Bard

BardParticipant

Master

Hi.

Can anyone please explain this indicator as my French is limited. See: http://hk-lisse.over-blog.com and the Blog Post on the 14th May 2009 (bottom 1/3rd of the page)

The original French description is:

“Dans le dernier article sur l’algorithme de Goertzel, le programme permettait de retrouver les 2 périodes des cycles qui avaient la meilleure réponse. Je l’ai complèté et corrigé pour qu’il sorte également l’amplitude correcte du cycle ainsi que la phase : cela afin de pouvoir redessiner la courbe.

Dans l’exemple ci-dessous, le signal (en noir) est une sinusoïde de période 11 ajoutée à une sinusoïde de période 19 (d’amplitude 2) avec un décalage de phase (90), le tout avec une pincée de bruit.. Les 2 courbes (rouge et bleue) sont reconstruites par le programme, il reste à les superposer pour avoir le signal sans bruit.”

Which I have “translated” as:

“In the last article on the Goertzel algorithm, the program allowed to find the 2 periods of cycles that had the best answer/fit. I completed and corrected it to also ensure the correct amplitude of the cycle and the phase in order to redraw the curve. In the example below, the signal (black) is an 11 period sinewave added to a 19 period sinewave (amplitude 2) with a phase shift (of 90 degrees), all with only a tiny bit of noise. The two curves (red and blue) are reconstructed by the program, it remains to superimpose to have the signal without noise.”

But this translation doesn’t really help me fully understand the indicator and how to use it or what to set the value of K to?

I am not clear in how this algorithm indicator helps predict the turning points in a market although I am familiar with John Ehler’s MESA Cycle/Phase concepts. I guess a good translation would be a start. It seems John Meyer gets good trading system results with high % of winning trades with good profit factors using the Goertzel Algorithm.

Any help would be great,

Thanks in advance,

ProRealTime Code:

//k = the frequency already found//

// sous prgm goertzel biss //

a=barindex

sig=sin(360*a/11)+2*sin(360*a/19+90)

b=SQRT(barindex*(b+1))

b=abs((b-ROUND(b))*4)

c=b-1

sig=sig+c

n=200

pr=sig

alpha=2*cos(360*1/k)

q1=0

q2=0

for i=n downto 0//fenêtre de 200 barres

q3=pr[i]+alpha*q1-q2

q2=q1

q1=q3

next

amp=sqrt(square(q1)+square(q2)-alpha*q1*q2)

real=q1-(alpha*q2)/2

imag=q2*sin(360*1/k)

phas=atan(imag/real)

if real<0 then

phas=phas+180

elsif real>=0 and imag<0 then

phas=phas+360

endif

return (2*amp/n)*sin(360/k+phas[1]+90),sig

k is the period of the signal previously found by the Goertzel algorithm. The main article (this one is the second) is in the “Cycles” category of the blog. I knew them already, but these codes are stunning! 🙂

Bard

BardParticipant

Master

Thanks Nicolas,

Do you think the clue was at the beginning of the paragraph: “In the last article on the Goertzel algorithm” ?

I agree. It is very clever what Ehler’s and Meyer’s have done.

I was wondering why did Meyer’s use a 11 period cycles combined with a 19 period cycles. Why specifically 11 and 19?

Also “prgm goertzel” has a call function: CALL “goertzel sous.” I assume that’s the “sous prgm goertzel” code? Shouldn’t it be renamed “goertzel sous” ?

For the ease of finding all these indicators in my Indicator List I renamed “prgm goertzel” to “Cycle Prgm Goertzel” and renamed “prgm goertzel: to “Cycle Prgm Goertzel.”

When I tried changing the Call function name within indicator “Cycle Prgm Goertzel” to “Cycle Sous Prgm Goertzel” I got the error below in the image?

This is the code for “prgm goertzel” (now called Cycle Prgm Goertzel)

l=0

maxi=l

maxo=0

for p=5 to 25//détection de cycle de période de 5 à 25

my = CALL "goertzel sous"[p]

if my>maxi then

per=p

maxi=my

endif

if my>maxo and my<maxi then

peri=p

maxo=my

endif

next

return max(per,peri),min(per,peri)

Shouldn’t you be on a break from inane questions by ‘newbies’? (-;

Cheers Nicolas

>> For clarity of messages on ProRealCode’s forums, please use the “insert code PRT” button to separate the text of the code part! Thank you! <<

I think you need to change the CALL function on line 6 to the correct new name of your indicator. Please use the attachments form if you need to attach screenshots.

