Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Candlestick Scalper 1s discussion

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Candlestick Scalper 1s discussion

-

AuthorPosts

-

@GraHal , can you post .itf?

@GraHal , can you post .itf?

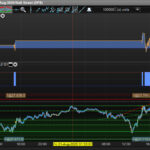

This has been in my 4Test folder since April 20 awaiting Forward Test.

So all results attached are Out of Sample.

I did not re-optimise or tweak the .itf since April … here are backtest results on 1 sec TF.

Good on 30 sec also?

Spread = 4 on attached.

Please post improvements?

Doh I forgot the .itf … that was the whole point of posting! 🙂

Well I just downloaded that. I’ve found it difficult to test seconds charts due ot their limited ability to backtest any reasonable period and have ventured to the minutes world for scalping.

Are there forward testing results since April for this?

I’ll stick it on a demo anyway for a few months and see and peruse the code.

winnie37 thanked this postAre there forward testing results since April for this?

No it was in my folder to be tested but I have no space due to the limit of 25 on running Systems in Demo!

I have another 146 Systems to be tested!

IG didn’t think it through when they culled / closed our Test Bed Accounts earlier in 2020!?

I’m sure IG must be losing out as a result … I might have lots of the 146 Systems (waiting to be tested) trading Live by now and so IG would be making spread revenue?

OK, yes it is limiting, but guess server bandwidth an issue for them as well. I’ve put it up on demo, quick glance dont think it had bearish code to take a trade bearish but had it to exit, but I’ll take another peek – I like to leave new ideas to weekend and tweak them intermittently.

I did have a full house on demo with some combinations but now just running a few and forwarding testing some minimally on live.

I can put up 15 or so and leave myself some room if you wanted some extra tested.

My most recent is 5 and 7 mins eurusd which can do about 50% a year based on margin requirement limitations in backtesting running 45 mins in a.m. Not related to this topic so won’t post pic here.

I’ll review next weekend most probably if it runs Ok over the week or if I need a distraction.. 🙂

GraHal thanked this postif you wanted some extra tested.

Here is a minute version, if you Forward Test then I will stop the 1 sec and 1 min versions I set going on Test from this morning … that gives me 2 more spaces.

The 1 sec and 1 min don’t take many trades, so maybe you can report back on performance monthly-ish … whenever suits you?

It be great if you can get 1 sec and / or 1 min to work good on Shorts also?

Thank You

PS

If anybody else comes up with improvements and / or more trades then let us know please.I guess reducing ‘>= 17’ in below will give more trades … I only just spotted it, else I would have tried previously.

c21m = abs(close-open) >= 17//------------------------------------------------------------------------- // Main code : Makside DJI M1 v1 //------------------------------------------------------------------------- //------------------------------------------------------------------------- // Code principal : CANDLE //------------------------------------------------------------------------- Defparam cumulateorders = false n = 1 timeframe(15 minute,updateonclose) c160m = open > open[1] and close > close[1] and close > open timeframe(1 minute,updateonclose) c11m = open > open[1] and close > close[1] c21m = abs(close-open) >= 17 c31m = abs(close[1]-open[1]) c41m = c31m > c21m timeframe(default) c1def = open > open[1] and close > close[1] c2def = abs(close-open) >= 1 IF not longonmarket and c1def and c11m and c21m and c41m and c2def and c1def and c160m and Close crosses over Supertrend[12,4] then BUY N contracts at market set stop ploss 300 ENDIF //if Summation[A29](Open - Close) > B29 then //sell at market //endif //************************************************************************ //trailing stop function trailingstart = 28 //A35 //19 //trailing will start @trailinstart points profit trailingstep = 14 //A36 // 7 //trailing step to move the "stoploss" //reset the stoploss value IF NOT ONMARKET THEN newSL=0 ENDIF //manage long positions IF LONGONMARKET THEN //first move (breakeven) IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN newSL = tradeprice(1)+trailingstep*pipsize ENDIF //next moves IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN newSL = newSL+trailingstep*pipsize ENDIF ENDIF //manage short positions IF SHORTONMARKET THEN //first move (breakeven) IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN newSL = tradeprice(1)-trailingstep*pipsize ENDIF //next moves IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN newSL = newSL-trailingstep*pipsize ENDIF ENDIF //stop order to exit the positions IF newSL>0 THEN SELL AT newSL STOP EXITSHORT AT newSL STOP ENDIFHa I couldn’t resist!

