per-bar event flags (independent of ‘who’ and visualization toggles)

var bool retailBullBar = false

var bool retailBearBar = false

var bool smartBullBar = false

var bool smartBearBar = false

if barstate.isnew

barMaxAbsZ := na

barBubbleDir := na

barBubblePrice := na

barBubbleClass := na

retailBullBar := false

retailBearBar := false

smartBullBar := false

smartBearBar := false

if res_size > 0

for i = res_size – 1 to 0

vols.unshift(lt_v.get(i))

while vols.size() > maximum

vols.pop()

if vols.size() > 0

for i = 0 to res_size-1

zscore = (vols.get(i) – vols.avg()) / vols.stdev()

if zscore > thAbs

indexes.unshift(i)

if indexes.size() > 0

for i = 0 to indexes.size() – 1

intra_close = lt_c.get(indexes.get(i))

intra_open = lt_o.get(indexes.get(i))

isBull = intra_close > intra_open

int typ = isBull ? 1 : -1

bodyMin = math.min(open, close)

bodyMax = math.max(open, close)

lvlPrice = intra_close

isAtClose = lvlPrice == close

isStrictInBody = lvlPrice > bodyMin and lvlPrice < bodyMax int cls = isAtClose ? 1 : (isStrictInBody ? 2 : 1) bool classAllowed = (who == “Both”) or (who == “Retail” and cls == 1) or (who == “Smart Money” and cls == 2) bool shouldCreate = levels and classAllowed evtVol = lt_v.get(indexes.get(i)) volsAvg = vols.avg() volsStdev = vols.stdev() zVal = volsStdev > 0 ? (evtVol – volsAvg) / volsStdev : 0.0

int widthZ = math.max(1, math.min(10, math.round(math.abs(zVal))))

// Mark event presence for alerts (ignore ‘who’ filter and display toggles)

if cls == 1

if isBull

retailBullBar := true

else

retailBearBar := true

else if cls == 2

if isBull

smartBullBar := true

else

smartBearBar := true

bool bubbleClassAllowed = (who == “Both”) or (who == “Retail” and cls == 1) or (who == “Smart Money” and cls == 2)

if bubbleClassAllowed and (na(barMaxAbsZ) or math.abs(zVal) > barMaxAbsZ)

barMaxAbsZ := math.abs(zVal)

barBubbleDir := isBull ? 1 : -1

barBubblePrice := lvlPrice

barBubbleClass := cls

if shouldCreate

lineColor = cls == 1 ? (isBull ? retailbullcol : retailbearcol) : (isBull ? bullColor : bearColor)

transpBase = math.round((10 – widthZ) * 80 / 9)

coreWidth = math.max(1, widthZ – 2)

midWidth = math.max(1, widthZ – 1)

colGlow1 = color.new(lineColor, math.min(80, transpBase + 20))

glow1 = line.new(bar_index, lvlPrice, bar_index, lvlPrice, xloc.bar_index, extend.none,

color = colGlow1, width = midWidth)

coreLine = line.new(bar_index, lvlPrice, bar_index, lvlPrice, xloc.bar_index, extend.none,

color = color.new(lineColor, transpBase), width = coreWidth)

array.unshift(levelGlow1Lines, glow1)

array.unshift(levelLines, coreLine)

array.unshift(levelPrices, lvlPrice)

array.unshift(levelTypes, typ)

array.unshift(levelCreatedBars, bar_index)

array.unshift(levelClasses, cls)

array.unshift(levelVols, evtVol)

array.unshift(levelZs, zVal)

while array.size(levelVols) > zStoredCap

array.pop(levelVols)

while array.size(levelZs) > zStoredCap

array.pop(levelZs)

array.unshift(levelActiveVols, evtVol)

if array.size(levelLines) > 0

for i = array.size(levelLines) – 1 to 0

if i < array.size(levelLines)

l = array.get(levelLines, i)

lvl = array.get(levelPrices, i)

created = array.get(levelCreatedBars, i)

l.set_x2(bar_index)

if i < array.size(levelGlow1Lines) array.get(levelGlow1Lines, i).set_x2(bar_index) ocMin = math.min(open, close) ocMax = math.max(open, close) crossesBody = bar_index > created and barstate.isconfirmed and (ocMin <= lvl and ocMax >= lvl)

if crossesBody

array.remove(levelLines, i)

array.remove(levelPrices, i)

array.remove(levelTypes, i)

array.remove(levelCreatedBars, i)

array.remove(levelClasses, i)

if i < array.size(levelGlow1Lines)

line.delete(array.remove(levelGlow1Lines, i))

if i < array.size(levelActiveVols) array.remove(levelActiveVols, i) while array.size(levelLines) > maxStored

array.pop(levelLines).delete()

if array.size(levelGlow1Lines) > maxStored

array.pop(levelGlow1Lines).delete()

array.pop(levelPrices)

array.pop(levelTypes)

array.pop(levelCreatedBars)

array.pop(levelClasses)

if array.size(levelActiveVols) > maxStored

array.pop(levelActiveVols)

retailProfitVol = 0.0

retailLossVol = 0.0

smartProfitVol = 0.0

smartLossVol = 0.0

sz = array.size(levelLines)

if sz > 0

for i = 0 to sz – 1

if i < array.size(levelActiveVols) and i < array.size(levelPrices) and i < array.size(levelTypes) and i < array.size(levelClasses) lvl = array.get(levelPrices, i) typ = array.get(levelTypes, i) cls = array.get(levelClasses, i) volA = array.get(levelActiveVols, i) inProfit = (typ == 1 and close >= lvl) or (typ == -1 and close <= lvl)

