Overnight fees calculation for ProOrder strategies

In order to calculate the overnight broker fees while testing an automated strategy, I made this little code snippet, that can be “plug” in any Probacktest code.Parameters to change are between lines 1 and 4:

“Capital”, set it accordingly to your starting balance in money (10.000€ in this case).

The “overnightfee” variable, that must be set to the correct broker’s fee (0.8€ per position in this case).

Overnight fees calculation, the code:

// --- parameters

Capital = 10000 // initial capital of account

overnightfee = 0.8 //broker overnight fee of a position (in money)

// ---

equity = Capital + StrategyProfit

ONCE BrokerProfit=0

FourHoursChart=5 //can be set to bar qu

once countofdays=0

if not onmarket then

countofdays=0

elsif onmarket and Intradaybarindex =FourHoursChart then

countofdays=countofdays+1

BrokerProfit=BrokerProfit+countofdays*overnightfee*countofposition

else

countofdays=countofdays

BrokerProfit=BrokerProfit

endif

trueEquity=Equity-BrokerProfit

graph BrokerProfit COLOURED(255,0,0) AS "BrokerProfit"

graph trueEquity COLOURED(0,0,255) AS "trueEquity"

graph countofdays COLOURED(0,0,0) AS "countofdays"

How to interpret results?

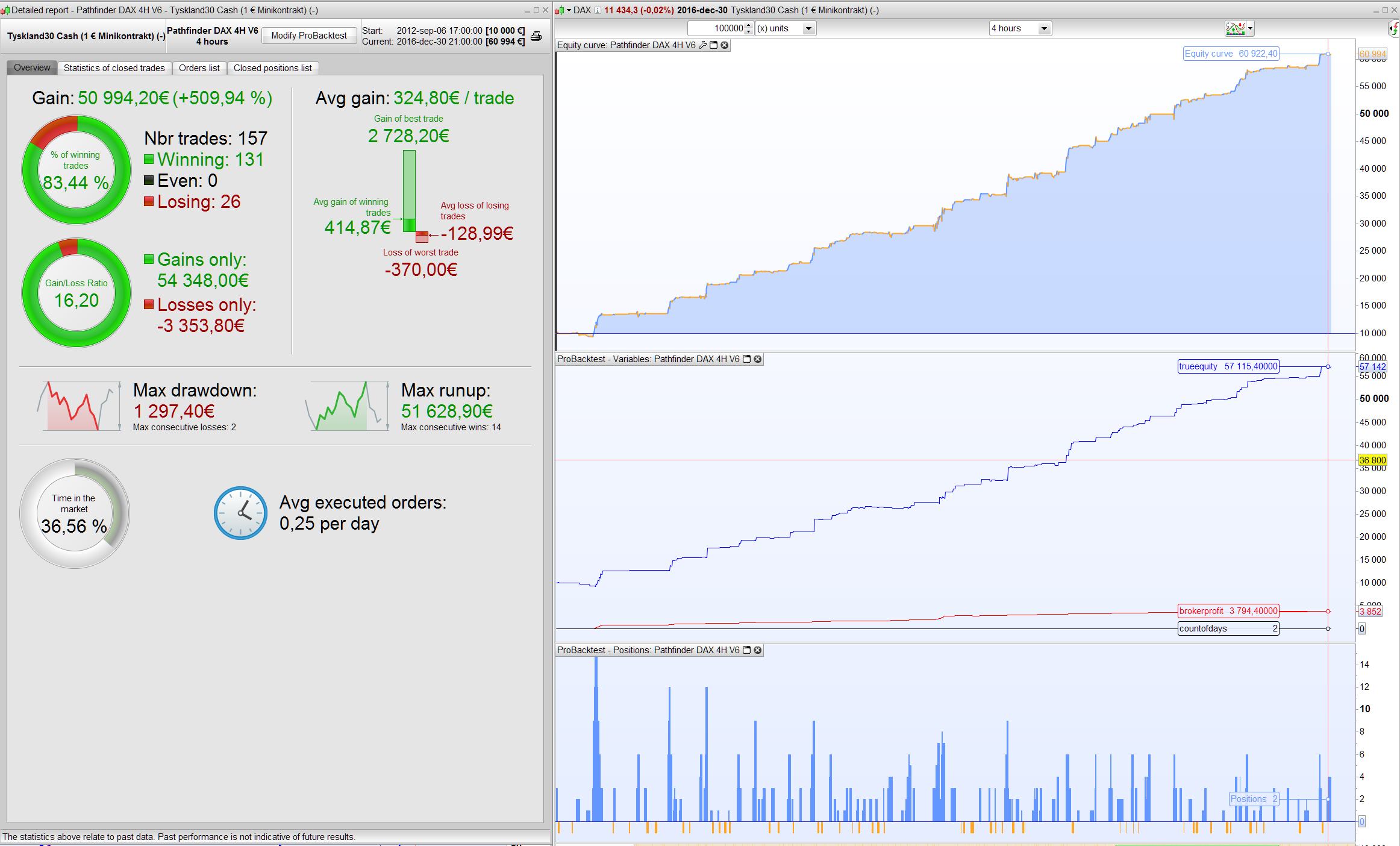

Results are displayed on chart when you run a backtest with Probacktest, they are “graphed” with 3 different curves:

- BrokerProfit in red, tell you how much are the overnight fees of the broker, for the current instrument and for the whole strategy period.

- trueEquity in blue, is the real strategy without the overnight fees, which is slightly different from the equity curve Probacktest give you (compare this blue line to the equity curve above).

- countofdays in black, is the final count of days when an overnight fees were encountered.

In this example, the calculation were made with the Pathfinder strategy, as you can see, only 6% of profit is wiped out of the whole strategy performance.

This blog post is related to the discussions of this topic: https://www.prorealcode.com/topic/brokers-overnight-interest-rate/