Just checked and there is no entry in the Orders List under Rejected / Cancelled??

I’ve started Strat running again and I’ll see if it trades during DAX volume available periods (as Nicolas suggested lack of volume might be the reason re the divide by zero error).

I’m ‘licking my wounds’ at the mo as I got on the wrong side of the DAX rout today and I let it run thinking the price drop would pull back!  Cheers GraHal

Cheers GraHal

Yes we are bouncing around a supply and demand zone that was evident back around 7th/8th Nov and just above one from 18th/19th Dec. A dangerous place to take a position as could go either way from here. Best to wait for a breakout and jump on once it is established.

Now how exactly do you code that is the big question?

Topic move to ProOrder support as correctly requested by @GraHal.

Due to the “divide by zero” issues I quit testing it.

Damn shame that Roberto as you put a lot of good effort into that Strat.

We need to bottom out the divide by zero error; Ill keep trying stuff and let you know, but as you are loads better than me so don’t hold your breath! 🙂

Vonasi that was July I wrote … I’m ‘licking my wounds’ at the mo 🙂

Today has been one of my best days for quite a while … so far!! 🙂

Vonasi that was July I wrote … I’m ‘licking my wounds’ at the mo  Today has been one of my best days for quite a while … so far!!

Today has been one of my best days for quite a while … so far!!

Ooops my bad. Should check the post dates before posting.

Yes today is a better day for going long than the range bound trading yesterday – but not as good as last week. If only everyday was as good as last week on the DAX? We are still within the 7th/8th Nov supply and demand zone and that big number 13400 is causing some difficulty to get over.

Due to having had a ‘bashing’ of late with my manual trading, I’m going over old Algos.

@robertogozzi helped me loads and did some super coding below so all credit goes to Roberto.

With two variable value changes, the original code now gives good results on a 1 Hour TF.

Can’t get trades beyond 10,000 bars … is that normal?? It’s on my Demo Platform, but no error messages.

GraHal

//-------------------------------------------------------------------------

// Main code : $ RGozzi Macd-Mfi DAX 5M

//-------------------------------------------------------------------------

//-------------------------------------------------------------------------

// Main code : RGozzi Macd-Mfi DAX 5M

//-------------------------------------------------------------------------

//-------------------------------------------------------------------------

// Macd-Mfi DAX 5 min

//-------------------------------------------------------------------------

DEFPARAM CumulateOrders = False

DEFPARAM FlatBefore = 080000//090000 //no trades before 09:00:00

DEFPARAM FlatAfter = 210000//213000 //no trades after 21:30:00

ONCE nLots = 1 //number of LOTs traded

ONCE TP = 25 //60 pips Take Profit

ONCE SL = 40 //40 pips Stop Loss

ONCE Macd1 = 14 //14

ONCE Macd2 = 32 //32

ONCE Macd3 = 9 //9

MacdVal = MACD[Macd1,Macd2,Macd3](close)

MacdSignal = MACDline[Macd1,Macd2,Macd3](close)

MfiVal = MoneyFlow[23](close) //23

//***************************************************************************************

IF LongOnMarket THEN

IF MacdSignal CROSSES UNDER MacdVal THEN

SELL AT MARKET //Exit LONGs when MACD reverses southwards

ENDIF

ENDIF

IF ShortOnMarket THEN

IF MacdSignal CROSSES OVER MacdVal THEN

EXITSHORT AT MARKET //Exit SHORTs when MACD reverses northwards

ENDIF

ENDIF

//***************************************************************************************

trailingstart = 6 //2 trailing will start @trailinstart points profit

trailingstep = 6 //8 trailing step to move the "stoploss"

//reset the stoploss value

IF NOT ONMARKET THEN

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN

newSL = tradeprice(1)+trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN

newSL = newSL+trailingstep*pipsize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN

newSL = tradeprice(1)-trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN

newSL = newSL-trailingstep*pipsize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

SELL AT newSL STOP

EXITSHORT AT newSL STOP

ENDIF

//***************************************************************************************