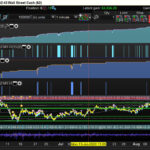

You can use below and still get 100% wins and loads more trades! See Top equity curve!

Why hasn’t this version been exalted on this Thread before??

We need to get the Shorts working without reducing profit on Longs??

And all the time this has been hiding in my 4Test folder … if only IG would give us unlimited on Demo!?

Please would somebody test above full code over 200K bars and then use the condition below so to show 2 equity curves over 200k bars??

c21m = abs(close-open) >= 2winnie37 thanked this postIts the same on 1 sec so that condition may be superfluous, but it’s worth leaving it in as it may be critical on other timeframes!

Would be great if we could have the 1 sec over 200k bars also … some kind soul?? 🙂

c21m = abs(close-open) >= 1bertrandpinoy and VinzentVega thanked this postSo I use other timeframes differently sometimes, but I assumed you just are changing the 1 minute code to 1 second and changing the cm21 to 1

I’ve put up the 1 minute and 1 seconds and also the 1 minute running on the 1 seconds as can produce different results historically. Just adding a bit of random chaos.. )

So they are up and running now..

I’ll add the 2 at peak times and see how it varies as well – sometimes most profits can be gained during specific times with less trading exposure

Hi Grahal,

I am happy to backtest on 200 K bares – can you post the itf files you want me to test (and precise any specifics you need, ie TF, tick by tick, walf forward, etc) ?

Also I have some space on my demo account for more strategies if needed.

Alex

Also I had a notion to add another filter I found useful before just to see, so running a volume check so I’ve got various combinations running, and will see how the timed varies.. however historically this won’t start running till tomorrow, but will see – dont ask me why, I’ve brought it to their attention..

bertrandpinoy thanked this postSo backtesting might depend on risk tolerance. Tested back to Feb on £1 per point using a volume filter and timed was a significant reduction in trades but gave 100% at 40% gain approx since feb on £1 per pip per £1K.

On 1 mins with 100% success since Feb for the timed it gave a little over 80% per £1 per pip per £1K.

Running all combinations on demo currently..

For me it would depend on account size, risk tolerance etc.. Apparently data is increasing this year from 200K to 999K but we don’t have that yet, a longer test is preferable.

For me trading less at 100% may be preferable for smaller accounts especially to keep risk down… Larger accounts not so bad, also risking 200p pips has more stopouts but 10% less risk per £1K per £1 point and not too much difference in outcome…

I also backtested without overnight trades and it was much better with only 2 losses since february reducing losses by 5. On a smaller account it would have had a large intial drawdoown but no drawdowns on the peak times trading timing.. Below is th eno overnight trades if your account tolerance permits it.. but of course you can trade DJI at 20p so less of an issue on lesse amount but reducing profits accordingly..

//------------------------------------------------------------------------- // Main code : Grahal 1 second test DJI timed //------------------------------------------------------------------------- Defparam cumulateorders = false td1 = 1 AND OpenDayOfWeek = 1 AND OpenTime >= 070000 AND OpenTime <= 205500 //Monday td2 = 1 AND OpenDayOfWeek = 2 AND OpenTime >= 070000 AND OpenTime <= 205500 //Tuesday td3 = 1 AND OpenDayOfWeek = 3 AND OpenTime >= 070000 AND OpenTime <= 205500 //Wednesday td4 = 1 AND OpenDayOfWeek = 4 AND OpenTime >= 070000 AND OpenTime <= 205500 //Thursday td5 = 1 AND OpenDayOfWeek = 5 AND OpenTime >= 070000 AND OpenTime <= 205500 //Friday tdCond = td1 OR td2 OR td3 OR td4 OR td5 //------------------------------------------------------------------------- //------------------------------------------------------------------------- // Code principal : CANDLE //------------------------------------------------------------------------- n = 1 timeframe(15 minute,updateonclose) c160m = open > open[1] and close > close[1] and close > open timeframe(1 minute,updateonclose) c11m = open > open[1] and close > close[1] c21m = abs(close-open) >= 1 c31m = abs(close[1]-open[1]) c41m = c31m > c21m timeframe(default) c1def = open > open[1] and close > close[1] c2def = abs(close-open) >= 1 IF not longonmarket and c1def and c11m and c21m and c41m and c2def and c1def and c160m and Close crosses over Supertrend[12,4] and tdcond then BUY N contracts at market set stop ploss 300 ENDIF //if Summation[A29](Open - Close) > B29 then //sell at market //endif //************************************************************************ //trailing stop function trailingstart = 28 //A35 //19 //trailing will start @trailinstart points profit trailingstep = 14 //A36 // 7 //trailing step to move the "stoploss" //reset the stoploss value IF NOT ONMARKET THEN newSL=0 ENDIF //manage long positions IF LONGONMARKET THEN //first move (breakeven) IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN newSL = tradeprice(1)+trailingstep*pipsize ENDIF //next moves IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN newSL = newSL+trailingstep*pipsize ENDIF ENDIF //manage short positions IF SHORTONMARKET THEN //first move (breakeven) IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN newSL = tradeprice(1)-trailingstep*pipsize ENDIF //next moves IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN newSL = newSL-trailingstep*pipsize ENDIF ENDIF //stop order to exit the positions IF newSL>0 THEN SELL AT newSL STOP EXITSHORT AT newSL STOP ENDIF //stop order to exit the positions IF newSL>0 THEN SELL AT newSL STOP EXITSHORT AT newSL STOP ENDIFNo overnight mod