Bard

BardParticipant

Master

Thanks Nicolas, Do you know why when I click on the add url link when trying to post a comment the page jumps down to the bottom of the page? It was doing that specifically on the Kase Peak Oscillator page despite clearing cookies: http://www.prorealcode.com/prorealtime-indicators/kase-peak-oscillator/

This page I’m on now clearly works but I have has lots of incidents like this? Cheers.

Yes this is a bug of the comment engine, this is on my to-do list 🙂

But you can type also URL in the comment without adding them with the link button, the URL will be automatically converted to a clickable link by the website.

Bard

BardParticipant

Master

Hi Nicolas,

I can’t get the Goertzel indicator: goertzel prgm from: Part 2

http://hk-lisse.over-blog.com/article-23944329.html to work.

I have tried with the original names and my own naming of these indicators but I get an error, pls see image.

The original code I have for goertzel prgm is below. The goertzel sous indicator is named exactly: goertzel sous

Any ideas what is causing the errors?

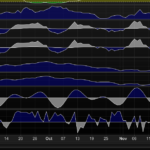

Once I have these indicators (please see 2nd charts screenshot) , I am not sure how to interpret them or how value of K is determined – from Part 1 – using the sous prgm goertzel?

Any help would be much appreciated,

Cheers

Brad

// prgm goertzel // Goertzel Program//

l=0

maxi=l

maxo=0

for p=5 to 25//détection de cycle de période de 5 à 25

my = CALL "goertzel sous"[p]

if my>maxi then

per=p

maxi=my

endif

if my>maxo and my<maxi then

peri=p

maxo=my

endif

next

return max(per,peri),min(per,peri)

Bard

BardParticipant

Master

Hello Nicolas,

Do you know how I can get this “prgm goertzel” to work? I deleted them all and re entered the indicators from the hk-lisse blog – please see screen. Is is just the prgm goertzel that is missing and which gives you the K value, right?.

The error message seems to be because of the [p] in the code after the call function. If you take it out it will load a non functioning chart.

Cheers and a late Happy New Year to you,

Brad

// prgm goertzel // Goertzel Program//

l=0

maxi=l

maxo=0

for p=5 to 25//détection de cycle de période de 5 à 25

my = CALL "goertzel sous" [p]

if my>maxi then

per=p

maxi=my

endif

if my>maxo and my<maxi then

peri=p

maxo=my

endif

next

return max(per,peri),min(per,peri)

Didn’t test it myself, but remove

[p]

at line 6 and everything should be ok.

Bard

BardParticipant

Master

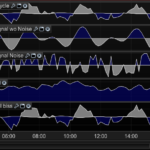

Thanks Nicolas, I already tried removing [P] and just got two straight lines, pls see images of Daily Dow Jones:

The code for “goertzel sous” called from the program “prgm goertzel” looks okay and the chart indicator loads okay:

k = 14

a=barindex

sig=sin(360*a/11)+sin(360*a/19+90)

b=SQRT(barindex*(b+1))

b=abs((b-ROUND(b))*4)

c=b-1

sig=sig+c

pr=sig

alpha=2*cos(360*1/k)

q1=0

q2=0

for i=200 downto 0//fenêtre de 200 barres

q3=pr[i]+alpha*q1-q2

q2=q1

q1=q3

next

amp=sqrt(square(q1)+square(q2)-alpha*q1*q2)

return amp

How are you meant to use the three indicators “sous prgm goertzel biss,” “goertzel sous” and “Goertzel Cycle Signal wo(without) Noise,”?

Cheers,

Sorry, I think I have answered too quickly in my last post.

The “goertzel sous” need a predefined external variable named “k” and that’s the intend of the “p” variable from the CALL function at line 6 of the main program. But this variable was not set external to be called by a CALL instruction, so you have to add it yourself.

So, don’t delete “p” from “program” indi and remove “k” from the “sous” indicator (line 1) and add an external “k” variable instead to it (value default is 14, but that’s not important).

Bard

BardParticipant

Master

Btw, Nicolas, just to clarify, my comments above on this goertzel issue aren’t a reflection of your skills to solve the issue, as you are effectively doing it blind and aren’t able to see my set up and all the codes I have entered. Everyone else using the hk-lisse blog seems to have been able to use the code and it works (they would have been amended the code if it didn’t). Doesn’t the Ehler’s Universal Supersmoother Oscillator ‘trump’ any of these indicators anyway?

Any news about thi topic?

Hi

@Nicolas,

Is there any way that we could get either Ehler’s MESA and/or the Goertzel algorithm for cycle detection use from the HK-lisse blog operational and uploaded into the Library?

The code is 90% there – but the missing CALL functions have made it had to get a final result, and having these indicators available for use I’m sure would be of benefit to some.

This would of course only be possible if you knew what these CALL functions should be – the only thing that has stopped me from putting them to use.

Thanks for your help,

Finning