if cls == 1

if inProfit

retailProfitVol += volA

else

retailLossVol += volA

else if cls == 2

if inProfit

smartProfitVol += volA

else

smartLossVol += volA

if barstate.islast and showPLTable

cols = 3

rows = 3

needRecreate = na(plTable) or na(plLastCols) or na(plLastRows) or plLastCols != cols or plLastRows != rows or plLastPos != plTablePosition or plLastSize != table_size

if needRecreate

if not na(plTable)

table.delete(plTable)

plTable := table.new(position = posFromString(plTablePosition), columns = cols, rows = rows, bgcolor = chart.bg_color, border_width = 1, border_color = chart.fg_color, frame_color = chart.fg_color, frame_width = 1)

plLastCols := cols

plLastRows := rows

plLastPos := plTablePosition

plLastSize := table_size

table.clear(plTable, 0, 0, cols – 1, rows – 1)

headerSize = tableSize(table_size)

maxProfit = math.max(retailProfitVol, smartProfitVol)

maxLoss = math.max(retailLossVol, smartLossVol)

profAlphaRetail = alphaForVal(retailProfitVol, maxProfit)

profAlphaSmart = alphaForVal(smartProfitVol, maxProfit)

lossAlphaRetail = alphaForVal(retailLossVol, maxLoss)

lossAlphaSmart = alphaForVal(smartLossVol, maxLoss)

table.cell(plTable, 0, 0, “Class”, text_color = chart.fg_color, text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 1, 0, “Profit”, text_color = chart.fg_color, text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 2, 0, “Loss”, text_color = chart.fg_color, text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 0, 1, “Retail”, text_color = chart.fg_color, text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 1, 1, str.tostring(retailProfitVol, format.volume), text_color = chart.fg_color, bgcolor = color.new(bullColor, profAlphaRetail), text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 2, 1, str.tostring(retailLossVol, format.volume), text_color = chart.fg_color, bgcolor = color.new(bearColor, lossAlphaRetail), text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 0, 2, “Smart”, text_color = chart.fg_color, text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 1, 2, str.tostring(smartProfitVol, format.volume), text_color = chart.fg_color, bgcolor = color.new(bullColor, profAlphaSmart), text_halign = text.align_center, text_size = headerSize)

table.cell(plTable, 2, 2, str.tostring(smartLossVol, format.volume), text_color = chart.fg_color, bgcolor = color.new(bearColor, lossAlphaSmart), text_halign = text.align_center, text_size = headerSize)

bubbleEnabled = bubbles and not na(barMaxAbsZ) and not na(barBubblePrice) and not na(barBubbleDir)

wRaw = math.round(barMaxAbsZ)

wClamped = math.max(1, math.min(10, wRaw))

zForTransp = math.min(10.0, math.max(0.0, barMaxAbsZ))

bubbleTransp = bubbleEnabled ? math.round((10 – zForTransp) * 80 / 9) : 100

bubbleClassOk = (who == “Both”) or (who == “Retail” and barBubbleClass == 1) or (who == “Smart Money” and barBubbleClass == 2)

classBullColor = barBubbleClass == 1 ? retailbullcol : bullColor

classBearColor = barBubbleClass == 1 ? retailbearcol : bearColor

bubbleColor = barBubbleDir == 1 ? classBullColor : classBearColor

yTiny = bubbleEnabled and bubbleClassOk and wClamped <= 2 ? barBubblePrice : na ySmall = bubbleEnabled and bubbleClassOk and wClamped > 2 and wClamped <= 4 ? barBubblePrice : na yNormal = bubbleEnabled and bubbleClassOk and wClamped > 4 and wClamped <= 6 ? barBubblePrice : na yLarge = bubbleEnabled and bubbleClassOk and wClamped > 6 and wClamped <= 8 ? barBubblePrice : na yHuge = bubbleEnabled and bubbleClassOk and wClamped > 8 ? barBubblePrice : na

plotshape(yTiny, “Volume Bubble”, shape.circle, location.absolute, color.new(bubbleColor, bubbleTransp), 0, “”, na, size = size.tiny, force_overlay = true)

plotshape(ySmall, “Volume Bubble”, shape.circle, location.absolute, color.new(bubbleColor, bubbleTransp), 0, “”, na, size = size.normal, force_overlay = true)

plotshape(yNormal, “Volume Bubble”, shape.circle, location.absolute, color.new(bubbleColor, bubbleTransp), 0, “”, na, size = size.large, force_overlay = true)

plotshape(yLarge, “Volume Bubble”, shape.circle, location.absolute, color.new(bubbleColor, bubbleTransp), 0, “”, na, size = size.huge, force_overlay = true)

plotshape(yHuge, “Volume Bubble”, shape.circle, location.absolute, color.new(bubbleColor, bubbleTransp), 0, “”, na, size = size.huge, force_overlay = true)

// ALERTS

alertcondition(retailBullBar, “Retail Bull”, “Retail bullish event detected”)

alertcondition(retailBearBar, “Retail Bear”, “Retail bearish event detected”)

alertcondition(smartBullBar, “Smart Money Bull”, “Smart Money bullish event detected”)

alertcondition(smartBearBar, “Smart Money Bear”, “Smart Money bearish event detected”)