// LONG trades

//***************************************************************************************

a1 = close > open //BULLish bar

a2 = MacdSignal CROSSES OVER MacdVal //MACD goes North

a3 = (MfiVal > 500) AND (MfiVal > MfiVal[1]) //3200 Mfi limit

IF a1 AND a2 AND a3 THEN

BUY nLots CONTRACT AT MARKET

ENDIF

//***************************************************************************************

// SHORT trades

//***************************************************************************************

b1 = close < open //BEARish bar

b2 = MacdSignal CROSSES UNDER MacdVal //MACD goes South

b3 = (MfiVal < - 500) AND (MfiVal < MfiVal[1]) //-3200 Mfi limit

IF b1 AND b2 AND b3 THEN

SELLSHORT nLots CONTRACT AT MARKET

ENDIF

//

SET TARGET PPROFIT TP

SET STOP PLOSS SL

//GRAPH MfiVal AS "Mfi"

The above code uses / needs volume figures.

Hey I think I might have thought of an answer to my question above re no trades beyond 10,000 bars … when did IG start providing volume figures … 10,000 x 1H bars ago??

Also the divide by zero error (see previous posts) may be caused by lack of volume during out of hours periods? Nicolas did suggest this a while back.

GraHal

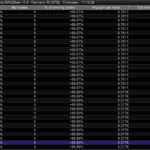

PS Yep that’s it … see attached

Hi everybody,

I allowed myself to revisit the 3 strategies with a TF 28 sec.

This helps to reduce space time and get results faster.

Below are the 3 strategies:

@Gertrade what do results for your 3 Strats look like on 5 Min TF?

Do you not think results would be more consistent on 5 Min or even 1 Min … as that is what loads of traders use and so we can jump on the bandwagon of success! 😉

Thanks

GraHal

@ Grahal,

Your questions are always very relevant. I like that. I will study this question. Instinctively, I will say that Backtests on 1mn and 5mn must be bad.

See you later.

Hey wow … must be loads of potential in these!!!!!

All I did was change below and look at results of 5 Min TF!!!!!!

Loving the staircase curve!!!!!!!!!!!!!!!!!!

Look at the 89% winning Trades!!!!!!!!!!! Look at the £5 Drawdown?????????????

Quick In and Out, money back in my pot and sleep soundly!!!!!!!!!!!!!!!!! 🙂 🙂 🙂

Onward and Upward eh Gertrade?

GraHal

PS If consistent returns over a long period then all we have to do to make big money is to increase Lot Size.

ONCE TP = 5 //23 pips Take Profit

ONCE SL = 15

Note that I didn’t pick the best overall result.

I selected a compromise between best % winning trades, number of Trades, profit and tick mode value etc (=1)

GraHal

PS Hope above fires you up to consider normal accepted Time Frames … 15Min, 5 Min, 1Min etc?

Hi Grahal and Gertrade,

When I backtest as Grahal in 5 mn TF with 200 000 bars the Gertrade’s Klinger, the strategy has always big losses, except the very short period you tested, since some weeks: but when you have only 9 positions, the backtest, optimised, has no signification. So Gertrade proposition in 28s TF is almost the same: very short backtest for a few days, optimised for a dozen of positions: unfortunatly it is not very reliable. Anyway live trading will tell us. And thanks for these searches! I am searching too, but I find nothing…

@Aloysius I agree, I only did it quick as I was going out and I was trying to get Gertrade fired up on the 5 min TF 🙂

Did you try optimising and Walk Forward over your 200,000 bars? It would be good if you could please as a lot / most of us can’t even get 200,000 bars.

We’d love to see optimised results if you could please Aloysius ?

I’m also intrigued … what are you searching for? 🙂

GraHal

PS we owe a big thank you to @robertogozzi as he coded the Algos on this Thread … Klinger, Tema and MACD-Mfi.

I’m sorry this thread was abandoned for quite some time, but it’s good we have ‘fresh blood’ on it now.

I hope Roberto comes back also … his coding is so well laid out, easy to read and lines are commented so we can see what the code is doing etc.

Cheers GraHal

Cheers GraHal Today has been one of my best days for quite a while … so far!!

Today has been one of my best days for quite a while … so far!!