@kaq52 @juanj @Nicolas @martentornquist @robertogozzi @Bard

Dear All, thank you very much for your support. The idea suggested by kaq52 is very much what I was looking for. For what it’s worth, I’m sharing here my code and the result of the backtest. Please bear with me if you find erros or room for improvement.

I’m not proficient in PRT, but I tired to assemble a few pieces here and there found on this forum. I used ML based on code published by Bard here https://www.prorealcode.com/reply/128486/

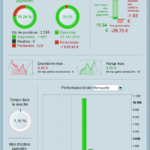

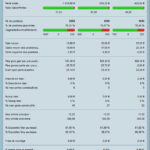

Variables have obviously been over-optimized for DAX 15 minutes 1€ with IG CFDs. WF provides a relatively high result… Not sure how this will work in live trading.

I’d apprecite if some of you can test it (live if possible) and share their feedback. I’ve doubts about:

1/ the price distance between certain orders calculated by the system vs what IG accepts.

2/ the interaction between Stop Loss calculated by this system, Spread and actual execution price… I’ve seen that for orders with nearly breakeven results in backtest I ended losing 1 or 2 euros in actual trading.

3/ overnight holding cost.

4 /not sure how these impressive Backtest results will translate in reality over a few weeks

4/ Last but not least… I tried ML with one and with two variables on a very simple SMA cross Algo and I’ve observed on different TF that ML with only one variable provides better results than ML with two variables… I’m very interested in your thoughts on this.

Next steps: add conditions/optimize entry points to reduce false signals, try wider SL (?),

Again, thank you and look forward to hear your feedback.

// DAX M15 Test with ML

DEFPARAM CUMULATEORDERS = FALSE

DEFPARAM PRELOADBARS = 10000

N = 1

ONCE C1 = 0

ONCE C2 = 0

iMACD = MACD[12,26,9](close)

iRSI = RSI[14](close)

StochK = Stochastic[14,3](close)

StochD = Average[5](Stochastic[14,3](close))

indicator7, indicator6 = CALL KST1 //Standard KST Indicator

c1L = (iMACD > 0) AND (iMACD > iMACD[1])

c2L = (iRSI > iRSI[1])

c3L = (StochK > StochD)

c4L = (StochD > StochD[1])

c5L = (indicator6 < indicator7)

c1S = (iMACD < 0) AND (iMACD < iMACD[1])

c2S = (iRSI < iRSI[1])

c3S = (StochK < StochD)

c4S = (StochD < StochD[1])

c5S = (indicator6 > indicator7)

IF c1L AND c2L AND c3L AND c4L AND c5L THEN

C1 = 1

ENDIF

IF c1S AND c2S AND c3S AND c4S AND c5S THEN

C2 = 1

ENDIF

// ALOG AND ML

heuristicscyclelimit = 7

once heuristicscycle = 0

once heuristicsalgo1 = 1

once heuristicsalgo2 = 0

if heuristicscycle >= heuristicscyclelimit then

if heuristicsalgo1 = 1 then

heuristicsalgo2 = 1

heuristicsalgo1 = 0

elsif heuristicsalgo2 = 1 then

heuristicsalgo1 = 1

heuristicsalgo2 = 0

endif

heuristicscycle = 0

else

once valuex = startingvalue

once valuey = startingvalue2

endif

if heuristicsalgo1 = 1 then

//heuristics algorithm 1 start

if (onmarket[1] = 1 and onmarket = 0) or (longonmarket[1] = 1 and longonmarket and countoflongshares < countoflongshares[1]) or (longonmarket[1] = 1 and longonmarket and countoflongshares > countoflongshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares < countofshortshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares > countofshortshares[1]) or (longonmarket[1] and shortonmarket) or (shortonmarket[1] and longonmarket) then

optimise = optimise + 1

endif

//Settings 1 & 2

startingvalue = 5 //5 //10 //40 //5, 100, 10 //LONG BOXSIZE

ResetPeriod = 1 //3 //1, 0.5 Specify no of months after which to reset optimisation

