Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

CFD AutoTrading – MarketPlace vendor – Questions, announcements and updates

- Forums

- ProRealTime English Forum

- General Trading: Market Analysis & Manual Trading

- CFD AutoTrading – MarketPlace vendor – Questions, announcements and updates

-

AuthorPosts

-

Can you post a chart of your portfolio? If I add up all the results published here, I come up with a loss. Which is terrible.

I understand you’re referring to this year’s results, not all of the results published here.

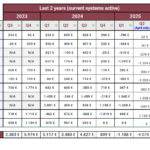

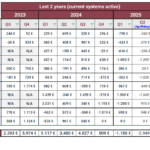

So far in 2025, we’ve seen a cumulative drawdown of –4.875€. Yes, that can be considered disappointing, depending on the initial reference capital. In fact, this has reached the worst-case expectations we shared on Discord at the beginning of the year (see attached image). With a reference capital of 16,000€, the drawdown represents around 30%. It’s not good, of course, but these things do happen. Meanwhile, we continue to improve our systems in the background and adapt to changing market conditions. We’re focused on long-term consistency while making carefully considered short-term adjustments—without rushing or overfitting.

It’s also important to take a broader view. If we look at the full results published here (starting in 2023-04, meaning we now have 24 months of data), the total profit amounts to 17.255€. To be accurate, the number is 17.451€ over two years when including revisions not republished here (but in our Discord and other channels). That averages about 727€/month or 8.725€ per year.

As mentioned, that refers to the period published here. For more historical data and graphs dating back to 2020, you can visit our website at cfdautotrading.com.

As always, when interpreting this type of data—averages, reference capital, portfolio allocations—it’s crucial to remember that variables change over time. Not only do market prices fluctuate, but the portfolio itself is dynamic (with versioning, new systems, and also halted ones). Because of this, projections or past revisions are rarely linear or straightforward.

APRIL 2025 RESULTS

Basically, it was the worst month in our history — by far. Since the beginning, our most challenging months typically resulted in losses of around 2.000 – 2.500€. However, this month went well beyond that, doubling it, with losses hitting even the systems that are usually the most consistent — affected mainly by the news, but not always.

Although it was a big punch, we remain stable and confident in the current systems (also considering that some necessary adjustments were already applied starting the month).

We do not manipulate results or hide them behind newly launched, well-presented, and overfitted systems designed to hide difficult market periods, which in fact we firmly believe are temporary.

May has started strong, with more than 1.200€ in profit. The outlook is beginning to clear.

It’s time to recover

It’s in the hardest moments that we remember to pause — and that’s when perspective matters most.

If you don’t know us yet, explore our live demo: http://bit.ly/cfdautodemo

Ready to enter the market? We’re offering everything at 50% off — for a limited time. http://bit.ly/cfdautostore

As a customer I would feel quite cheated, after so much loss and now be told that (expensively rented) algos now only cost half (50% off)…

@js It’s totally understandable what you’re saying. We’ve actually avoided major promotions since 2024 start, for reasons including maintaining integrity and ensuring similar conditions for all clients. However, given the current market conditions, overall trader sentiment, and the business context, we felt it was the right time to take action with this offer. That said, feel free to reach out to us directly via message or email. We’ll be happy to review your specific case and explore a suitable option, offer, or agreement together.I am not a customer… (kyc)MAY 2025 RESULTS ✅ A Positive (and necessary!) month – Recovery is underway

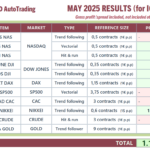

After a series of challenging months, May delivered a welcome turnaround with positive performance. Although we saw stronger momentum earlier in the month, a few trades slipped near the end. Nevertheless, we closed in positive territory, driven by standout performances, notably from PLUG NIKKEI. This is a strong first step toward the broader recovery we anticipate in the coming months.

Take the opportunity to explore our systems by downloading the demo yourself at: https://cfdautotrading.com/demo.

You’ll likely find something interesting, and you can still take advantage of the 50% OFF offer. But don’t wait too long — the offer ends when the S&P 500 reaches a new all-time high…Hi. How was ur month?📉 June 2025 Update

June closed with a light-to-medium loss that, coincidentally, reversed the gains we had posted in May. The setback was mainly due to commodities systems, with SETH CRUDE suffering a 350-point gap on June 23rd caused by war-related news.

Additionally, the new HEPHA GOLD [TF7min] experienced a common first-trade loss following its launch.

Despite the overall drawdown, it’s essential to note that not all strategies performed poorly — those using diversified combinations of systems were notably more resilient.

We’ll revisit performance in more detail after the holiday period. We will continue refining our portfolios and platform options, including a new review of the usage and combination of IG FUTURES.

🔁 Thank you for your patience and ongoing trust — we remain focused on achieving long-term results.