Trail optimisation below. 20 trail is better but retains losses.

15 trailstart with 7 step gives improved results reducing stopouts to 1

I’ll have a peek at a few more mods and see if they improve anything.

// Main code : Grahal 1 min test code timed //------------------------------------------------------------------------- Defparam cumulateorders = false td1 = 1 AND OpenDayOfWeek = 1 AND OpenTime >= 070000 AND OpenTime <= 205500 //Monday td2 = 1 AND OpenDayOfWeek = 2 AND OpenTime >= 070000 AND OpenTime <= 205500 //Tuesday td3 = 1 AND OpenDayOfWeek = 3 AND OpenTime >= 070000 AND OpenTime <= 205500 //Wednesday td4 = 1 AND OpenDayOfWeek = 4 AND OpenTime >= 070000 AND OpenTime <= 205500 //Thursday td5 = 1 AND OpenDayOfWeek = 5 AND OpenTime >= 070000 AND OpenTime <= 205500 //Friday tdCond = td1 OR td2 OR td3 OR td4 OR td5 //------------------------------------------------------------------------- //------------------------------------------------------------------------- // Code principal : CANDLE //------------------------------------------------------------------------- n = 1 timeframe(15 minute,updateonclose) c160m = open > open[1] and close > close[1] and close > open timeframe(1 minute,updateonclose) c11m = open > open[1] and close > close[1] c21m = abs(close-open) >= 2 c31m = abs(close[1]-open[1]) c41m = c31m > c21m timeframe(default) c1def = open > open[1] and close > close[1] c2def = abs(close-open) >= 1 IF not longonmarket and c1def and c11m and c21m and c41m and c2def and c1def and c160m and Close crosses over Supertrend[12,4] and tdcond then BUY N contracts at market set stop ploss 300 ENDIF //if Summation[A29](Open - Close) > B29 then //sell at market //endif //************************************************************************ //trailing stop function trailingstart = 15 //A35 //19 //trailing will start @trailinstart points profit trailingstep = 7 //A36 // 7 //trailing step to move the "stoploss" //reset the stoploss value IF NOT ONMARKET THEN newSL=0 ENDIF //manage long positions IF LONGONMARKET THEN //first move (breakeven) IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN newSL = tradeprice(1)+trailingstep*pipsize ENDIF //next moves IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN newSL = newSL+trailingstep*pipsize ENDIF ENDIF //manage short positions IF SHORTONMARKET THEN //first move (breakeven) IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN newSL = tradeprice(1)-trailingstep*pipsize ENDIF //next moves IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN newSL = newSL-trailingstep*pipsize ENDIF ENDIF //stop order to exit the positions IF newSL>0 THEN SELL AT newSL STOP EXITSHORT AT newSL STOP ENDIFbertrandpinoy and winnie37 thanked this post -

AuthorPosts

- You must be logged in to reply to this topic.

Candlestick Scalper 1s discussion

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 171 replies,

has 16 voices, and was last updated by CMM

3 years, 6 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 04/07/2020 |

| Status: | Active |

| Attachments: | 62 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.