Hello Great Community!

I wonder if we can organize a poll of actual results of Algos run by the members (Real or Demo accounts) who are happy to share. No need to discolse how much money people are making or investing, just % Win Rate, Risk/Reward, Drawdawn, etc. And for those who want, they can share one or two tips on indicators or methods they use in their best winners (Entry, Exit, Money Management).

Backtest with WF/OOS is good but, in my case, actual results have always been surprising (Up or Down) although I’m not fan of curve fitting.

The idea is not to compete over results, but just want to see based on actual performance if there’s room to outperform buy & hold of major Indices on the long run.

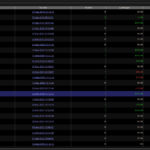

I dive first. Enclosed the result of my live algos running on a Demo account at IG… I whish I had them running on real account… I’ve some losers that I don’t show because of the size of the table.

Sharing is Caring ! Thank you

Judging from yours … think I’ll get a few running on US Tech 100! 🙂

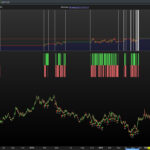

My older Algos have not been running continually … for example, see the 3 x several month gaps on my top gainer on the attached Detailed Report.

how come you have not put the GBP/USD one live? GraHal

i see it started 2016?

Drawdown I reckon, but I have often asked myself the same question!? 🙂

okay, i scrap strats immidietly if i dont think i will use it in the future, no point in having it just laying there and giving me a false hope 🙂

If I’d scrapped the GBP/USD Algo immediately then I would not know that over a long period the drawdown is not a problem because the Algo is profitable?

Attached is the equity curve, it can be seen that I have turned it off many times. Also 2/3 of the profit (£20k ish) has been made in the last 12 months.

It looks like the Algo has a bias towards upturns, although it takes many shorts (always on-market) and is stable during downturns?

Also I never scrap / delete anything as I may do some tweak on another Algo that can be applied across many of my Algos.

Drawdown I reckon

Drawdown is low according to the PRT stats … see attached.

I think I will review this one! This Topic is working for me! 🙂

My two longest running period. From 29th Dec. to today.

Algo NQ Capital = 12896*.5*.1*1€=645€ generated 1519€ (+235%) gains over a bit less than four months. Skewed towards Longs…

Algo DAX Capital = 13821*.5*.1*1€=691€ generated 1317€ (+190%) gains over a bit less than four months. Skewed towards Longs… (small but frequent losses with Shorts).

Which is(are) your best extra filter(s) on Shorts during an Uptrend?

My two highest winners over the shortest period of time. Running from 4th April 2021 to this morning.

Just figured out this morning that 122a and 122b are losing money on Shorts.

So I’ve put 122a on on retirement this morning and created a new one Long only, until I figure out how to stop bleeding on Shorts. I kept 122b, a slightly different version of 122a, running just to see if Short losses will be recovered by the end of this week or if it’s weak on the Short side.

What extra filters for Shorts in an uptrending market would you suggest?

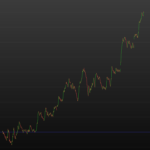

heres my 1 year total performance, live account. Running 15+ system, this performance chart is 1311 total trades, i would guess 90% are Long trades.

15m, 30m, 1h, 2h, daily timeframes.

USTECH100, US500, Wall st, Dax are my main markets.

View post on imgur.com

What extra filters for Shorts in an uptrending market would you suggest?

Below can, on some strategies, make a surprising difference.

If Close > Average[Period,Type](close) Then //Type = min =0 to max = 8 step = 1

Sell at Market

Endif

in steps of 1.

This self made Velocity, Acceleration and Momentum improved my Longs… less effective with Shorts

@GraHal

My less elegant version 🙂

IF MATYPE=1 then

EMA34Close=EndPointAverage[ClosePeriod](MedianPrice)

EMA34High=EndPointAverage[HighPeriod](high)

EMA34Low=EndPointAverage[LowPeriod](low)

ELSIF MATYPE=2 THEN

EMA34Close=HullAverage[ClosePeriod](MedianPrice)

EMA34High=HullAverage[HighPeriod](high)

EMA34Low=HullAverage[LowPeriod](low)

ELSIF MATYPE=3 THEN

EMA34Close=TriangularAverage[ClosePeriod](MedianPrice)

EMA34High=TriangularAverage[HighPeriod](high)

EMA34Low=TriangularAverage[LowPeriod](low)

ELSIF MATYPE=4 THEN

EMA34Close=ExponentialAverage[ClosePeriod](MedianPrice)

EMA34High=ExponentialAverage[HighPeriod](high)

EMA34Low=ExponentialAverage[LowPeriod](low)

ENDIF