Commitment of Traders

Forums › ProRealTime English forum › General trading discussions › Commitment of Traders

- This topic has 5 replies, 3 voices, and was last updated 5 years ago by

Despair.

-

-

05/23/2018 at 1:41 PM #71176

I’d be interested in a discussion on whether anyones anyone use the Commitment of Traders weekly reports in their trading decision making process – either auto-trading or manual trading?

I find them to be a very interesting insight into an overall market sentiment but they obviously suffer from lag due to the fact that they tell you what everyone did last week!

Also does anyone have links to any useful sites where the reports can be found or are analysed?

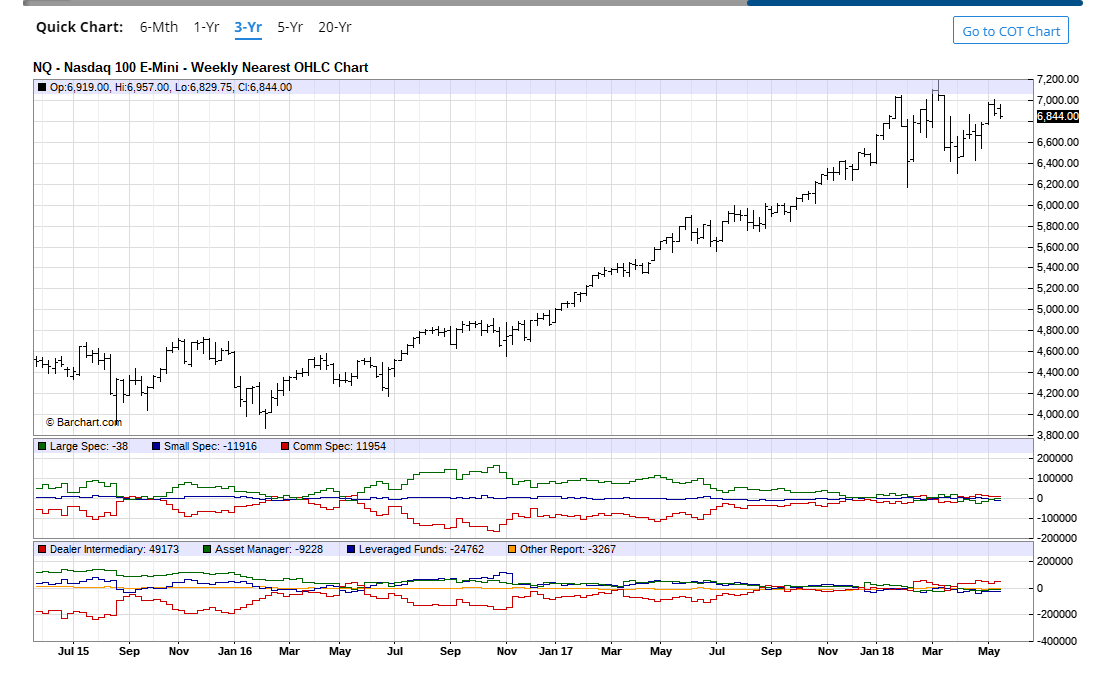

I use this one for looking at the reports but the graphs are quite difficult and cluttered to interpret sometimes.

05/23/2018 at 9:10 PM #7121205/23/2018 at 10:29 PM #71220It was a couple of years ago that I was first introduced to it by the ‘InnerCircleTrader’ but I never really got to grips with the benefits of it at that time due to trying to get to grips with every other aspect of trading! Funnily enough I was reminded of it yesterday when I listened to Larry Williams being interviewed in a podcast. I feel like the COT is possibly very powerful information but have not quite worked out how to involve it in my decision making yet. Part of me feels that maybe it is just another lagging indicator.

Not sure how it could ever be used in autotrading unless PRT were to provide access to COT charts or you just decided to manually turn strategies on or off dependent on the latest report. Impossible to backtest though.

05/24/2018 at 8:03 AM #71227Gonna add my 2 noob cents here: I think that 98% of the information we find and see is pure noise and should be blocked out.

all the news outlets are mostly bullshit clickbait trying to sell u something, and information that makes u turn on and off systems are most likely gonna fail because there is no “knowing”, only hoping and uncertainty. In a perfect world you will not turn off ur systems almost no matter what. Ur systems should be able to handle trumps tweets and brexits without busting your account.. Now if we see the market down -40% we’re most likely too late for turning off anything and if you turn it off then ur gonna miss all the profits going back up.. From what i can gather this is indeed lagging and i would guess not that helpful.

If you want to tho u can ofc make up rules saying ull “turn off systems if ….” and then “manually backtest” ur systems and removing results during the “off” period to check the results.. But again thats kinda just more curvefitting for past data… u never know what happens with ur rules in 2 years from now, or 2 days..

So yea my suggestion is to just make sure that youre systems are robust enough to handle tough times. And diversification so u make money going down as well as up… if u got those 2 things then im gonna guess ur set..

05/24/2018 at 8:16 AM #71229I was thinking more along the lines of turning off long only strategies when the commercials position is long and they are increasing that position – as they buy on the way down and sell on the way up. Some markets seem to have better correlation regarding this – I guess dependent on supply and demand of certain commodities at any one time for example.

05/24/2018 at 9:08 AM #71234 -

AuthorPosts

Find exclusive trading pro-tools on