Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

strategy BarHunter DAX v1p

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- strategy BarHunter DAX v1p

-

AuthorPosts

-

TimeHunter v1p MOD FIFI

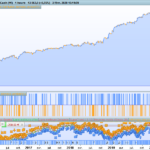

Hey interesting … with no optimisation or even adjustment of Time (yet) for UK Timezone see attached on DJI @ H2 TF.

Well done Paul and Fifi!

Hello,

Cannot add backtest “TIMEHUNTER V1P MODFIFI” PRT wants me to edit the variables.

But the variables are already in the code I don’t understand where is the problem?

Thank you @Grahal !

see attached on DJI @ H2 TF.

Even better on DJI H1 with EntryHour = 15 at Line 42.

Hour 15 being 15:00 to 16:00 UK time is logical as the DJI opens at 14:30 so after half an hour to settle down?

0.2 size

You are showing Size = 1 on your results?

I haven’t yet got decent results on DAX 1 Hour … have you Francesco?

Maybe they were okay. but I was so impressed with the DJI results!? I’ll go back and have a look now I have got the DJI running in Forward Test on Demo.

All hail Paul and Fifi ! 🙂

Yes it’s size 1, I was wrong to write, that’s why I also edited the post

that’s why I also edited the post

We are too quick for each other! 🙂

I have added to my previous with a question for you anyway.

Yes we are 🙂

Anyway, I was not even able to get close to the results of the DAX.

It is probably due to the nature of the asset which is much more versatile for strategies in terms of volatility and trend.Could someone help in pointing out where I can adjust this?

Change mindist in the code to 15.

But you may still get Rejected as IG ‘Flash widen’ (for several seconds) the spread often.