📈 July 2025 Update July delivered a modest but positive 568€ profit on IG CFDs, showing steady recovery from June’s setback. BASTET DAX dominated with +579.20€, while TALOS NAS systems performed strongly (+301.50€ and +275.15€ respectively for half sizing, 0.5 contracts). However, SETH CRUDE continued its challenging streak with a significant loss — now marking four consecutive difficult months in commodities. PLUG NIKKEI also faced headwinds at -219.81€. Commodities remain under focused review as we assess whether current pressures are temporary volatility or require strategic adjustments. On the other hand, when using IG FUTURES the results was different: Nice performance this month, with multiple algorithms delivering strong results that overshadow the SETH strategy losses Not always posting the IG FUTURES results due to low usage for now, but I wanted to show the differences that can sometimes occur. Recommend taking a look at our IG Futures vs. CFDs guideHi, The “Futures” perform better here because more contracts are used compared to the CFDs… (so they’re not directly comparable…)

Furthermore, it’s strange that some systems show profits with Futures while making losses with CFDs…

Are these figures (CFD/Futures) based on live trading?Starting with whether the results are from live trading: no, these are BackTest results in this case, with a brief review to ensure no major differences with demo instances. A few months ago in this post (https://www.prorealcode.com/topic/cfd-autotrading-marketplace-vendor-questions-announcements-and-updates/page/3/#post-244887) we mentioned that we weren’t running all active systems live for various reasons. Since starting in 2020, we’ve been extracting results only from real instances, but it’s also true that for quite a few months (perhaps a year) we’ve drastically reduced the active instances in use on real accounts. And I say “active” because as I pointed out in that post, or as we openly explain in our groups or to those who ask us, beyond the current portfolio, we need to launch future versions and tests to validate them in real trading. Additionally, this multiplies numerous robots with their variants, using IG CFD, IG FUTURES, standard FUTURES in a few cases (we’re also IBKR AutoTrading)… not to mention a decapitalization I personally made last year, with other ongoing businesses (including robots for another platform which we haven’t wanted to publish/relate). All together we could need a huge amount of money. And there’s an extra and very simple factor: we know that robots with more losses on the last period aren’t generally used. Added to all the above reason, we don’t always use them either to unnecesarely increase the risk and potential losses. In the end, it’s a combination of many factors; and we also have to consider clients with longer licenses (like 3+ years, or LIFETIME), who for certain cases sometimes only want to know when it’s time to restart a system or not. I mean that we continue using live results when possible, but that’s recently near an exception. Regarding the results with IG FUTURES (don’t worry, we distinguish them well from standard futures, which is why we always put “IG” in front). This is also one of those complex things we can’t always explain completely because otherwise people don’t read anything, but which we explain in groups, emails, etc. To consider, at least: – When we made the sizing proposal with FUTURES, we tried to set sizing equivalent to CFD; and anyway we have tables with the “weights” in each case (because not all instruments have equivalent weight). Not to mention the EUR/USD change, which also changes everything (and now more than months ago) – Anyway, speaking of NASDAQ, where there’s the biggest difference in contract weights: The 0.05 contracts at $20 contemplated for NASDAQ IG FUTURES was what we proposed as equivalent to 1 CFD contract. Later on, we proposed 0.5 contracts in NASDAQ systems by default portfolio sizing, to reduce risk and DDs that those systems had experienced; and so it remained using 0.5 contracts in CFDs… while in IG FUTURES you can’t set less than 0.05 (you can’t make that reduction by half) – So… in the IG FUTURES results, barring error and understanding they’re approximate (ignoring currency), the size per system is indeed approximate, except for NASDAQ, which is double. And, coincidentally, this month it’s in NASDAQ where IG FUTURES have performed worse than CFD (less profit even with double weight); but in almost all other systems the gains have been higher. Therefore, IG FUTURES have indeed performed better on July. – Finally, here’s the link to the guide I mentioned: https://cfdautotrading.com/en/ig-futures-guide/. Among other things, it explains why results from the same system can vary (and they will at all levels, also in BT-BT, not just in REAL-REAL comparisons) basically because the instruments aren’t the same (the price and its variations can be different at any given moment, yes). The same system launched on NASDAQ IG CFD, NASDAQ IG FUTURES, or standard NASDAQ FUTURE could give different entries and exits, yes. It will always give something “similar”, but the shorter the period, the more differences there can be. If this weren’t the case, we wouldn’t have, for example, a table suggesting the use of our own systems in CFD or IG FUTURES depending on the case. Sorry I couldn’t find a shorter way to explain both topics. In fact, I tried to shorten it. 😛📉 August 2025 Update

Considerable losses on with markets turning in the opposite direction just after various entries. Acceptable behaviour for COMMS this time. It seems that the only good news are the around +1.100€ of September so far, with COMMS systems positive and specially with BASTET DAX with a great recover that makes it return near ATH.

📈 September 2025 Update Exceptional performance with +4.501€ gross profit – our strongest month since December 2023. The most profitable month we’ve seen in almost 2 years, featuring outstanding returns from HEPHA GOLD and impressive profits from BASTET DAX. Both TALOS NAS M2 and ZEUS NAS would have surpassed 1.000€ each if traded at full contract size rather than half contracts. All systems with trades generated profits except ARES SP500, which is now officially discontinued. The current portfolio consists of 8 systems across 6 markets (using 5 different timeframes), and that could be enough when it is correctly dimensioned. -

AuthorPosts

- You must be logged in to reply to this topic.

CFD AutoTrading – MarketPlace vendor – Questions, announcements and updates

General Trading: Market Analysis & Manual Trading

Author

Summary

This topic contains 63 replies,

has 0 voices, and was last updated by CFD AutoTrading

1 month ago.

Topic Details

| Forum: | General Trading: Market Analysis & Manual Trading |

| Language: | English |

| Started: | 04/18/2023 |

| Status: | Active |

| Attachments: | 81 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.