Paul

PaulParticipant

Master

no sl in 2 weeks. That’s very good, regardless if it’s big or not with that many trades!

condsell=condsell and (close<pivot or (close>pivot and (close-pivot)/pointsize >ecart))

condsell=condsell and (close<weeklypivot or (close>weeklypivot and (close-weeklypivot)/pointsize >ecartwp))

condbuy=condbuy and (close>pivot or (close <pivot and (pivot-close)/pointsize >ecart))

condbuy=condbuy and (close>weeklypivot or (close <weeklypivot and (weeklypivot-close)/pointsize >ecartwp))

I don’t think in current form it would add something to a 1s system but perhaps it gives a new ideas.

thx paul for your suggestion, i will try

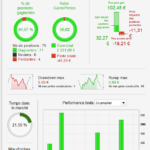

I’m also going to apply something around the sl with a pivot method.. for the moment with it, 1.86 for the ratio, positionsize 0.4

Do you know the current spread following trading hours about DJI ?

I’m trying to check the difference between the positions backtest and live

@Paul, nothing about the test.. regarding my pivot 1h, it’s the same thing… for the moment, i’dont find the best way to decrease the sl

as these are quick wins, maybe to decrease the pivot or pivot depending of the ATR …..

@MAKSIDE

Please do not quote unnecessarily.

Thanks GraHal is enough to know who you want to thank, and topics would be smaller and easier to read!

Thank you 🙂

Paul

PaulParticipant

Master

with 300 points stoploss, you can try if a position is still 50 points less then 300 points loss, start reducing the sl every x minutes x points. Not a fan of that though.

there isn’t a good solution. Only to make a strategy with small profits & limited data work with a smaller stoploss, I would say in range of 0.25-0.5%.

with 300 points stoploss, you can try if a position is still 50 points less then 300 points loss, start reducing the sl every x minutes x points. Not a fan of that though.

there isn’t a good solution. Only to make a strategy with small profits & limited data work with a smaller stoploss, I would say in range of 0.25-0.5%.

Sure Paul, … i will leave it and continue to find the best way for that

for the moment, i’m keeping my fingers..

strategy with small profits & limited data work with a smaller stoploss,

I agree … a 1 sec, 5 sec or 10 sec, 15 sec, 30 sec strategy should be aiming to ride a wave for anything from a few seconds to 2, 3 or 4 minutes … quick in and out on small profit or small loss.

@MAKSIDE … you could try using the same Strategy but increase to 5 sec or 10 sec etc TF … sometimes this – and a few tweaks – is all that is needed to turn a loss maker into a profit maker!?

@Grahal

I already tried higher timeframe, not too good and 1s is my passion .. 😉 i hate waiting for gains 😉

i’m working other strategy too, based on triangular mm, very basic but for the moment, on the way

Paul

PaulParticipant

Master

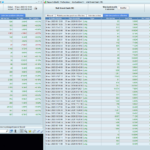

@MAKSIDE can’t argue with your data. It looks great! Multiple days and a good amount of trades & profit. I understand your confidence 🙂

Nice results, position size is still 1?

yes

demo : 1 / dji 2$

live : 0.4 dji 1€

in progress :..

regarding the sl, i’m trying to use a coefficient depending of the ATR/14 periods

following the value of the ATR, value of coeff is changed and then i multiply with the coef the positionsize and divide the stoploss… but for the moment i cannot find the good parameters to define slot for ATR..

maybe it’s not the way to use atr… i don’t know..

i also noted that in demo there is any type of error (other strategies stopped.. often i don’t understand.. and restart.. ,.. ) but on live this is not the case

as if the demo system of IG was not really the reality… :/