//------------------------------------------------------------------------- // Hoofd code : BarHunter v3p //------------------------------------------------------------------------- //Germany //24 uur //01.15-08.00 = 4 //08.00-09.00 = 2 //09.00-17.30 = 1 //17.30-22.00 = 2 //22.00-01.15 = 5 //South Africa 40 //24 uur ZAR50 ZAR10 //07.30-16.30 8 //Alle andere tijden 30 //Wall Street 24 uur $10 / $2 //09.00-15.30 2,4 //15.30-22.00 1,6 //22.15-22.30 9,8 //23.00-00.00 9,8 //Alle andere tijden 3,8 defparam cumulateorders = FALSE defparam preloadbars = 1000 once enablets = 1 // trailing stop once enabletsvir = 1 // trailing stop virtual once displayts = 0 // trailing stop once holiday = 1 once closebeforeweekend = 0 once closebeforeweekendinloss =0 once securebeforeweekendprofit=0 once entrytype= 1 //entrytype=1 first version with error minimum distance stop //entrytype=2 entry modified with stop //entrytype=3 entry modified with market //entrytype=4 stop distance defnined first entry as entrytype 1 tds= 4// trend detection system off when optimising barnumbers // separate long/short or go both once longtrading =1 once shorttrading=1 // select which intradaybar should be analysed (depends on timeframe settings) once barnumberlong = 3 //long (timezone dependent) once barnumbershort= 3 //short (timezone dependent) // select the number of points above/below the breakvaluelong/short breakpoint=5 //========= once limitSLbroker=0 if time >210000 and time<070000 and CurrentDayOfWeek>=0 then limitSLbroker=12 elsif time>070000 and time<210000 and CurrentDayOfWeek>=0 then limitSLbroker =10 elsif time>210000 and CurrentDayOfWeek>5 then limitSLbroker=271 endif //fixed value 10 for dax (the minimum distance the stop can be place to the current close) if breakpoint <= limitSLbroker then if (15-breakpoint)>=0 and (15-breakpoint)<=15 then once minstopdistance=(15-breakpoint) else once minstopdistance = 15 endif else once minstopdistance = 0 endif // main criteria if intradaybarindex=0 then tradecounter=0 breakvaluelong=99999 breakvalueshort=0 tradeday=1 endif // holiday if holiday then if (Month = 5 AND Day = 1) OR (Month = 12 AND Day >=15) then tradeday=0 else tradeday=1 endif endif tradecount = tradecounter < 1 //perhaps 2 if using seperate bars for long & short // if entrytype>=1 and entrytype<4 then if longtrading or (longtrading and shorttrading) then if intradaybarindex=barnumberlong then breakvaluelong=high endif endif if shorttrading or (longtrading and shorttrading) then if intradaybarindex=barnumbershort then breakvalueshort=low endif endif elsif entrytype=4 then if longtrading or (longtrading and shorttrading) then if intradaybarindex=barnumberlong then breakvaluelong=high if high-close<minstopdistance then breakvaluelong=close+minstopdistance else breakvaluelong=breakvaluelong endif endif endif if shorttrading or (longtrading and shorttrading) then if intradaybarindex=barnumbershort then breakvalueshort=low if close-low<minstopdistance then breakvalueshort=close-minstopdistance else breakvalueshort=breakvalueshort endif endif endif endif // trend detection if tds=0 then trendup=1 trenddown=1 else if tds=1 then trendup=(Average[10](close)>Average[10](close)[1]) trenddown=(Average[10](close)<Average[10](close)[1]) else if tds=2 then bbup=BollingerUp[20](close) bbdn=BollingerDown[20](close) bbav=(bbup+bbdn)/2 trendup=bbav>bbav[1] trenddown=bbav<bbav[1] else if tds=3 then Period= 3 inner = 2*weightedaverage[round( Period/2)](typicalprice)-weightedaverage[Period](typicalprice) HULL = weightedaverage[round(sqrt(Period))](inner) trendup = HULL > HULL[1] trenddown = HULL < HULL[1] else if tds=4 then Period= 2 inner = 2*weightedaverage[round( Period/2)](totalprice)-weightedaverage[Period](totalprice) HULL = weightedaverage[round(sqrt(Period))](inner) trendup = HULL > HULL[1] trenddown = HULL < HULL[1] endif endif endif endif endif // POINT PIVOT HEBDOMADAIRE IF dayofweek < dayofweek[1] THEN weeklyhigh = prevweekhigh weeklylow = prevweeklow weeklyclose = prevweekclose prevweekhigh = high prevweeklow = low weeklyPivot = (weeklyHigh + weeklyLow + weeklyclose) / 3 ENDIF prevweekhigh = max(prevweekhigh, high) prevweeklow = min(prevweeklow, low) prevweekclose = close // POINT PIVOT JOURNALIER IF dayofweek = 1 THEN dayhigh = DHigh(2) daylow = DLow(2) dayclose = DClose(2) ENDIF IF dayofweek >=2 and dayofweek < 6 THEN dayhigh = DHigh(1) daylow = DLow(1) dayclose = DClose(1) ENDIF Pivot = (dayhigh + daylow + dayclose) / 3 S3 = daylow - 2 * (dayhigh- Pivot) R3 = dayhigh + 2* (Pivot - daylow) ecart=4 ecartWP=5 EC= HIGH-low/pointsize //SP=call"filtre_barhunter" // entry criteria if entrytype=1 and tradeday=1 then // entry criteria if hour<=21 then if longtrading then if intradaybarindex >= barnumberlong then if trendup and tradecount and (close>pivot or (close <pivot and (pivot-close)/pointsize >ecart)) and (close>weeklypivot or (close <weeklypivot and (weeklypivot-close)/pointsize >ecartWP))and ec>3.9 then buy 1 contract at breakvaluelong+breakpoint stop ppf=0 tradecounter=tradecounter+1 endif endif endif if shorttrading then if intradaybarindex >= barnumbershort then if trenddown and tradecount and (close<pivot or (close>pivot and (close-pivot)/pointsize >ecart))and (close<weeklypivot or (close>weeklypivot and (close-weeklypivot)/pointsize >ecartWP)) and ec>3.1 then sellshort 1 contract at breakvalueshort-breakpoint stop ppf=0 tradecounter=tradecounter+1 endif endif endif endif elsif entrytype=2 then if hour<=23 then if longtrading then if intradaybarindex >= barnumberlong then if trendup and tradecount then if ((breakvaluelong+breakpoint)-close)>=minstopdistance then buy 1 contract at breakvaluelong+breakpoint stop tradecounter=tradecounter+1 else buy 1 contract at close+(minstopdistance+breakpoint) stop tradecounter=tradecounter+1 endif endif endif endif if shorttrading then if intradaybarindex >= barnumbershort then if trenddown and tradecount then if (close-(breakvalueshort-breakpoint))>=minstopdistance then sellshort 1 contract at breakvalueshort-breakpoint stop tradecounter=tradecounter+1 else sellshort 1 contract at close-(minstopdistance-breakpoint) stop tradecounter=tradecounter+1 endif endif endif endif endif elsif entrytype=3 then if hour<=23 then if longtrading then if intradaybarindex >= barnumberlong then if trendup and tradecount then if high crosses over (breakvaluelong+breakpoint) then buy 1 contract at market endif endif endif endif if shorttrading then if intradaybarindex >= barnumbershort then if trenddown and tradecount then if low crosses under (breakvalueshort-breakpoint) then sellshort 1 contract at market tradecounter=tradecounter+1 endif endif endif endif endif elsif entrytype=4 then if hour<=23 then if longtrading then if intradaybarindex >= barnumberlong then if trendup and tradecount then buy 1 contract at breakvaluelong+breakpoint stop tradecounter=tradecounter+1 endif endif endif if shorttrading then if intradaybarindex >= barnumbershort then if trenddown and tradecount then sellshort 1 contract at breakvalueshort-breakpoint stop tradecounter=tradecounter+1 endif endif endif endif endif // trailing atr stop if enablets then // once steps=0.05 once minatrdist=3 once atrtrailingperiod = 14 // atr parameter once minstop = 15 // minimum distance if barindex=tradeindex then trailingstoplong = 5 // trailing stop atr distance trailingstopshort = 5 // trailing stop atr distance else if longonmarket then if newsl>0 then if trailingstoplong>minatrdist then if newsl>newsl[1] then trailingstoplong=trailingstoplong else trailingstoplong=trailingstoplong-steps endif else trailingstoplong=minatrdist endif endif endif if shortonmarket then if newsl>0 then if trailingstopshort>minatrdist then if newsl<newsl[1] then trailingstopshort=trailingstopshort else trailingstopshort=trailingstopshort-steps endif else trailingstopshort=minatrdist endif endif endif endif // atrtrail=averagetruerange[atrtrailingperiod]((close/10)*pipsize)/1000 trailingstartl=round(atrtrail*trailingstoplong) trailingstarts=round(atrtrail*trailingstopshort) tgl=trailingstartl tgs=trailingstarts // if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then maxprice=0 minprice=close newsl=0 endif // if longonmarket then maxprice=max(maxprice,close) if maxprice-tradeprice(1)>=tgl*pointsize then if maxprice-tradeprice(1)>=minstop then newsl=maxprice-tgl*pointsize else newsl=maxprice-minstop*pointsize endif endif endif // if shortonmarket then minprice=min(minprice,close) if tradeprice(1)-minprice>=tgs*pointsize then if tradeprice(1)-minprice>=minstop then newsl=minprice+tgs*pointsize else newsl=minprice+minstop*pointsize endif endif endif // if longonmarket then if newsl>0 then sell at newsl stop endif endif if shortonmarket then if newsl>0 then exitshort at newsl stop endif endif if displayts then //graphonprice newsl coloured(0,0,255,255) as "trailingstop atr" endif endif // ================trailing atr stop VIRTUAL================== if enabletsvir then // once stepsvir=0 once minatrdistvir=0 once atrtrailingperiodvir = 2 // atr parameter once minstopvir = 10 // minimum distance if barindex=tradeindex then trailingstoplongvir = 5 // trailing stop atr distance trailingstopshortvir = 5 // trailing stop atr distance else if longonmarket then if newslvir>0 then if trailingstoplongvir>minatrdistvir then if newslvir>newslvir[1] then trailingstoplongvir=trailingstoplongvir else trailingstoplongvir=trailingstoplongvir-stepsvir endif else trailingstoplongvir=minatrdistvir endif endif endif if shortonmarket then if newslvir>0 then if trailingstopshortvir>minatrdistvir then if newslvir<newslvir[1] then trailingstopshortvir=trailingstopshortvir else trailingstopshortvir=trailingstopshortvir-stepsvir endif else trailingstopshortvir=minatrdistvir endif endif endif endif // atrtrailvir=averagetruerange[atrtrailingperiodvir]((close/10)*pipsize)/1000 trailingstartlvir=round(atrtrailvir*trailingstoplongvir) trailingstartsvir=round(atrtrailvir*trailingstopshortvir) tglvir=trailingstartlvir tgsvir=trailingstartsvir // if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then maxpricevir=0 minpricevir=close newslvir=0 endif // if longonmarket then maxpricevir=max(maxpricevir,close) if maxpricevir-tradeprice(1)>=tglvir*pointsize then if maxpricevir-tradeprice(1)>=minstopvir then newslvir=maxpricevir-tglvir*pointsize else