Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Buying stocks in foreign currency

- Forums

- ProRealTime English Forum

- Platform Support: Charts, Data & Broker Setup

- Buying stocks in foreign currency

-

AuthorPosts

-

Hello,

I am trying to understand what is happening with the currency risk and fees when I buy a stock in a foreign currency so I have some questions. Broker is IB over ProRealTime. For example: my base currency is EUR and I have only Euros in my account and I want to buy a stock in USD. I opened a position as a test:

GM LONG AT MARKET 3 x 38,05$ = 114,15 USD

The fee is 1,95 USD. EURUSD at this point 1,08518.

Question 1: So 1,95 USD (1,80 EUR) will be decucted immediately from my account right?

Question 2: At the same time I have a short position of 114,15 USD (or long EURUSD) so I have no currency risk in my GM position? Lets assume my GM position in USD stays the same at 38,05$. If EUR gets stronger (consequently my GM position converted in EUR gets lower) it will be compensated by the USD short position.

Question 3: So far I only have to pay the overnight interest on my USD short position right?

Thank you

Hello,

I suggest you to contact directly ProRealTime Trading in order to get all these information about you trading account.

Thank you in advance,

Raph

Hi there,

Question 1: So 1,95 USD (1,80 EUR) will be decucted immediately from my account right?

Yes.

If EUR gets stronger (consequently my GM position converted in EUR gets lower) it will be compensated by the USD short position.

Virtually, Yes. In practice you won’t be able to handle this, because GM does not stay the same at USD 38,05. And then what ? All (instruments you have a position in) will be a huge obfuscating mess.

So far I only have to pay the overnight interest on my USD short position right?

I don’t think so. You will need the US dollars to buy the GM. So you’d have to borrow those. This means interest.

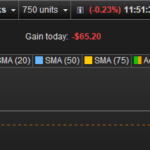

It is more complicated because when you get out of your position with profit, you may be left with what you see below. In my case this is USD because my portfolio is in USD. So here I made profit on (a) EUR instrument(s). This is thus the other way around as your situation – with you it will show a EUR amount.

This amount continuously fluctuates with the price of the EUR/USD relation. In my case, the higher the EUR the higher that amount. In your case it will be the other way around – the higher the EUR the lower that amount.

(dizzy ?)

Notice that you can convert this “cash to be converted” at any time, but you won’t do that because the PRT platform (the broker) can utilize that for your next purchase in your case in USD. When exactly this happens has always been beyond me – possibly when your purchase fits in that amount. If it does not fit, you will borrow more USD which is the normal behavior (and pay interest twice).When you reflect this to the portfolio value, it gets again more complicated because the e.g. rise of that cash amount is not reflected in the “Gain today”. You can only observe that / understand what happens if you don’t have a position anywhere. Gain Today will be zero now but your portfolio amount rises.

Notice that this cash amount can grow really large, if you only always make profit in that foreign currency. Or … you may lose everything just because that amount sits there and it goes the other way around. It really is a dangerous thing because it goes unnoticed. You stop trading, never start the platform, but that amount in there is still very active …Ah, did I tell you that you must pay interest over that amount ? in your case you will be borrowing the USD in there. So the next pitfall is that you did not pay attention to that interest because, well, there was no interest for a decade. But now there is, and it is rising.

If you call the dutch support desk, you have 50% chance you will get a dutch guy (if not you can ask for him). If you have him on the phone, ask him for where interest is payed. He is better at that part than I am, but I have the answer in advance : everywhere. So whatever you do, you pay interest. This means two times (from two angles) at whatever it is you do.

If you got the hang of this a little, dive into your IB statement. You will see it happening from those angles.If you want to trade instruments in a foreign currency, consider converting your portfolio to that currency. You can do that yourself and it is even free of commission or anything (but you will pay the usual spread). For the IG gang – don’t do that with IG blindly because the “interest” (commission) you will pay with them is killing.

Thus in your case, consider setting your portfolio currency to USD. But now don’t trade European instruments too much (for now hopefully obvious reasons).All this stuff deducts from your account mostly on a daily basis. Some monthly. Nothing is payed from your bank account – only the PRT subscription is.

Regards !

PeterPS: The conversion of that cash amount can be done “instantly” via the PRT platform. There is no fun in that. Now try to remember that the old procedure still exists. This goes by means of placing an Fx order. Now you can get the best price for your cash, for example by means of a Limit order. Now that is fun. I think his procedure is not publically known – it involves Trader Workstation (TWS) from IB.

virus010 thanked this postHi PeterSt,

thank you for all the information. Indeed it is a little bit complicated with multi-currency trading and portfolio management.

So that means when I close my position with a loss, the loss cash value will remain as a USD short position in my account? And I have to pay an interest for that. The same vice versa: a gain in USD will remain there as a positive USD cash balance and I have to pay interest for that too?

So it is the best to convert the portfolio currency in the main instrument currency or if the foreign currency amount is not to big to accumulate some and convert back to EUR (There are some conversion fees there too) So if interest gets bigger than my conversion fee, I could convert back.

Please don’t forget, this is about IB :So that means when I close my position with a loss, the loss cash value will remain as a USD short position in my account?

I just tested it;

I start out today with a value of $30046 cash to be converted (no screenshot of that). I created a small position for a EUR instrument while the portfolio is in USD. I was set to lose that trade (win it would have been OK too 😉 ). Indeed it lost.The amount the trade lost (in USD this is -216.73), has been added to my to be converted amount, which now is at $30200.00. Meanwhile the EUR/USD fluctuated too (by 0,04% or so) and this is the part which can’t be kept track of really and during the writing of this it is at 30.235).

