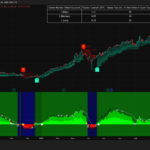

voici:

// ---------------------------------------------//

// PRC_Ichimoku Oscillator (BY LonesomeTheBlue)

//version = 0

//26.08.2025

//Iván González @ www.prorealcode.com

//Sharing ProRealTime knowledge

// ---------------------------------------------//

// --- PARÁMETROS CONFIGURABLES ---

conversionPeriods = 8

basePeriods = 13

laggingSpan2Periods = 26

displacement = 13

useatr = 1

atrlen = 9

atrmul = 2.0

bounceoff = 1

useema = 1

emalen = 9

ematkpartprft = 1

bgcolupI = 1 // 1=Verde, 2=Rojo, 3=Azul

bgcoldnI = 3 // 1=Verde, 2=Rojo, 3=Azul

bgtransp = 60

// --- CÁLCULOS ICHIMOKU ---

highestConv = HIGHEST[conversionPeriods](High)

lowestConv = LOWEST[conversionPeriods](Low)

conversionLine = (lowestConv + highestConv) / 2

highestBase = HIGHEST[basePeriods](High)

lowestBase = LOWEST[basePeriods](Low)

baseLine = (lowestBase + highestBase) / 2

leadLine1 = (conversionLine + baseLine) / 2

highestLagging = HIGHEST[laggingSpan2Periods](High)

lowestLagging = LOWEST[laggingSpan2Periods](Low)

leadLine2 = (lowestLagging + highestLagging) / 2

// --- CÁLCULO DEL OSCILADOR ---

CloudMin = MIN(leadLine1[displacement - 1], leadLine2[displacement - 1])

CloudMax = MAX(leadLine1[displacement - 1], leadLine2[displacement - 1])

inthecloud = (close >= CloudMin AND close <= CloudMax)

IF close > CloudMax THEN

mtrend = 1

ELSIF close < CloudMin THEN

mtrend = -1

ENDIF

// CAPA 1: Oscline

IF mtrend = 1 THEN

Oscline = (close - CloudMin)

ELSE

Oscline = (close - CloudMax)

ENDIF

// CAPA 2: Lagging

laggingComponent = 0

IF mtrend = 1 THEN

laggingComponent = MAX(close - CloudMax[displacement - 1], 0)

ELSE

laggingComponent = MIN(close - CloudMin[displacement - 1], 0)

ENDIF

Lagging = Oscline + laggingComponent

// CAPA 3: Conversion/Base

convBaseComponent = 0

IF mtrend = 1 THEN

convBaseComponent = MAX((conversionLine - baseLine), 0)

ELSE

convBaseComponent = MIN((conversionLine - baseLine), 0)

ENDIF

ConvBase = Lagging + convBaseComponent

// CAPA 4: Cloud

cloudComponent = 0

IF mtrend = 1 THEN

cloudComponent = MAX(leadLine1 - leadLine2, 0)

ELSE

cloudComponent = MIN(leadLine1 - leadLine2, 0)

ENDIF

cloud = ConvBase + cloudComponent

// --- LÓGICA DE TENDENCIA ---

anyofthemrising = (conversionLine > conversionLine[1]) OR (baseLine > baseLine[1])

anyofthemfalling = (conversionLine < conversionLine[1]) OR (baseLine < baseLine[1])

convoverbase = conversionLine >= baseLine

baseoverconv = conversionLine <= baseLine

tole = 0

IF useatr = 1 THEN

tole = AverageTrueRange[atrlen] * atrmul

ENDIF

IF mtrend = 1 THEN

IF mtrend[1] = -1 THEN

trend = 0

ENDIF

IF trend < 4 AND close > CloudMax THEN

newTrend = 1

IF Lagging > Oscline THEN

newTrend = newTrend + 1

ENDIF

IF convoverbase AND anyofthemrising THEN

newTrend = newTrend + 1

ENDIF

IF leadLine1 >= leadLine2 THEN

newTrend = newTrend + 1

ENDIF

trend = newTrend - 1

ELSIF conversionLine < baseLine - tole THEN

trend = 0

ENDIF

ELSIF mtrend = -1 THEN

IF mtrend[1] = 1 THEN

trend = 0

ENDIF

IF trend > -4 AND close < CloudMin THEN

newTrend = -1

IF Lagging < Oscline THEN

newTrend = newTrend - 1

ENDIF

IF baseoverconv AND anyofthemfalling THEN

newTrend = newTrend - 1

ENDIF

IF leadLine1 <= leadLine2 THEN

newTrend = newTrend - 1

ENDIF

trend = newTrend + 1

ELSIF conversionLine > baseLine + tole THEN

trend = 0

ENDIF

ENDIF

IF trend = 3 AND trend[1] <> 3 THEN

entrylevel = close

ELSIF trend = -3 AND trend[1] <> -3 THEN

entrylevel = close

ENDIF

// --- DIBUJO DE LAS ÁREAS DEL OSCILADOR CON COLORBETWEEN ---

// CAPA 4: Cloud

IF mtrend = 1 THEN

rcap4 = 0

gcap4 = 70

bcap4 = 0

ELSE

rcap4 = 70

gcap4 = 0

bcap4 = 0

ENDIF

COLORBETWEEN(0, cloud, rcap4, gcap4, bcap4, 255)

