Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Broker data anomoly closing auto systems

- Forums

- ProRealTime English Forum

- Platform Support: Charts, Data & Broker Setup

- Broker data anomoly closing auto systems

-

AuthorPosts

-

Evening (here) all!

I often read of some less than favourable situations occuring with auto systems on this forum. Whilst often they get resolved being a coding issue or in playdough accounts, today I present a case which clearly is a broker issue and very much my issue. Now I feel your pain.

I have contacted both IG and opened a ticket with PRT with no response as yet. The new IG AI chatbot very kindly told me some things which could have occurred with margin yada yada…. I asked to speak to a human and got offered an email communication instead. But don’t worry, the email was clear to state that if you are ‘small town’ you will be prioritised accordingly.

The Case:

On Sat morning cash close I see the price has gapped up 2.11% on my market ASX200, knocking out my shorts. I think this is fine as I have some long positions, much more productive trades. So I note the Trailing stop has not moved with the price. Very concerning all weekend.

This morning I get a phone ping saying the ASX200 has dropped 2.29%. As if it never happened, though it is still here on my charts and my phone app (IG) did record the highest price in the glitch. The IG charts are corrected as if trading as usual.

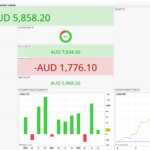

So here, I present the charts and my resulting actions. I show with both HLOC an HA candles to highlight this perculiar behaviour.

I suspect I got out favourably monetarily even though these are tiny trades. Note, the 1.5X trade is a DSP system and does not use a hard stop is unscathed. But I won’t be small forever, I am scaling rapidly and have grave concerns moving forward with my Quant business using this provider should it not get resolved.

So I show this to my Euro buddies for any feedback please or at very least serve as a warning to others. On the most part I have very little issues with execution with my providers and instruments and take off 15% performance when I model portfolios due to slippage etcetera. This has served me well when it comes to performance expectations.

This post is not a complaint about tiny losses as I am a trader and can lose just fine, but about TRUST and accountability.

Oh, importantly I forgot to add that the Long Position closed out at a random price as part of this glitch. Giving me a loss and the trade should still be in. The auto log has recorded the result but notably NOT rejected. See image attached ( I have small image of the system BB XJO 4hr sorry I cannot delete this in edit function)

The EOM shorts have their back test showing monster losses (yes even in tick data). Yet real stops were honoured.

On Sat morning cash close

Would it have helped if you exclude weekend trading?

I’m sure there is a setting somewhere as my Algos never trade over weekend.

I speed read your post, so apologies if my comment ‘misses your problem’.

Thanks Grahal. I don’t know of this magic setting for the weekends. To be clear, the long was a position requiring weekend holds and the shorts can fire anywhere near the end of month which often gets disrupted by a weekend. So this will not help.

My concern is with the price data causing mayhem with my orders and causing incorrect fills relative to my codes thus not getting my system results. I would rather take the full loss on the long and have my EOM shorts take their wins just for accountancy. We need to trust this right? Auto is the growth part of my trading business. I can’t accept such discrepancy as a ‘cost of business’. There is enough of that in overnight fees, broker fees, fx conversions and slippage.

So this will not help

Setting ‘weekend exclusion’ means that any trade open at Friday’s Close stays open over weekends.

Your comments in your last post are like you think ‘weekend exclusion’ means that all trades are closed at or before Friday Close?

coincatcha thanked this postOn Sat morning cash close I see the price has gapped up 2.11% on my market ASX200, knocking out my shorts.

I think (?) we have to opt IN for weekend trading (not opt out) so for your trade to have closed on Saturday, you must have opted IN for weekend trading (somewhere?)??

I have never opted IN for weekend trading, hence my trades remain open over the weekend … this is what you want, right??

Yes that it what I thought Grahal. So this really is a magic button? Where do I find it? When I start an algo?

I will look but can’t now as many times I try to open my auto list it does not function. Either a PRT bug or my computer I don’t know.

But please take a look at the charts, this anomaly is not just some dark pool transaction but highway robbery. I have placed over 5000 trades in my career and declare myself an expert on my local market with a very profitable track record for years. A 2%+ gap up then down that nobody on my local forum can see through their broker should not need a work around. XJO is not the Nasdaq on NFP night! Far from it. This must be why @Justisan swears by futures markets and PeterSt has a vendetta against brokers!