Anyway the point is : that amount to convert has grown because I *lost*.

Maybe (but I must really guess this) nothing happened to shrink that amount because the money invested was 148K (one contract of AEX). This is more than the available 30K, so nothing happened to it (??). Notice again that it definitely is so that the amount can shrink automatically, which theoretically is so because I win. In the Statement either (loss or profit) is not eliminated from the Statement (coming in next morning) because it is normal loss or profit and this is reflected in the Statement. This is normal and as expected (everybody would want that). Meanwhile and in parallel, however, there’s a balance amount for me in that to be converted cash amount. Would I convert that, then the amount does not cause loss or profit again – this was already “done” (the Statement story). One thing : from the moment it emerges till the moment I convert it, it is subject to the currency factor difference. I did not look back really, but in my previous post the amount was lower than at the start of this post, and the euro went higher against the USdollar.In a later stage I will enter a trade again with the purpose of winning it. Then we can see whether the amount drops. By now I really wonder myself …

So it is the best to convert the portfolio currency in the main instrument currency or if the foreign currency amount is not to big to accumulate some and convert back to EUR (There are some conversion fees there too) So if interest gets bigger than my conversion fee, I could convert back.

Converting back the portfolio is not something which is on my mind. When I converted it from EUR to USD ever back, the USD was EUR 1.24 or so and underway it has been 0.97. It is clear that I don’t want to do anything with this kind of “speculation” and instead I set my mind to let it be forever. And Yes, all together this comprises a LOT of money and loss vs profit on that part. But would I want to trade Fx, then I obviously can do that too. Or, hedge it with the same value, when applicable.

“Converting back” would be in order when I’d need some money for living from the portfolio, and redrawal is completely free if you do it once per month (but again pay a small spread – see last attachment). And otherwise I recall some crazy amount like USD1 for cost.

Another means would be to convert from the one portfolio to the other – me suggesting another portfolio in that other currency. Now you trade the euro stocks etc. in there.

(but pay all subscriptions double)

I have one most crucial hint for anyone going the route of creating an e.g. USD portfolio :

For a consumer/retailer it would be common to NOT have a USD (etc.) bank account. Thus, suppose this is EUR or GBP for that matter. Now, it would be fairly normal to once and then add money to the portfolio. Say you add EUR 25K. Now immediately the cash to convert will show that 25K euro, but transferred to USD today this is USD 27100. The story is the same : you now have a long position in EUR/USD and when the EUR rises you earn money. But it is not about that, it is about the possibility to lose just the same, while you added the money for the portfolio in USD. So never forget to convert it right away !

As said in my previous post – or make an Fx transaction of it via TWS with a nice Pending Stop order (at 1% higher) or Limit order at a bit lower than the current price. Or trail it.I hope I did not make any mistakes.

PeterSo I created an other trade with this time a profit of USD 87, and now the to be converted amount is ~87 less (EUR dropped a bit to 0.07% today).

Thank you for the test,

so I owe you now -216.73 USD + 87 USD = 129,73 USD :D.

so I owe you now -216.73 USD + 87 USD = 129,73 USD :D.

Hahaha. That depends on the value of the euro. I think this has risen again. Now I must think. 😉

Anyway in such an isolated test I now finally know it myself. That was (to me) worth USD 129,73 a couple of days ago.

What I still don’t know is if that money is really utilized by the broker if I’d buy stocks with a value less than that money. But by now I didn’t trade stocks in a year. Or maybe a micro DAX or something.I will try to get some information from IB or PRT Support on this topic and get in touch here.

So I bought for USD 8830 some stock which appeared in my Screener.

Now my Cash to be converted has risen with that amount to 39000-something (from ~32000). Tbh this was the last I expected.This must now be related to this being a stock (in your possession) vs a Future of my previous test (not in possession).

Apparently I should have gone Short in order to let decrease the to be converted amount ?

Whatever would happen with that, I assume that the amount to convert as of now, will decrease when that stock has been sold again ?PS: Apparently I did not buy USD 8830 but EUR 8830. See the Exposure of ~ $9500 in the 3rd attachment (8830 * 1.0865 from the EUR vs USD will be ~ that amount).

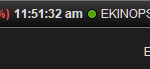

Today my EKINOPS stock finally went out with profit and the Cash to be converted is back to the original amount excl. EUR/USD rate changes underway and excl. profit made on the stock(-sell). So back to 29K+ now, where it was 39K+ (see attachment in previous post).

By now I almost forgot what this was about, but I think I wanted to know where the borrowed money because of getting a stock in an other currency (EUR while my Portfolio is in USD) – and which money let increase the To Be Exchanged amount … whether that amount could decrease again when I sold that stock in EUR. Well, it indeed did decrease.

-

AuthorPosts

- You must be logged in to reply to this topic.

Buying stocks in foreign currency

Platform Support: Charts, Data & Broker Setup

Summary

This topic contains 10 replies,

has 4 voices, and was last updated by PeterSt

2 years, 11 months ago.

Topic Details

| Forum: | Platform Support: Charts, Data & Broker Setup |

| Language: | English |

| Started: | 01/14/2023 |

| Status: | Active |

| Attachments: | 10 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.