// CAPA 3: ConvBase

IF conversionLine >= baseLine THEN

rcap3 = 0

gcap3 = 130

bcap3 = 0

ELSE

rcap3 = 130

gcap3 = 0

bcap3 = 0

ENDIF

COLORBETWEEN(0, ConvBase, rcap3, gcap3, bcap3, 255)

// CAPA 2: Lagging

acap2 = 0 // alpha a 0 por defecto (transparente)

IF close > CloudMax THEN

rcap2 = 0

gcap2 = 190

bcap2 = 0

acap2 = 255

ELSIF close < CloudMin THEN

rcap2 = 190

gcap2 = 0

bcap2 = 0

acap2 = 255

ENDIF

IF acap2 > 0 THEN // Solo dibuja si hay color que aplicar

COLORBETWEEN(0, Lagging, rcap2, gcap2, bcap2, acap2)

ENDIF

// CAPA 1: Oscline

IF inthecloud THEN

rcap1 = 209

gcap1 = 212

bcap1 = 220

ELSIF close > CloudMax THEN

rcap1 = 0

gcap1 = 250

bcap1 = 0

ELSE // close < CloudMin

rcap1 = 250

gcap1 = 0

bcap1 = 0

ENDIF

COLORBETWEEN(0, Oscline, rcap1, gcap1, bcap1, 255)

// --- CÁLCULO DE SEÑALES ---

closetrade = 0

IF (trend <> trend[1]) AND (ABS(trend[1]) = 3) THEN

IF trend[1] > 0 THEN

closetrade = 1

ELSE

closetrade = -1

ENDIF

ENDIF

uptrendSignal = 0

downtrendSignal = 0

IF trend = 3 AND trend[1] <> 3 THEN

uptrendSignal = 1

ENDIF

IF trend = -3 AND trend[1] <> -3 THEN

downtrendSignal = -1

ENDIF

bouncbackup = 0

bouncbackdn = 0

IF bounceoff = 1 THEN

IF trend = 3 AND close > CloudMax AND inthecloud[1] THEN

bouncbackup = 1

ENDIF

IF trend = -3 AND close < CloudMin AND inthecloud[1] THEN

bouncbackdn = -1

ENDIF

ENDIF

partclose = 0

profitable = (trend = 3 AND close > entrylevel) OR (trend = -3 AND close < entrylevel)

IF profitable THEN

emaline = ExponentialAverage[emalen](cloud)

basecrosscons = baseLine CROSSES UNDER conversionLine

emacrosscloud = emaline CROSSES OVER cloud

convcrossbase = conversionLine CROSSES OVER baseLine

cloudcrossema = cloud CROSSES OVER emaline

IF (trend = 3 AND basecrosscons) OR (trend = 3 AND emacrosscloud AND ematkpartprft=1) THEN

partclose = 1

ENDIF

IF (trend = -3 AND convcrossbase) OR (trend = -3 AND cloudcrossema AND ematkpartprft=1) THEN

partclose = -1

ENDIF

ENDIF

// --- COLOR DE FONDO ---

alphaBG = 100 - bgtransp

uptmult = 159 + POW(trend, 3)

dntmult = 159 + POW(ABS(trend), 3)

rup = 0

gup = 0

bup = 0

rdn = 0

gdn = 0

bdn = 0

IF bgcolupI = 1 THEN

gup = uptmult

ELSIF bgcolupI = 2 THEN

rup = uptmult

ELSE

bup = uptmult

ENDIF

IF bgcoldnI = 1 THEN

gdn = dntmult

ELSIF bgcoldnI = 2 THEN

rdn = dntmult

ELSE

bdn = dntmult

ENDIF

IF trend > 0 THEN

BACKGROUNDCOLOR(rup, gup, bup, alphaBG)

ELSif trend < 0 then

BACKGROUNDCOLOR(rdn, gdn, bdn, alphaBG)

else

BACKGROUNDCOLOR("grey", alphaBG)

ENDIF

// --- SALIDA DE DATOS ---

emalineFinal = UNDEFINED

IF useema = 1 THEN

emalineFinal = ExponentialAverage[emalen](cloud)

ENDIF

RETURN emalineFinal AS "EMA", cloud coloured(rcap4,gcap4,bcap4), ConvBase coloured(rcap3,gcap3,bcap3), lagging coloured(rcap2,gcap2,bcap2), oscline coloured(rcap1,gcap1,bcap1)style(histogram)//, uptrendSignal AS "BuySignal", downtrendSignal AS "SellSignal", bouncbackup+bouncbackdn AS "AddSignal", closetrade AS "CloseSignal", partclose AS "PartialCloseSignal"