newslvir=maxpricevir-minstopvir*pointsize endif endif endif // if shortonmarket then minpricevir=min(minpricevir,close) if tradeprice(1)-minpricevir>=tgsvir*pointsize then if tradeprice(1)-minpricevir>=minstopvir then newslvir=minpricevir+tgsvir*pointsize else newslvir=minpricevir+minstopvir*pointsize endif endif endif // if longonmarket and close <newslvir and newslvir>0 then sell at market endif if shortonmarket and close>newslvir and newslvir>0 then exitshort at market endif if displayts then //graphonprice newsl coloured(0,0,255,255) as "trailingstop atr" endif endif //======================AJOUTER PAR FIFI PP=positionperf(0)*100 if pp>ppf then ppf=pp endif filtre=call"Forme_bougie" spread=abs(OPEN-CLOSE) coeff=spread/highest[200](spread)*100 //================= // coefficient de la bougie if longonmarket and barindex-tradeindex>1 AND ppf>0.5 and pp<ppF and coeff<4 and close<positionprice then sell at market endif if longonmarket AND coeff[1]<3 and coeff>80 and close>positionprice then sell at market endif //===============SHORT if shortonmarket and barindex-tradeindex<3 and pp<ppF and coeff>55 and close>positionprice then exitshort at market endif if shortonmarket and barindex-tradeindex>6 AND ppf>0.1 and pp<ppF and coeff<3 and close>positionprice then exitshort at market endif if shortonmarket AND coeff[1]<6 and coeff>70 and close<positionprice then exitshort at market endif //===================FORME DE BOUGIE if filtre[1]=-1 and barindex-tradeindex<4 and pp<ppF and longonmarket and close>positionprice then sell at market endif if filtre[1]=-1 and pp>0.7 and pp<ppF and longonmarket and close>positionprice then sell at market endif if filtre=1 and pp>2.5 and pp<PPF and shortonmarket and close<positionprice then exitshort at market endif if filtre[1]=1 and barindex-tradeindex<7 and pp<PPF and shortonmarket and close<positionprice then exitshort at market endif //=====================CROSS POINT DE PIVOT If longonmarket and close[1] < R3 and high[1]>R3 and open>close and pp>ppF-pp and close>positionprice then sell at market endif if shortonmarket and close[1]>S3 and low[1]<S3 and open<close and pp>ppF-pp and close<positionprice then exitshort at market endif //======================================= if longonmarket and pp>ppF-pp and close>positionprice and open>close and( (high-open>18)or(open=high and open-close>9)or(open[1]<close[1] and close[1]=high[1] and open[1]>close)) then sell at market endif if shortonmarket and pp>ppF-pp and close<positionprice and open<close and open[1]>close[1] and close[1]=LOW[1] and open[1]<close then exitshort at market endif // test de nombre de bar negative ajouter fifi743 if longonmarket and barindex-tradeindex>138 and close<positionprice then sell at market endif if shortonmarket and barindex-tradeindex>11 and close>positionprice then exitshort at market endif //===============AJOUTER FERMETURE DES POSITIONS RSI ET barindex-tradeindex ===== Myrsi=RSI[15](close) //34 if Myrsi<47 and barindex-tradeindex>3 and longonmarket and close>positionprice then sell at market endif if Myrsi>69 and barindex-tradeindex>1 and shortonmarket and close<positionprice then exitshort at market endif //=========================NB bar for i=0 to 3 if longonmarket and barindex-tradeindex<4 AND COEFF[i]>60 AND COEFF<10 and coeff[i]>coeff and ppf=0 then sell at market break endif if shortonmarket and barindex-tradeindex<5 AND COEFF[i]>60 AND COEFF<10 and coeff[i]>coeff and ppf=0 then exitshort at market endif next // =================== FORME DE BOUGIE DOJI ==================== if longonmarket and abs(open-close)<1 and high-close>18 and high[1]<high and close>positionprice then sell at market endif if shortonmarket and abs(open-close)<1 and low[1]<low and close<positionprice then exitshort at market endif //====================PAUL if closebeforeweekend then if onmarket then if (dayofweek=5 and hour>=22) then sell at market exitshort at market endif endif endif if securebeforeweekendprofit then if (dayofweek=5 and hour>=18) then if longonmarket then if close>positionprice+15 then sell at tradeprice(1)+10 stop //else //if hour>=22 then //sell at market //endif endif endif if shortonmarket then if close<positionprice-15 then exitshort at tradeprice(1)-10 stop else if hour>=22 then exitshort at market endif endif endif endif endif if closebeforeweekendinloss then if (dayofweek=5 and hour>=22) then if longonmarket then if close<positionprice then sell at market endif endif if shortonmarket then if close>positionprice then exitshort at market endif endif endif endif //============================== if CurrentDayOfWeek=1 and time>060000 and time<180000 then SL=160 elsif CurrentDayOfWeek=2 and time>060000 and time<180000 then SL=160 elsif CurrentDayOfWeek=3 and time>060000 and time<180000 then SL=170 elsif CurrentDayOfWeek=4 and time>060000 and time<180000 then SL=130 elsif CurrentDayOfWeek=5 and time>060000 and time<180000 then SL=150 elsif time>180000 and time<060000 then sl=270 endif SET STOP PLOSS sl //set stop %loss 2 //set target %profit 3Florian Legeard – I removed your ‘bad’ code and replaced it with the second code that you posted. I also removed the French part of your post.