Thank you for responding. There is always more I can learn.

this is what you want, right??

Oh I see what your thinking. My trades must run full time. The shorts that got taken out by the spike had stops honoured correctly. Thankfully. But the spike should not have occurred. Sounds a weird thing to say as a day trader, even feels weird typing it. If stops are hit and price reverses and ultimate direction is correct no problem, happens every week and that’s trading. But this is not what happened entirely. My long position closed nowhere near any such thing it should do. A 240pt stop is very hard to hit on such a paltry index, but it never trailed with the blip. At a high of 9068 my stop should still be at 8828 and not hit. That’s how I know it was a mistake in the data not some liquidity hunt. It closed at the price of the data blip, yet did not kick out the system for some error. I’ll work tomorrow at some cleaner images and a more precise explanation so as not to confuse any further.

Also, please note that here in Oz futures close a 7am on Sat morning and I’m not on daylight saving in Queensland. So this really isn’t about weekends. Australia is a terrible place to be a trader and we only trade the local for sanity. Bots do the rest.

How’s your DSP adventure going?

I see that you already have some systems running — great job!

What you’re experiencing now, I’ve been through three times myself over the past few weeks, and the cause was still the IG migration mess… it was a total disaster…

If you’re really serious about trading, you should forget about IG completely and trade with IB instead…

I’ve filed a complaint with both PRT and IG, but I don’t have much hope that anything will come of it…

coincatcha thanked this postHow’s your DSP adventure going?

Hi JS. Myself and my family are forever indebted to you! I am lazy to get back and check in as they are still testing having completed 5 months now.

It worked, all those sleepless nights coding and testing. I came up with 4 useful signals that I wrote 6 or so systems with. Lo and behold my win rate has climbed, accuracy is outstanding on the signal only systems (as opposed to the full time DSP models). I no longer have fomo on anything because the full time models will always be exposed and generally on the right side however slow to lock in. In fact, they are like a flock of birds changing direction and has been an amazing regime filter for my manual trading. I haven’t yet made fast models with any accuracy. They are still slowbots but I run 14 algos meaning I’m trading multiple times a day/week. Half my profits are from this new generation and largely volatility/phase models being the two major components. I’m now consistently producing 10% per month return (auto only) but yet to have a true draw down. So far 50% return with 7.5% DD. They are outperforming so much I don’t day trade any where near as much as I used to so I actually have a life. I just do one VPOC open drive scalp each morning for income if I’m around but of course I am trying to automate that also.

How are yours going? Please tell.

The best thing I find is none of this silly stops getting taken business as per regular trades where your stop has to go somewhere! Holding costs aren’t too bad but I run the full time systems small because they can swing around a bit. If the market ever crashes we will print money with this style of system. When I turned on the Dow15 the first move was 2000pts. I couldn’t stop laughing. I am about to do my first compound so the next 6months will be interesting indeed.

I never performed an FFT. It sort of became obvious once I looked hard enough. I did reinvent the wheel on one occasion but that just helped deepen my understanding of the topic. So now I know 1%!…and it is enough!

I saw you had some issues with the broker also. It’s frustrating isn’t it? I don’t expect much either but they asked for exact prices/times to investigate this morning so that is something.

JS thanked this posthi coincatcha,

good to hear from you again, and good to heear that you are catching so many coins (gold nuggets?) – and more than earlier 😀 now with your new methods.

you and now also JS telling that you experience very strange “price” moves tells me that probably the unprecedented mess triggered by IG beginning of september is not yet fully solved. myself I stopped all algos running on cfds first day right after I realized – due to things happening on my account and based on reports of other folks here in forum – what kind of horrific chaos is taking place. and I did not restart any of them since then – seeing how little the provider takes care about solving the issue and communicate the progress, and how much troubles they obviously have to solve all that. poor responses by IG and unfortunatelly by PRT towards their clients have very long history, and I am with IG since 15+ years, and with PRT approx since they introduced automated trading tools… and I somehow don’t have much hope that it will improve significantly any time soon. by now I have a “reason” for that lack of hope, I would say it’s kind of “conspiracy” theory (or simply business/investment decision logic): why would one care a lot about the clients, if one knows that within 3 months 75% and within 1 year 95% of them will be gone anyway – not making money, or losing all their capital, due to poor trading, not due to mess brokers create some times.