increment = 5 //10 //5 //10 //10 //5, 20, 10

maxincrement = 5 //20 //5, 10 limit of no of increments either up or down

reps = 6 //3 //1 number of trades to use for analysis //2

maxvalue = 5 //5 //10 //70 //50 //50, 20, 300, 150 //maximum allowed value

minvalue = increment //15, 5, minimum allowed value

startingvalue2 = 5 //5 //10 //50 //15 //40 //5, 100, 50 //SHORT BOXSIZE

ResetPeriod2 = 3 //1, 0.5 Specify no of months after which to reset optimisation

increment2 = 5 //10 //10 //5, 10

maxincrement2 = 5 //20 //1, 30 limit of no of increments either up/down //4

reps2 = 2 //3 //1, 2 nos of trades to use for analysis //3

maxvalue2 = 5 //5 //50, 20, 300, 200 maximum allowed value

minvalue2 = increment2 //15, 5, minimum allowed value

once monthinit = month

once yearinit = year

If (year = yearinit and month = (monthinit + ResetPeriod)) or (year = (yearinit + 1) and ((12 - monthinit) + month = ResetPeriod)) Then

ValueX = StartingValue

WinCountB = 0

StratAvgB = 0

BestA = 0

BestB = 0

monthinit = month

yearinit = year

EndIf

once valuex = startingvalue

once pincpos = 1 //positive increment position

once nincpos = 1 //negative increment position

once optimise = 0 //initialize heuristicks engine counter (must be incremented at position start or exit)

once mode1 = 1 //switches between negative and positive increments

//once wincountb = 3 //initialize best win count

//graph wincountb coloured (0,0,0) as "wincountb"

//once stratavgb = 4353 //initialize best avg strategy profit

//graph stratavgb coloured (0,0,0) as "stratavgb"

if optimise = reps then

wincounta = 0 //initialize current win count

stratavga = 0 //initialize current avg strategy profit

heuristicscycle = heuristicscycle + 1

for i = 1 to reps do

if positionperf(i) > 0 then

wincounta = wincounta + 1 //increment current wincount

endif

stratavga = stratavga + (((positionperf(i)*countofposition[i]*close)*-1)*-1)

next

stratavga = stratavga/reps //calculate current avg strategy profit

//graph (positionperf(1)*countofposition[1]*100000)*-1 as "posperf1"

//graph (positionperf(2)*countofposition[2]*100000)*-1 as "posperf2"

//graph stratavga*-1 as "stratavga"

//once besta = 300

//graph besta coloured (0,0,0) as "besta"

if stratavga >= stratavgb then

stratavgb = stratavga //update best strategy profit

besta = valuex

endif

//once bestb = 300

//graph bestb coloured (0,0,0) as "bestb"

if wincounta >= wincountb then

wincountb = wincounta //update best win count

bestb = valuex

endif

if wincounta > wincountb and stratavga > stratavgb then

mode1 = 0

elsif wincounta < wincountb and stratavga < stratavgb and mode1 = 1 then

valuex = valuex - (increment*nincpos)

nincpos = nincpos + 1

mode1 = 2

elsif wincounta >= wincountb or stratavga >= stratavgb and mode1 = 1 then

valuex = valuex + (increment*pincpos)

pincpos = pincpos + 1

mode1 = 1

elsif wincounta < wincountb and stratavga < stratavgb and mode1 = 2 then

valuex = valuex + (increment*pincpos)

pincpos = pincpos + 1

mode1 = 1

elsif wincounta >= wincountb or stratavga >= stratavgb and mode1 = 2 then

valuex = valuex - (increment*nincpos)

nincpos = nincpos + 1

mode1 = 2

endif

if nincpos > maxincrement or pincpos > maxincrement then

if besta = bestb then

valuex = besta

else

if reps >= 10 then

weightedscore = 10

else

weightedscore = round((reps/100)*100)

endif

valuex = round(((besta*(20-weightedscore)) + (bestb*weightedscore))/20) //lower reps = less weight assigned to win%

endif

nincpos = 1

pincpos = 1

elsif valuex > maxvalue then

valuex = maxvalue

elsif valuex < minvalue then

valuex = minvalue

endif

optimise = 0

endif

// heuristics algorithm 1 end

elsif heuristicsalgo2 = 1 then

// heuristics algorithm 2 start

if (onmarket[1] = 1 and onmarket = 0) or (longonmarket[1] = 1 and longonmarket and countoflongshares < countoflongshares[1]) or (longonmarket[1] = 1 and longonmarket and countoflongshares > countoflongshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares < countofshortshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares > countofshortshares[1]) or (longonmarket[1] and shortonmarket) or (shortonmarket[1] and longonmarket) then

optimise2 = optimise2 + 1

endif

//Settings 2

once monthinit2 = month

once yearinit2 = year

If (year = yearinit2 and month = (monthinit2 + ResetPeriod2)) or (year = (yearinit2 + 1) and ((12 - monthinit2) + month = ResetPeriod2)) Then