Florian thanked this posthere’s an early strategy I based on barhunter. It had to be very simple and it isn’t perfect by any stretch but it shows that there’s some predictable behaviour at certain times in the market. Uses market orders, based on 15 minutes, dax.

and here’s TimeHunter v1.01p VS crude oil

take into account, when going back in time and a index is half the value, a stoploss using points or percentage matters.

Same goes using points for a break or percentage. Using percentage can lower the equity curve.

Change mindist in the code to 15. But you may still get Rejected as IG ‘Flash widen’ (for several seconds) the spread often.

Have you been rejected at mindist = 15 Florian?

Try below (for mindist = 30) just so you can understand what goes on and hopefully you may get a trade triggered.

Below relates to Lines 51 to 71 in the code you posted.

Only try on Demo (Not Real Live).

breakpoint=5 //========= once limitSLbroker=0 if time >210000 and time<070000 and CurrentDayOfWeek>=0 then limitSLbroker=30 elsif time>070000 and time<210000 and CurrentDayOfWeek>=0 then limitSLbroker =10 elsif time>210000 and CurrentDayOfWeek>5 then limitSLbroker=271 endif //fixed value 10 for dax (the minimum distance the stop can be place to the current close) if breakpoint <= limitSLbroker then if (30-breakpoint)>=0 and (30-breakpoint)<=25 then once minstopdistance=(30-breakpoint) else once minstopdistance = 30 endif else once minstopdistance = 0 endif -

AuthorPosts

- You must be logged in to reply to this topic.

strategy BarHunter DAX v1p

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 255 replies,

has 11 voices, and was last updated by sfl

2 years, 6 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 01/15/2020 |

| Status: | Active |

| Attachments: | 136 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.