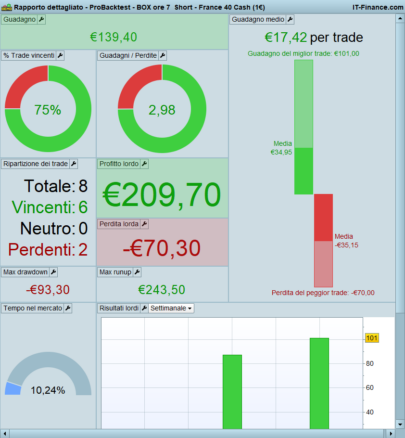

Using the same code for both strategies, only reversing BUY with SELLSHORT and SELLSHORT with BUY.

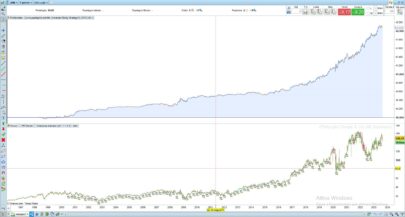

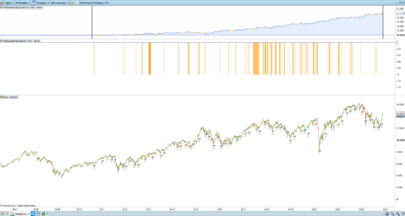

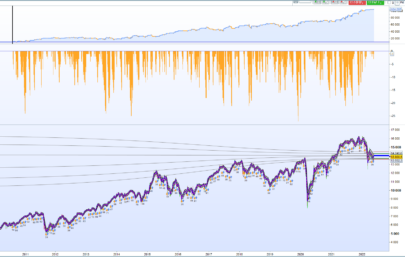

– AUDNZD 4H Reversal

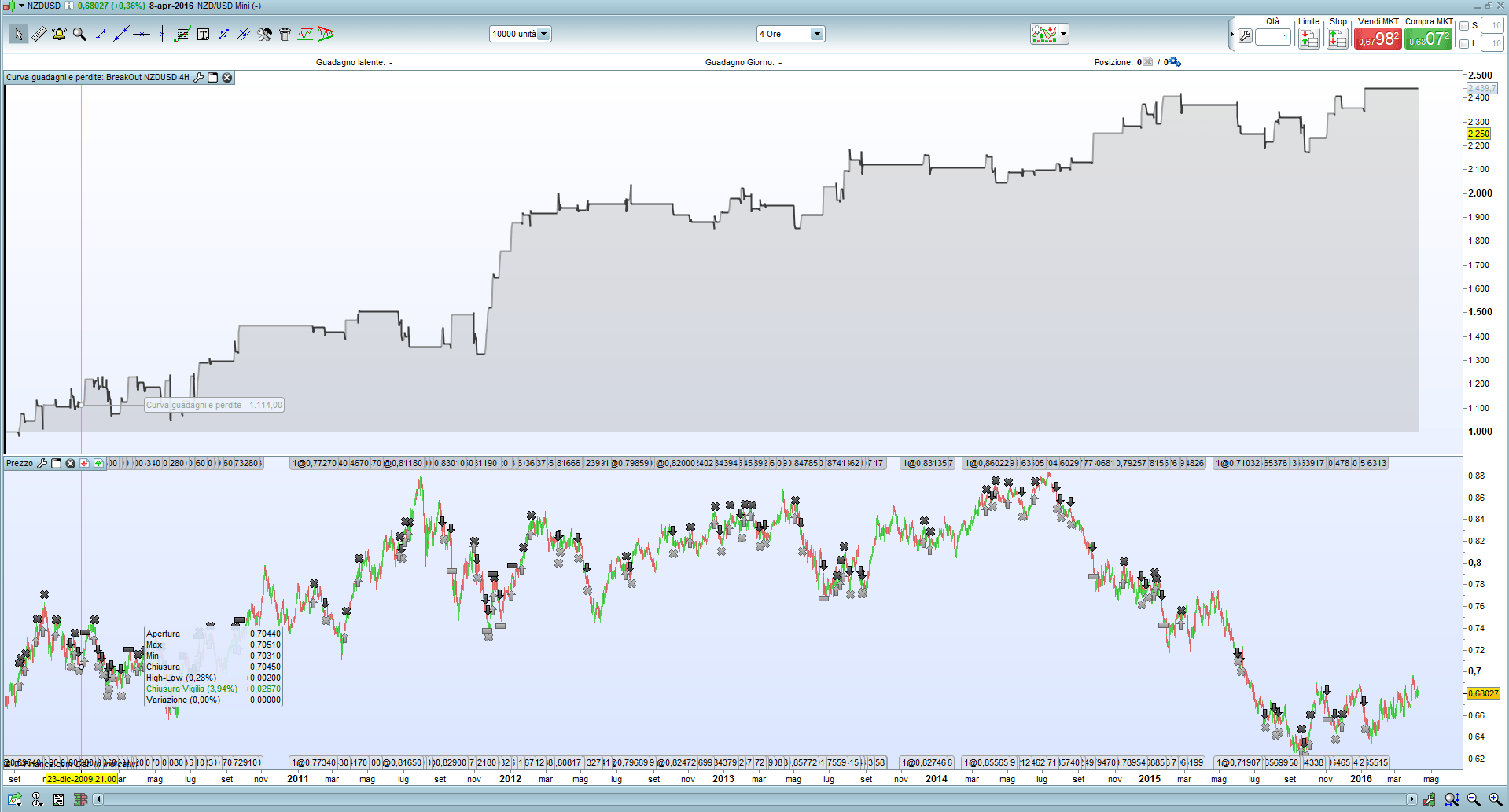

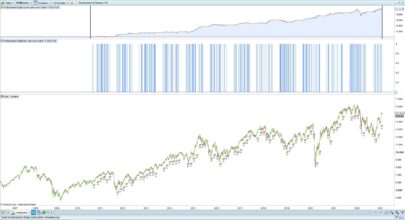

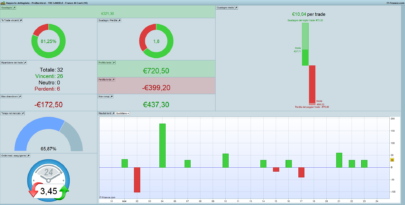

– NZDUSD 4H Breakout

You look in the system: daily closings, breaking a max or min of X days, range, strength of the candle, moving average.

if you find the best parameters for this strategy would be grateful! 🙂

I wrote this also thanks to the support of the staff of ProRealTime,

Gianluca

Italy(BS)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 |

//BreakOut NZDUSD 4H DEFPARAM CUMULATEORDERS=FALSE max5 = HIGHEST[5](HIGH) min5 = LOWEST[5](LOW) REM posizione long IF dclose(1)>dclose(2) and dclose(2)>dclose(3) and low=min5 and close>open and range>range[1] and close>((high+low)/2) THEN IF CLOSE>Average[100](close) THEN BUY 1 SHARE AT MARKET endif endif REM posizione short if dclose(1)<dclose(2) and dclose(2)<dclose(3) and HIGH=max5 and close<open and range>range[1] and close<((high+low)/2) THEN IF CLOSE<Average[100](close) THEN sellSHORT 1 SHARE at market endif endif IF LONGONMARKET AND (BARINDEX - TRADEINDEX ) =6 THEN sell AT MARKET ENDIF IF SHORTONMARKET AND (BARINDEX - TRADEINDEX ) =6 THEN EXITSHORT AT MARKET ENDIF SET TARGET %PROFIT 1.5 SET STOP %LOSS 2.5 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello,

On NZDUSD, this is profitable since August 2010.

On AUDNZD, the system is profitable since August 2009.Congratulations and thanks for your share and your work !

thank you Doctrading, congratulations to you too, I see you are very active on the forum! I hope everyone can share their knowledges (and their codes …). Is a good way to grow…

Ciao, vorrei utilizzare e ottimizzare una delle due sulla coppia eurusd. Nella strategia di break out hai inserito nei commenti dei valori per alcune coppie di valute. A che cosa si riferiscono ? Grazie

non so su eurusd ma forse modificando qualcosa potrebbe funzionare con altre coppie. Se vuoi prova ad ottimizzare il Lowest e Highest e i controlli sulle barre daily (dclose) , oppure sostituire la media mobile con un altro indicatore ma non aggiungerne altri perchè il rischio di overfitting è alto.

Se scopri qualcosa fammi sapere…

Ciao, ho già provato ma non ho avuto risultati buoni. Se trovo qualcosa ti faccio sapere.

Non capisco dove sta la strategia reversal

L’allegato Reversal-AUDNZD-4H.itf lo vedi ? Comunque la strategia è la stessa che vedi nel listato ma con segni invertiti

salve qualcuno l ha provata in reale come sta andando???

bel lavoro comunque grazie