trading futures with IB/PRT since ~ two years I still have rather little experience with this combination of service providers. on one side it’s due to lack of issues 😀 for which I would need help desk support. on other hand one serious issue – on PRT side – I in fact have had last summer and I have to say PRTs response in that case was not very impressive but somewhat better, more serious and more proactive than whatever I experienced during many years with IG/PRT.

cheers

justisan

coincatcha and JS thanked this postIf you’re really serious about trading, you should forget about IG completely and trade with IB instead…

Sensei, every time we speak I have work to do!

I will educate myself on why I should change broker. I have no attachment to IG but don’t really know why I should change. It will introduce exchange fees from USD to AUD. I am sadly not large enough yet to qualify for a pro account.

I will read up on the forum but maybe was put off by something Peter said a few years back.

Please don’t ask me the sound of one hand clapping, I hear monks get stuck on that for up to 8yrs!

JS thanked this postHi Coincatcha,

Great to hear that things are going so well — and of course, you’ve got no one but yourself to thank for it, after all those sleepless nights coding and testing…

The numbers — 50% return with a 7.5% drawdown — look fantastic for a breakout/trend system…

You’re right, using the stop loss differently is one of the major advantages of such a system (I still use an emergency stop of 3% myself)…

Indeed, the first months of compounding positions are always exciting…

My own system is also performing well; of course, I’m still improving it every day…

My biggest breakthrough so far has been applying the z-score to the data…

The “z” stands for Zahl (German for “number”), and in statistics it’s used to compare different data sets…

The idea behind it is that each dataset has a mean and a standard deviation, so when you apply the formula ((Close – Average) / Standard Deviation), you obtain a scaled, dimensionless number — a normalized value…

Essentially, you’re normalizing or scaling the data, but the main advantage is that your system becomes adaptive — it adjusts itself to the average and the volatility of the current data. It works beautifully…

Of course, the system behaves like a typical breakout/trend model with a low win rate and a relatively high drawdown (16%), but it’s still the best one I’ve built so far…

At this point, it has become quite simple — it really comes down to three key steps:

-

Decomposing the data

-

Normalizing/making the data adaptive

-

Using thresholds to interpret the data

If you know even 1% about digital signal processing, it helps 100% when designing algos…

As for brokers, I now trade exclusively with IB, and what a relief it is to be done with all the IG nonsense…

My performance is also much better with IB…

Great hearing from you again, and best of luck going forward!

coincatcha thanked this postJustisan, I am pleased you turned up. We must have been typing simultaneously and you answered my query before I posted. Have you recovered well since earlier in the year? Reading through the forum let me know that you are also trading with IB. Thank you for your input. To be honest, I have had very little problems over the years. Trying to front run future growth as I have embarked on a fairly aggressive journey and though my recent trades were small very soon they will triple and some positions will go to 10x in size. That was the whole point of the live test so I am blessed a problem occurs now and I can seek help from you guys. Having read about why you moved to futures highlights something for me. You can see the trades I just posted are position and swing trades so maybe could benefit from that move also. What I am truly avoiding is learning Python/C++ and using APIs. Although my father could teach me he is painfully slow and accurate, my head hurts and I get restless to think about such a thing. I even have to talk to him in 1’s and 0’s. The all in one approach appealed to me 3 years ago but I can see it’s limitations and once your in the vortex they sort of have you by the cojones. Then we have to come here to bang our heads together and hand out hugs for the pains we share. -

-

AuthorPosts

- You must be logged in to reply to this topic.

Broker data anomoly closing auto systems

Platform Support: Charts, Data & Broker Setup

Author

Summary

This topic contains 33 replies,

has 5 voices, and was last updated by coincatcha

3 months, 1 week ago.

Topic Details

| Forum: | Platform Support: Charts, Data & Broker Setup |

| Language: | English |

| Started: | 11/03/2025 |

| Status: | Active |

| Attachments: | 19 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.