ValueY = StartingValue2

WinCountB2 = 0

StratAvgB2 = 0

BestA2 = 0

BestB2 = 0

monthinit2 = month

yearinit2 = year

EndIf

once valuey = startingvalue2

once pincpos2 = 1 //positive increment position

once nincpos2 = 1 //negative increment position

once optimise2 = 0 //initialize heuristicks engine counter (must be incremented at position start or exit)

once mode2 = 1 //switches between negative and positive increments

if optimise2 = reps2 then

wincounta2 = 0 //initialize current win count

stratavga2 = 0 //initialize current avg strategy profit

heuristicscycle = heuristicscycle + 1

for i2 = 1 to reps2 do

if positionperf(i2) > 0 then

wincounta2 = wincounta2 + 1 //increment current wincount

endif

stratavga2 = stratavga2 + (((positionperf(i2)*countofposition[i2]*close)*-1)*-1)

next

stratavga2 = stratavga2/reps2 //calculate current avg strategy profit

if stratavga2 >= stratavgb2 then

stratavgb2 = stratavga2 //update best strategy profit

besta2 = valuey

endif

if wincounta2 >= wincountb2 then

wincountb2 = wincounta2 //update best win count

bestb2 = valuey

endif

if wincounta2 > wincountb2 and stratavga2 > stratavgb2 then

mode2 = 0

elsif wincounta2 < wincountb2 and stratavga2 < stratavgb2 and mode2 = 1 then

valuey = valuey - (increment2*nincpos2)

nincpos2 = nincpos2 + 1

mode2 = 2

elsif wincounta2 >= wincountb2 or stratavga2 >= stratavgb2 and mode2 = 1 then

valuey = valuey + (increment2*pincpos2)

pincpos2 = pincpos2 + 1

mode2 = 1

elsif wincounta2 < wincountb2 and stratavga2 < stratavgb2 and mode2 = 2 then

valuey = valuey + (increment2*pincpos2)

pincpos2 = pincpos2 + 1

mode2 = 1

elsif wincounta2 >= wincountb2 or stratavga2 >= stratavgb2 and mode2 = 2 then

valuey = valuey - (increment2*nincpos2)

nincpos2 = nincpos2 + 1

mode2 = 2

endif

if nincpos2 > maxincrement2 or pincpos2 > maxincrement2 then

if besta2 = bestb2 then

valuey = besta2

else

if reps2 >= 10 then

weightedscore2 = 10

else

weightedscore2 = round((reps2/100)*100)

endif

valuey = round(((besta2*(20-weightedscore2)) + (bestb2*weightedscore2))/20) //lower reps = less weight assigned to win%

endif

nincpos2 = 1

pincpos2 = 1

elsif valuey > maxvalue2 then

valuey = maxvalue2

elsif valuey < minvalue2 then

valuey = minvalue2

endif

optimise2 = 0

endif

// heuristics algorithm 2 end

endif

//

boxsizeL = max ( ValueX , (maxvalue+minvalue)/2)

boxsizeS = max ( ValueY , (maxvalue2+minvalue2)/2)

//

renkomaxl = round(close / boxsizel) * boxsizel

renkominl = renkomaxl - boxsizel

renkomaxs = round(close / boxsizes) * boxsizes

renkomins = renkomaxs - boxsizes

//

if high > renkomaxl + boxsizel then

renkomaxl = renkomaxl + boxsizel

renkominl = renkominl + boxsizel

endif

if low < renkomins - boxsizes then

renkomaxs = renkomaxs - boxsizes

renkomins = renkomins - boxsizes

endif

IF time>=001500 AND time>060000 then

spread = 2

ELSIF (time>=060000 AND time>070000) AND (time>=153000 AND time>200000)then

spread = 1

ELSIF time>=070000 AND time>153000 then

spread = 0.6

ELSIF time>=200000 AND time>001500 then

spread = 2.5

ENDIF

IF C1=1 THEN

BUY N CONTRACT at (renkoMaxL + boxSizeL + spread) STOP

ENDIF

IF C2=1 THEN

SELLSHORT N CONTRACT at (renkoMinS - boxSizeS - spread) STOP

ENDIF

C1 = 0

C2 = 0

SET STOP pTRAILING 2

SET TARGET pPROFIT 200