wouldn’t you mind that this historical value is not available in backtesting?

As always we would need to enter a worst case / average for spread in backtesting.

If Systems do not make money under worst case / average then no point trading.

I’ve stopped all my Systems under Demo True Forward Test as I don’t want to lose the historical performance under temporary wide spreads that was built up under normal spreads.

Problem is that if backtesting is not acting the same as in real time trading, due to abnormal spread, a lot of people will argue that this is a shame… blablabla 😆 But throwing away a good system into the garbage because of a 24 points spread on one of the largest world index is a non sense.

Just like most of the major events that have taken place in recent years (11/09, subprime crisis, Obama election, etc.), we will have to keep in mind the episode of Coronavirus in your future backtests. I am convinced that from today, the trend following systems will very often have a very correct WFE over the current periods 🙂

But throwing away a good system into the garbage because of a 24 points spread on one of the largest world index is a non sense.

I agree, we need to sit on our hands until normal times are restored.

if backtesting is not acting the same as in real time trading

Backtesting never acts as real time trading because real time spreads etc are never reflected into the backtest engine.

I am going to continue developing and backtesting etc, but store Systems ready for trading under normal spreads. This is what I meant by ‘not trading‘ … in case you misunderstood me.

Oh the irony 🙂 … I’ve had Systems where my code was flawed and entry was immediately followed by exit and when I looked in the Detailed Report, it showed only trades with 0 bars and a loss = spread.

Try as I might now, when I want above scenario, I can’t code it to happen!! 🙁

Lunch and try again on a full stomach!

Getting there now … I had no entry for spread in the backtest settings! doh

Always something simple when the simple won’t happen! 🙂

Good to get away from the screen when code is not working!?

Sorry for the OT Grahal.

I would like to ask you if there’s a web page where you can live check spreads of IG without going into the platform and do it by yourself?

Yes below

https://www.ig.com/uk/help-and-support/spread-betting-and-cfds/fees-and-charges/what-are-igs-indices-spread-bet-product-details

What is OT anyway?? 🙂

Ahh just noticed you asked for Live Spreads … NO … that is why I raised this Topic … to try and come up code which gives Live Spreads.

OT is off topic.

Yes i already knew that page, so we need to check by ourselves for live ones.. Thanks!

Your question was not OT anyway as this Topic is about Live Spreads! 🙂

IG don’t want us to easily know what the live spread is in real time … so, for example, when we are sleeping and our Systems are running, IG can make £££’s by widening the spread at various times when the probability is high that more £££’s can be made! 🙂

It would be great if you could find a way to code protection against this sort of thing, it really would, but tbh my instinct is to avoid algos that are likely to suffer under those conditions. The 1 sec Renkos are interesting and truly little cash machines in a strong trending market, but maybe just a bit too fragile.

I’m still p*ssed that IG is allowed to do it, but 5 -10 pts on the DOW is nothing in the bigger picture. A more robust strategy should be able to handle it.

It’s not the same but a filter with big average true range can help. So in this period, strategies do not operate. (often big spread = big average true range)

avoid algos that are likely to suffer under those conditions.

I agree and we would if we had only known … 26.6 points spread yesterday at one point!?

Yeah we’ll have to put the Little 1 Sec cash machine toys back in the cupboard until better weather comes!? 🙂

often big spread = big average true range

Yeah IG probably have some algo that ramps up the spread relative to ATR … maybe it is surprising that spread during normal market hours stayed so low for so long!? 🙂

1 sec strategy or not, in my opinion it is better to avoid using automatic systems when the spreads are so high, regardless of the robustness of the same and the asset on which you operate.

Probably our automatic systems will never be completely automatic, you must always have an eye on external factors

Paul

PaulParticipant

Master

Little 1 Sec cash machine toys back in the cupboard until better weather comes

Yes, but in the meantime there were too many trades. So it’s maybe good to find some kind of filter which reduces the number.

Still potential is there, even now.

Still potential is there, even now.

I’d like to think so and that was my thoughts re starting this Topic.

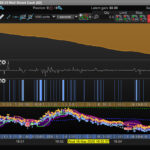

I reckon attached could be put to use as a measure / indicator of real time spread?

- The middle line at 9.96 is the spread on a zero bar (spread currently = 8.6) plus slippage of 1.36.

2. The line goes to zero / 0 when there is no position taken for that 1 second interval.

3. All other values are where the trade exists for longer than 1 second (profit or loss).

2. and 3. should not happen.

The fact that 2. and 3. do happen brings up some interesting (but not good) odd occurences??

If you don’t agree with middle line being the spread + slippage … just say, I won’t cry even though my cash machine toys have been taken off me! 🙂

DEFPARAM CUMULATEORDERS = False

If barindex >= 100 Then

Buy at Market

BuyPrice = TradePrice

Sell at BuyPrice stop

//SellPrice = TradePrice

Endif

Myspread = - PositionPerf(1) * Close

GRAPH MySpread //= 0 //< 1.6

//GRAPH TRadePrice