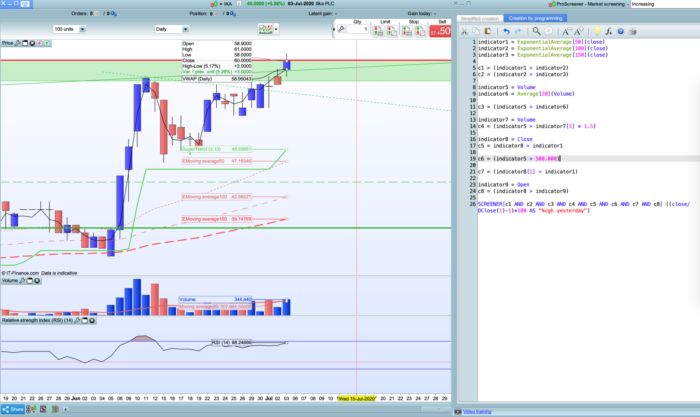

Simple and effective way to find bullish stocks.

It works perfect for Day Trading

Formula is:

Price > EMA(50) > EMA(100) > EMA(150)

Volume > 50% Previous Volume && Volume > SMA(20)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 |

indicator1 = ExponentialAverage[50](close) indicator2 = ExponentialAverage[100](close) indicator3 = ExponentialAverage[150](close) c1 = (indicator1 > indicator2) c2 = (indicator2 > indicator3) indicator5 = Volume indicator6 = Average[20](Volume) c3 = (indicator5 > indicator6) indicator7 = Volume c4 = (indicator5 > indicator7[1] * 1.5) indicator8 = Close c5 = indicator8 > indicator1 c6 = (indicator5 > 500.000) c7 = (indicator8[1] > indicator1) indicator9 = Open c8 = (indicator8 > indicator9) SCREENER[c1 AND c2 AND c3 AND c4 AND c5 AND c6 AND c7 AND c8] ((close/DClose(1)-1)*100 AS "%cgh yesterday") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi, i don’t get any result on DAX!

hey! just remove the volume condition and you should be good to go, I personally use it in a 5 min timeframe when daytrading, I hope it helps

@omidnajaf this will give you DAX/currencies/etc, volume is not in part of the conditions anymore

// EMA9 increasing

ema9 = ExponentialAverage[9](close)

c1 = (ema9 > ema9[1])

// EMA20 increasing

ema20 = ExponentialAverage[20](close)

c2 = (ema20 > ema20[1])

c3 = (ema9 > ema20)

// Close > EMA9

currentclose = Close

c6 = currentclose > ema9

// Prev close > EMA9 -> second candle that increases

c8 = (currentclose[1] > ema9)

// It closes possitive

currentopen = Open

c9 = (currentclose > currentopen)

highCurrent = High

highPrevious = High[1]

c10 = (highCurrent > highPrevious)

SCREENER[c1 AND c2 AND c3 AND c6 AND c8 AND c9 AND c10] ((close/DClose(1)-1)*100 AS “%cgh yesterday”)

Be aware that due to the use of volume indicators this screener is unlikely to flag stocks during the early parts of the day. Conditions c3, c4 and c6 imply that the trading session must, in most cases, have been well under way before they are likely to become TRUE.

true Violet! how I use it is for Day Trading on US stocks, and I set a 5 mins timeframe, and I only start trading 30 mins after market opens, by then the results are effective, I hope it helps!

Cristofor, what do you mean by 500.000 in c6? Is it five hundred thousand or a mere five hundred. ProRealTime interprets it as five hundred.

I meant 500k, but you are right, as it is is interpreted as 500, sorry I am new on PRT and of course to the values they use, as well to this programming language. Actually Im trying to find a way to edit this screener, as I would like to add ema9 as well, which is what I used yesterday to detect bullish US stocks and it worked quite well, so I will just post the version I used yesterday here on this comment:

// EMA9 increasing

ema9 = ExponentialAverage[9](close)

c1 = (ema9 > ema9[1])

// EMA20 increasing

ema20 = ExponentialAverage[20](close)

c2 = (ema20 > ema20[1])

// EMA9 > EMA20

c3 = (ema9 > ema20)

// Vol over SMA20

vol = Volume

// Current vol 20% bigger than previous

c5 = (vol > vol[1] * 1.20)

// Close > EMA9

currentclose = Close

c6 = currentclose > ema9

// Vol bigger than 200k

c7 = (vol > 200000)

// Prev close > EMA9 -> second candle that increases

c8 = (currentclose[1] > ema9)

// It closes possitive

currentopen = Open

c9 = (currentclose > currentopen)

highCurrent = High

highPrevious = High[1]

c10 = (highCurrent > highPrevious)

SCREENER[c1 AND c2 AND c3 AND c5 AND c6 AND c7 AND c8 AND c9 AND c10] ((close/DClose(1)-1)*100 AS “%cgh yesterday”)

Cheers – Been trying configure for weekly-trading.

Anyone configured it for weekly buys and had some decent results? Eg. buy those bullish medium-term on Mondays – close Fridays .

This gives awesome results ! Thanks

Is there a way to transform it into a bearish version ?

Here is the version for bearish stocks:

indicator1 = ExponentialAverage[50](close)

indicator2 = ExponentialAverage[100](close)

indicator3 = ExponentialAverage[150](close)

c1 = (indicator1 < indicator2)

c2 = (indicator2 indicator6)

indicator7 = Volume

c4 = (indicator5 > indicator7[1] * 1.5)

indicator8 = Close

c5 = indicator8 500.000)

c7 = (indicator8[1] < indicator1)

indicator9 = Open

c8 = (indicator8 < indicator9)

SCREENER[c1 AND c2 AND c3 AND c4 AND c5 AND c6 AND c7 AND c8] ((close/DClose(1)-1)*100 AS "%cgh yesterday")